Apply For a UK Bridging Loan To Help You

Grow

Purchase Stock

Employ Staff

Expand

Pay Suppliers

Bridging loans can help you ‘bridge the gap’ between an immediate cash requirement and a future influx of cash.

- Apply in minutes

- Applying won’t affect your credit score

- Free, no obligation quote

6.90%

Interest rates per annum

£100,000 +

UK Based

No early settlement fees

£5k - £500k

Funding requirement

Our lending partners

About Bridging Loan

Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia.

Fast, flexible bridging finance with Aurora Capital

Need a reliable bridging loan comparison? As leading business finance experts, we’re well-placed to provide the most appropriate bridging finance quotes for your project. With access to a large pool of quality lenders, Aurora Capital can help you borrow the ideal loan amount with the best interest rates on the market.

Our bridging loan specialists are here to provide all the support you need. Get fast, bridging loan rates from us today and see your business grow.

Whether you need a bridging loan to cover the gap between purchasing a property at auction and getting a mortgage, or if you need one to make an essential business purchase quickly before you’re able to secure an alternative type of credit, we can put you in contact with your ideal lender. Most applications take just minutes to complete and decisions can be made within hours, making us one of the fastest and most flexible bridge loan brokers.

What is a bridging loan?

A bridging loan, also known as a bridge loan or bridge finance, is a type of short-term business loan that is designed to provide fast finance to complete a purchase or business expense. This is where the name ‘bridge loan’ comes from, as it essentially bridges the gap between your immediate need and your available credit.

The loan is secured against residential or commercial property. If you want to buy a new property, that will be used as collateral until the loan is paid back. If you buy new assets, the assets will be used as collateral. If you’re using the money for offsetting other types of finance or for cash flow reasons, you will need to secure it against property and/or assets you already own. This provides more security to the lender, makes it easier for you to obtain finance if you don’t have the best credit score, and means that if you default on payments, the lender has something to redeem their money from.

In essence, bridge loans are high-value, short-term lending solutions. Borrowers should note, though, that bridging loans have a higher interest rate than a typical mortgage product Lenders will provide credit in the form of a bridging loan only if you have what’s known as an exit strategy, which is a structured plan of how you’re going to secure additional credit to pay off your bridging loan at the end of the term.

Key features of bridging loans

- Suitability: All types of businesses that have either a commercial or residential property to secure on.

- Purpose: Bridging loans can have a number of purposes, but are more commonly used for light property refurbishments.

- Amount: Bridging finance loans range from £25k – £15m. We can usually lend up to 75% LTV.

- Term: Up to 24 months. This will depend on the equity left in the property and how much you need on day 1.

- Cost: Interest rates from 0.55% per month.

- Security: Security can be taken as either a 1st, 2nd or equitable charge of a residential or commercial property depending on your circumstances.

- Speed: Decisions can be made within 24 hours.

Generally speaking, bridging loans can be used for the majority of business-related purposes, but they’re most commonly used in order to acquire property. For example, if you want to purchase a new property for your business, or if you’re a landlord and want to buy a new property to add to your portfolio, you’ll need a mortgage. However, mortgages can take a while to be approved, in which time you could end up missing out on the property – especially if it’s being sold at auction.

In this instance, a bridging loan would provide you with the money to purchase the property until the mortgage was approved, ensuring you don’t miss out. When your mortgage is approved, you would use it to pay off the bridge loan.

Alternatively, you can use a bridging loan to fund renovations until your property is sold, to buy new equipment until an alternative loan is secured, or to solve cash flow issues until you can pay back what you owe (although there are better options for this available).

Bridging finance is usually relatively quick, with decisions in principle offered within 24 hours. The time scale it takes to complete is often between 5-18 days, however this does depend on a few factors beyond our control, such as 2nd charge consent (if applicable), the availability of local surveyors, and your solicitors.

When you compare bridging loans, you will usually be able to compare the speed at which you will be able to access the funds based on how much you are needing to borrow. Variable factors will depend on the individual lender.

At Aurora Capital, we provide access to a large pool of lenders who can offer bridge loans. These lenders will differ significantly in terms of broker fees, exit fees, legal fees and so on, but we will be sure to match you with the most appropriate lender according to your project specifications and other needs.

In addition to the standard interest rates, the cost of a bridging loan will also depend on:

- Lender arrangement fee: Charged for the arrangement of your bridging loan and payable to the lender

- Broker fee: Charged for the processing of your application

- Valuation fee: A basic survey of the security property, usually payable early in the application process

- Legal fees: Some lenders will require separate legal representation which needs to be paid for by the borrower

- Exit fee: Sometimes charged on repayment of the loan

Note that most commercial bridging finance options are limited to 18 months before full payment is required. But with high interest rates usually charged per month rather than over the full loan term, it’s recommended to pay off early to avoid paying large fees.

All types of businesses that have either a commercial or residential property, or other types of redeemable assets to secure on, can get a bridging loan. How much you are able to borrow is calculated based on the value of your asset, so to get the best bridging loan rates with reasonable monthly interest, you will need a property with a good amount of equity available.

One of the biggest risks of using a bridging loan is the fact that you may not have an agreed exit. Seeing as all bridging loans will need to be repaid after the agreed term, you will need a planned exit. This puts your business at risk, with the chance of necessary assets and property being reclaimed to make your payments. If you haven’t considered how you will exit your commercial bridging loan, it’s recommended to hold fire and get assurances beforehand.

Speak to our team for some helpful advice on commercial bridge loans.

Bridging finance and development finance both provide businesses with short-term injections of cash to help finance assets and buy or renovate property. Once the funds are used and the project has been completed, both types of loan need to be repaid. The key difference is the fact that development finance is restricted to development projects and can last up to 3 years. Bridging finance, on the other hand, is commonly used for light development work and working capital requirements and will generally last up to 24 months.

If you feel you need support understanding the risks involved with bridging loans, consider speaking to our team or looking at other funding options with Aurora Capital, such as development finance.

Generally speaking, bridging loans can be used for the majority of business-related purposes, but they’re most commonly used in order to acquire property. For example, if you want to purchase a new property for your business, or if you’re a landlord and want to buy a new property to add to your portfolio, you’ll need a mortgage. However, mortgages can take a while to be approved, in which time you could end up missing out on the property – especially if it’s being sold at auction.

In this instance, a bridging loan would provide you with the money to purchase the property until the mortgage was approved, ensuring you don’t miss out. When your mortgage is approved, you would use it to pay off the bridge loan.

Alternatively, you can use a bridging loan to fund renovations until your property is sold, to buy new equipment until an alternative loan is secured, or to solve cash flow issues until you can pay back what you owe (although there are better options for this available).

Bridging finance is usually relatively quick, with decisions in principle offered within 24 hours. The time scale it takes to complete is often between 5-18 days, however this does depend on a few factors beyond our control, such as 2nd charge consent (if applicable), the availability of local surveyors, and your solicitors.

When you compare bridging loans, you will usually be able to compare the speed at which you will be able to access the funds based on how much you are needing to borrow. Variable factors will depend on the individual lender.

At Aurora Capital, we provide access to a large pool of lenders who can offer bridge loans. These lenders will differ significantly in terms of broker fees, exit fees, legal fees and so on, but we will be sure to match you with the most appropriate lender according to your project specifications and other needs.

In addition to the standard interest rates, the cost of a bridging loan will also depend on:

- Lender arrangement fee: Charged for the arrangement of your bridging loan and payable to the lender

- Broker fee: Charged for the processing of your application

- Valuation fee: A basic survey of the security property, usually payable early in the application process

- Legal fees: Some lenders will require separate legal representation which needs to be paid for by the borrower

- Exit fee: Sometimes charged on repayment of the loan

Note that most commercial bridging finance options are limited to 18 months before full payment is required. But with high interest rates usually charged per month rather than over the full loan term, it’s recommended to pay off early to avoid paying large fees.

All types of businesses that have either a commercial or residential property, or other types of redeemable assets to secure on, can get a bridging loan. How much you are able to borrow is calculated based on the value of your asset, so to get the best bridging loan rates with reasonable monthly interest, you will need a property with a good amount of equity available.

One of the biggest risks of using a bridging loan is the fact that you may not have an agreed exit. Seeing as all bridging loans will need to be repaid after the agreed term, you will need a planned exit. This puts your business at risk, with the chance of necessary assets and property being reclaimed to make your payments. If you haven’t considered how you will exit your commercial bridging loan, it’s recommended to hold fire and get assurances beforehand.

Speak to our team for some helpful advice on commercial bridge loans.

Bridging finance and development finance both provide businesses with short-term injections of cash to help finance assets and buy or renovate property. Once the funds are used and the project has been completed, both types of loan need to be repaid. The key difference is the fact that development finance is restricted to development projects and can last up to 3 years. Bridging finance, on the other hand, is commonly used for light development work and working capital requirements and will generally last up to 24 months.

If you feel you need support understanding the risks involved with bridging loans, consider speaking to our team or looking at other funding options with Aurora Capital, such as development finance.

Get your free, no

obligation quote Today!

- Apply in minutes

- FREE, no obligation, personalised quote

- FCA regulated

How much do you want to borrow?

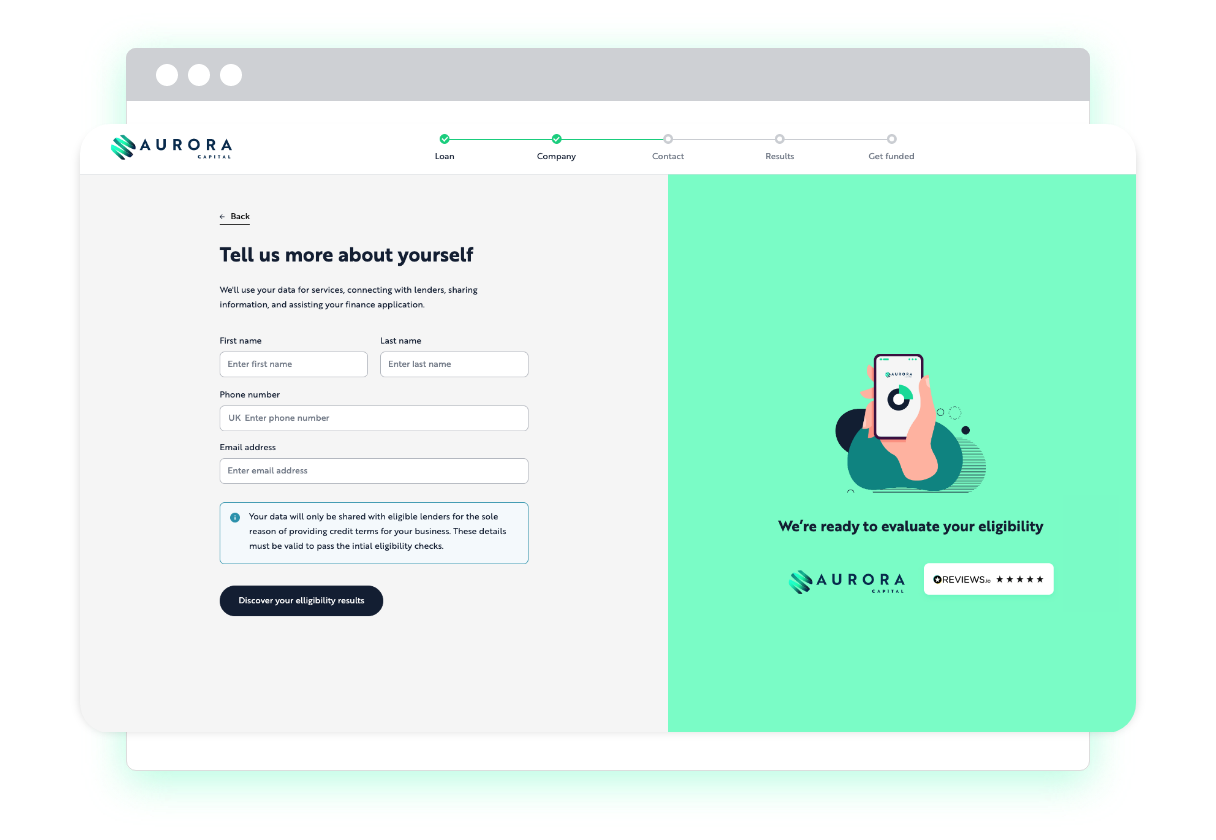

Securing business funding:

How it works

We understand that timing is key when you’re looking to find funding options for your business,so our process is as quick and as streamlined as possible.

1

Apply Online in minutes

We cater to any sized business, so to apply for business funding, we only need you to share basic information about your company. Your application will take a few minutes, and our experts are always happy to assist with any questions you have about specific loan types or alternative finance options.

2

Get Matched in hours

Our LendTech technology will compare our trusted panel of lenders and match you with your most suitable finance option. Each business funding option is different, and we’ll help to make sure you’re fully clued up on the terms and conditions as well as indicative repayment details.

3

Get Funded in days

One of our funding specialists will discuss the available options with you and guide you through the process from application to approval. Once approved, the funds can be deposited in a matter of hours.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers

Navigate our range of business

funding options to find out more

We understand that timing is key when you’re looking to find funding options for your business, so our process is as quick and as streamlined as possible.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers

100+ Happy Customers & Counting

bridging loans: FAQs

Excepteur sint occaecat cupidatat non proidentExcepteur sint occaecat cupidatat.

You can borrow between £25k and £15 million with bridging loans, depending on your secured assets, your credit history, and your immediate business needs.

How much you will be charged for a bridging loan depends on a number of things, from your credit score and current interest rates to the value of what you have secured against. All costs (such as the arrangement fees and interest) are deducted from your loan when you receive your money. They can also be added, depending on your preference. These fees typically include:

- An arrangement fee of 2%

- Interest from 0.55% per month to 1.5% per month

In order to be able to apply for a bridging loan, you need to meet the following criteria:

- Be a limited company

- Use the loan for business purposes, not personal

- Have a robust exit strategy

Different lenders will have different criteria, but as a starting point, this is what most lenders will expect.

An exit strategy is a plan you make that outlines, in detail, how you’re going to pay the bridging loan off. Common exit strategies include:

- A mortgage

- A secured loan

- Selling a property

At Aurora Capital, we can help you define an exit strategy that is realistic and watertight.

There are a number of benefits to bridging loans that make them a go-to choice for a range of businesses. Firstly, they are high-value loans, which means you can make big purchases, including the value of commercial property, with them. If you need a lot of money lending, bridge finance can stretch to it.

Another benefit is the fact that they are so versatile and flexible. Unlike other types of secured loans, you are able to use a bridge loan for almost any business need. Keep in mind, though, that if you’re having cash flow problems, other types of finance might be better suited, particularly if you don’t need to borrow a large amount of money.

The fast turnaround of bridging loans makes them particularly attractive for businesses that need money in a pinch, e.g., if they’re looking to buy property at auction. The money can be in your account in days.

Finally, being a type of secured loan means that bridging finance is often easier to get approval for as it’s less risky for the lender. This is of special interest to businesses that don’t have an extensive credit history or that don’t have the best credit score overall.

This depends on the deal and the safety of the planned exit route. If there is an exit or early redemption charge, the typical amount would be one month’s interest payment or 1% of the loan. The minimum is zero.

Below is a list of the security we lend against with bridging finance at Aurora Capital:

- Residential property

- Residential developments

- Commercial property

- Commercial developments

- Mixed-use property schemes

- Offices

- Retail

- Land, farms and agricultural

- Investment property – residential and commercial

- Auction

Each lender will have its own collections process in place if you default on payments. In a worst case scenario, the property or assets the loan is secured against may be seized.

Yes. Many people seek a bridging loan due to having gone over term on their financial commitments, and as a result have adverse credit. A bridging loan can be a good tool to help alleviate this financial pressure and allow clients the time and flexibility to return to a stable footing again and improve their credit.

You can opt to service the interest monthly or you can pay the interest back at the end of the loan.

The interest rate is a fixed figure displayed monthly. The interest does not compound. The interest does not fluctuate and it is not variable.