Business Loans with Aurora Capital: Get Flexible Business Funding Today

- Apply in minutes

- Applying won’t affect your credit score

- Free, no obligation quote

Navigate our range of business

funding options to find out more

We understand that timing is key when you’re looking to find funding options for your business, so our process is as quick and as streamlined as possible.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers

Securing business funding:

How it works

We understand that timing is key when you’re looking to find funding options for your business,so our process is as quick and as streamlined as possible.

1

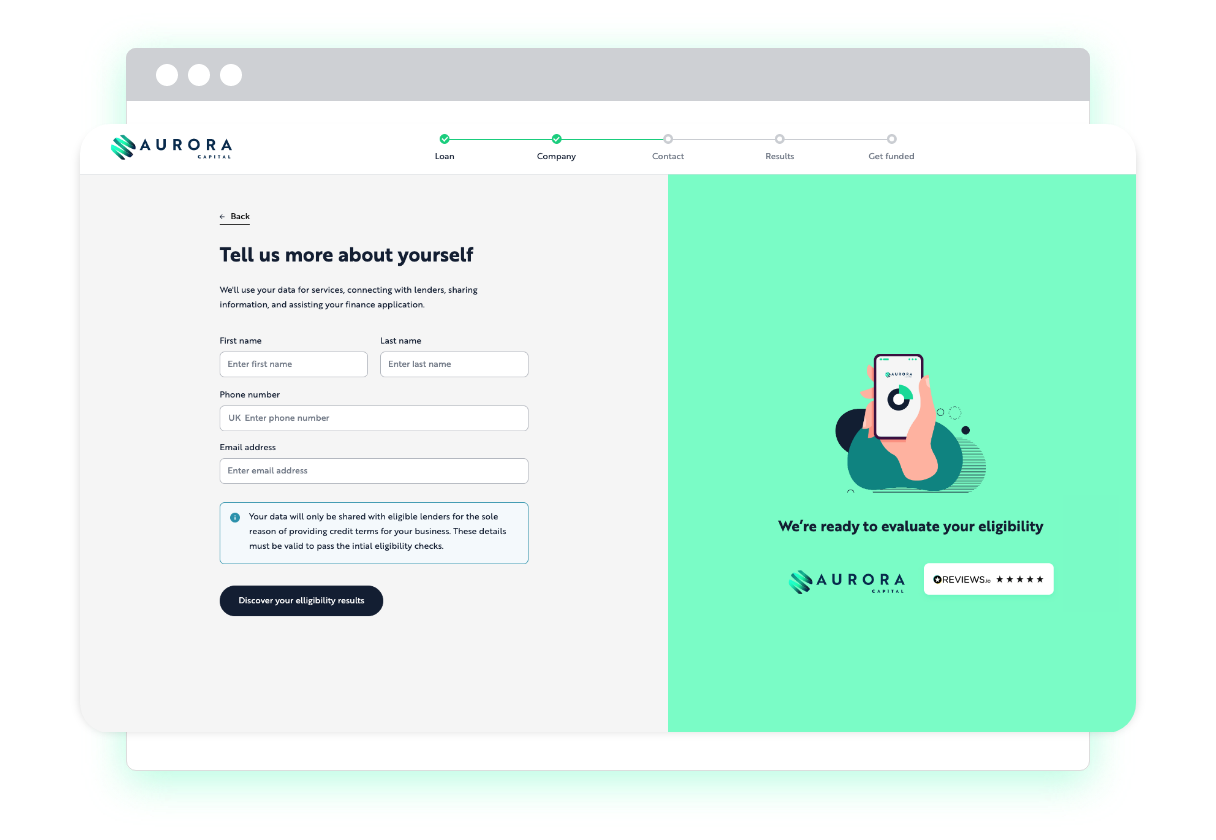

Apply Online in minutes

We cater to any sized business, so to apply for business funding, we only need you to share basic information about your company. Your application will take a few minutes, and our experts are always happy to assist with any questions you have about specific loan types or alternative finance options.

2

Get Matched in hours

Our LendTech technology will compare our trusted panel of lenders and match you with your most suitable finance option. Each business funding option is different, and we’ll help to make sure you’re fully clued up on the terms and conditions as well as indicative repayment details.

3

Get Funded in days

One of our funding specialists will discuss the available options with you and guide you through the process from application to approval. Once approved, the funds can be deposited in a matter of hours.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers

What makes us different? Our streamlined application process for quick business loans

- Simple and efficient online application: Our online application process is designed to be user-friendly and straightforward. We’ve eliminated unnecessary complexities to ensure a seamless experience. In just a few minutes, you can complete your business loan application and submit it for review.

- Minimal documentation requirements: We believe in minimising the paperwork involved in the loan application process. We only ask for the essential documentation necessary to assess your eligibility and creditworthiness. This means less time spent gathering paperwork and more time focusing on your business.

- Expert guidance and personalised support: Our team of funding specialists is dedicated to providing personalised assistance throughout the loan application process. If you have any questions or need clarification on specific loan options, our experts are here to help. We believe in open communication and transparency, ensuring that you have all the information you need to make informed decisions.

- Fast approval and funding: Time is critical when it comes to business loans. Once your application is submitted and reviewed, our efficient approval process ensures timely decisions – usually within 24 hours. If approved, you can expect to receive the funds in your business account within a short timeframe, allowing you to seize opportunities and meet your financial needs promptly.

- Flexibility and tailored solutions: Every business is unique, and we recognise that. Our range of business loan options offers flexibility to suit different industries, sizes, and funding requirements. Whether you need a small loan to bridge a temporary gap or a larger investment for expansion, we have solutions that can be tailored to your specific needs.

Frequently asked questions

Excepteur sint occaecat cupidatat non proidentExcepteur sint occaecat cupidatat.

Applying for a business loan with Aurora Capital will not directly impact your personal credit score. We conduct a soft credit check during the initial pre-qualification process, which does not leave a mark on your credit report. However, if you proceed with a formal loan application, a hard credit check may be performed, which could have a minor impact on your credit score. Rest assured, we strive to minimise any potential impact and ensure a transparent and responsible lending process.

Note: The minimum credit score required may vary depending on the lender and loan program. However, there are options available for small businesses with lower credit scores.

Aurora Capital offers business funding to a wide range of industries and businesses. Our eligibility criteria include factors such as the minimum credit score, minimum annual revenue, and the length of time the business has been operating. While specific criteria may vary depending on the types of loan and amount you are borrowing, we work with small businesses and business owners across various sectors. To find out if you meet our eligibility requirements, we encourage you to fill out our simple online application or speak with one of our funding specialists.

The documents required to apply for a business loan with Aurora Capital may vary depending on the loan program and the specific needs of your business. Generally, you will need to provide documents such as bank statements, financial statements, tax returns, proof of business ownership, and identification documents. Our dedicated team will guide you through the document submission process and ensure that it is as convenient as possible for you.

Aurora Capital offers flexible repayment terms for our business loans. The repayment term can vary based on factors such as the loan amount, the type of loan, and the specific needs of your business. Our business loans typically range from several months to several years. During the application process, our funding specialists will work closely with you to determine the most suitable repayment term for your business, ensuring that it aligns with your cash flow and growth objectives.

Absolutely! Aurora Capital offers business loans that can be used for a wide range of purposes, including funding equipment purchases and expanding your business’s infrastructure. Whether you need to upgrade machinery, invest in technology, or improve your physical workspace, our business loans can provide the necessary capital. We understand the unique needs of different industries, and we are here to support your growth and development.

At Aurora Capital, we understand that businesses may want to pay off their loans early to reduce interest costs or free up capital. That’s why we do not charge any prepayment penalties for paying off your business loan ahead of schedule. We encourage our customers to seize opportunities for early repayment, as it can help save money on interest and provide greater financial flexibility.

If your industry is not listed below, don’t worry! We cater to businesses across various sectors, and our funding specialists are equipped to understand and address the specific needs of your industry.

We strive to provide flexible funding solutions for small businesses across different industries. Whether you require a small business loan, equipment financing, or a line of credit, our commitment is to help you achieve your business goals efficiently and effectively.

Remember, with Aurora Capital, you can access our small business loan calculator, explore different loan options, and receive personalised guidance from our experts. We believe in empowering business owners like you with the funding and resources needed to thrive. Start your business loan application today and experience the support of a trusted lending partner.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers

Business loans with continuous customer support: Our commitment to your success

At Aurora Capital, we are dedicated to supporting your business beyond just providing funding. We are here for you every step of the way, offering continuous customer support to ensure your success. Our team of experienced funding specialists is available to answer any questions you have, guide you through the loan application process, and provide expert advice tailored to your business’s unique needs.

Whether you have inquiries about the loan terms, need assistance with documentation, or require guidance on loan repayment options, we are here to help. We understand that your business’s success is our success, and we take pride in building long-lasting relationships with our customers.

Contact Aurora Capital today and let us help you navigate the world of business loans, maximise your funding opportunities, and propel your business forward.