Funding for Wholesale

Businesses

There are a wide range of wholesale funding options to help your business plug temporary cash flow issues, expand into new markets, improve your store facilities, and buy new inventory. Learn more about the ways you can help your wholesale business flourish with external funding through Aurora Capital.

- Apply in minutes

- Applying won’t affect your credit score

- Free, no obligation quote

from 6.90%

Interest rates per annum

£100,000 +

UK Based

No early settlement fees

£5k - £500k

Funding requirement

Our lending partners

Funding for Wholesale Businesses Loan

Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia.

Best Funding Options for Your Wholesale Business

Unsecured Business Loans

You might not always have assets to use as collateral for a loan. In such cases, unsecured business loans can be an ideal option as they don’t require collateral. However, it’s worth noting that unsecured loans typically have higher interest rates than secured loans due to the increased risk to the lender as a result of the lack of collateral. While you may not be able to borrow as much with an unsecured loan as you would with a secured loan, you can still access a substantial amount of credit. Unsecured loans are versatile and can be used for any business-related expense, making them an appropriate option for wholesale businesses. The loan amounts usually range from £1,000 to £500,000 and can be repaid over a maximum period of six years. Find out more about unsecured business loansRevolving Credit Facility

For wholesale businesses, revolving credit facilities can provide a flexible credit line that functions similarly to an overdraft. This credit option can be advantageous for businesses that require a financial cushion to address unexpected expenses or cash flow challenges. Revolving credit facilities typically offer loan amounts ranging from £10,000 to £2 million and can be borrowed over a two-year period. As funds are borrowed, the available credit decreases, but once the borrowed amount is repaid, the original amount becomes available again and can be used repeatedly as needed. Find out more about revolving credit facilitiesRecovery Loan Scheme

For wholesale businesses, recovery loans can provide much needed help to overcome financial difficulties. This type of borrowing is appropriate for businesses that have experienced setbacks and require a larger sum of money to move forward. Recovery loans typically offer loan amounts ranging from £25k to £500k and can be borrowed over a maximum period of six years. Find out more about recovery loansMerchant Cash Advance

For wholesale businesses, merchant cash advances are a borrowing option designed to provide quick access to funds with flexible repayment terms. Unlike traditional loans, this option involves a lender providing an upfront cash advance in exchange for a percentage of future credit and debit card transactions. Repayment of the advance and associated fees is typically done through automatic daily or weekly deductions from the business’s credit card sales until the loan is fully repaid. For instance, a lender may agree to deduct 10% of every card transaction until the loan and agreed interest are paid off. The amount repaid increases with higher sales, facilitating faster loan repayment. However, during slow sales periods, there’s no pressure to make high payments, and businesses only pay what they can afford. Find out more about merchant cash advancesInvoice Finance

It’s not uncommon for wholesale businesses to offer payment periods of 30, 60, or 90 days. However, this can pose challenges to cash flow management. When multiple invoices are outstanding, your business might not have immediate access to funds to purchase new stock or pay suppliers and staff until the previous invoices are paid. Invoice finance can help address this issue. With this option, a lender will pay up to 90% of the value of your outstanding invoices, and you pay the lender back when your clients settle their accounts, plus interest. Find out more about invoice financingUsing Finance to Purchase More Stock

Wholesale businesses require a lot of capital to operate effectively, which can be difficult to come by without the help of external funding. Wholesale business loans are a form of financing designed to assist businesses in managing their cash flow, expanding operations, and addressing unexpected expenses.

Wholesale businesses hold onto a large amount of stock to sell onto their customer base. A Business Loan is a great way to increase your stock holding or look to bring in a new product that you haven’t been able to do before. Not only does this allow you to potentially grow your business, but funding may also allow you to save some money from your suppliers. By buying in bulk or purchasing a large order it may allow you to negotiate better payment terms with your suppliers, which in turn will add to your bottom line.

There are many different types of loans which can be used for different things, so it’s important to consider all your options before deciding which loan to go with.

Choosing the right type of funding can be tricky. Here are some tips to help you secure the right funding for your wholesale business.

- Firstly, consider the different loan options available to you. There are several types of loans to choose from, including term loans, lines of credit, invoice finance, and merchant cash advances. Each type of loan is designed for specific purposes, so it’s important to choose the one that best suits your needs.

- Secondly, affordability is key. When considering funding options, ensure that you can afford the monthly repayments. Failure to do so could lead to financial difficulty or even defaulting on the loan. This may mean compiling a business plan and forecasts to show to lenders should they need it as a reference to determine how much you can borrow.

- Thirdly, collateral may be required for certain types of funding, such as equipment financing. In this case, make sure you have equal value assets to secure the loan, or consider whether you’d be prepared to offer a personal guarantee.

Lastly, consider how much money you actually need to borrow. Overborrowing can lead to unnecessary interest payments, so make sure to only borrow what you need.

Every lender has different requirements when making a funding decision, but some of the fundamental things they look at include:

- Credit Score: Lenders typically use credit scores to evaluate a borrower’s creditworthiness. A good credit score demonstrates that you have a history of responsibly managing credit, which increases your chances of getting approved for a loan.

- Business Revenue: Lenders also consider your business’s revenue and profitability. They want to ensure that you have enough revenue to repay the loan, so they’ll likely look at your income statements, balance sheets and cash flow statements.

- Industry and Market Trends: Lenders may also consider the industry and market trends in which your business operates. They want to ensure that your business has a stable and promising future and that you’re aware of the potential risks and challenges, especially if you’re asking for a higher loan amount.

- Debt-to-Income Ratio: Your debt-to-income ratio is the percentage of your monthly income that goes towards paying debt. Lenders use this ratio to determine if you have the capacity to take on additional debt.

Understanding these factors can help you prepare a strong loan application that meets the lender’s criteria. If you’re unsure on any of these points, speak to a member of our team to find out how you can improve your application and boost your chances of getting approved.

At Aurora Capital, we are business loan brokers. We work with 50+ lenders, all offering different types of finance to suit your unique borrowing needs. Whether you need to stem a short-term cash flow issue, or you need a helping hand to expand your business into a new market, we can help you find a lender that will help you get where you need to be.

Some of the most common types of wholesale funding options we provide are:

- Secured business loans

- Unsecured business

- loans

- Merchant cash advances

- Revolving credit facilities

- Invoice finance

If you want to find out more about which credit solution could be best for your business, contact us.

Choosing the right type of funding can be tricky. Here are some tips to help you secure the right funding for your wholesale business.

- Firstly, consider the different loan options available to you. There are several types of loans to choose from, including term loans, lines of credit, invoice finance, and merchant cash advances. Each type of loan is designed for specific purposes, so it’s important to choose the one that best suits your needs.

- Secondly, affordability is key. When considering funding options, ensure that you can afford the monthly repayments. Failure to do so could lead to financial difficulty or even defaulting on the loan. This may mean compiling a business plan and forecasts to show to lenders should they need it as a reference to determine how much you can borrow.

- Thirdly, collateral may be required for certain types of funding, such as equipment financing. In this case, make sure you have equal value assets to secure the loan, or consider whether you’d be prepared to offer a personal guarantee.

Lastly, consider how much money you actually need to borrow. Overborrowing can lead to unnecessary interest payments, so make sure to only borrow what you need.

Every lender has different requirements when making a funding decision, but some of the fundamental things they look at include:

- Credit Score: Lenders typically use credit scores to evaluate a borrower’s creditworthiness. A good credit score demonstrates that you have a history of responsibly managing credit, which increases your chances of getting approved for a loan.

- Business Revenue: Lenders also consider your business’s revenue and profitability. They want to ensure that you have enough revenue to repay the loan, so they’ll likely look at your income statements, balance sheets and cash flow statements.

- Industry and Market Trends: Lenders may also consider the industry and market trends in which your business operates. They want to ensure that your business has a stable and promising future and that you’re aware of the potential risks and challenges, especially if you’re asking for a higher loan amount.

- Debt-to-Income Ratio: Your debt-to-income ratio is the percentage of your monthly income that goes towards paying debt. Lenders use this ratio to determine if you have the capacity to take on additional debt.

Understanding these factors can help you prepare a strong loan application that meets the lender’s criteria. If you’re unsure on any of these points, speak to a member of our team to find out how you can improve your application and boost your chances of getting approved.

At Aurora Capital, we are business loan brokers. We work with 50+ lenders, all offering different types of finance to suit your unique borrowing needs. Whether you need to stem a short-term cash flow issue, or you need a helping hand to expand your business into a new market, we can help you find a lender that will help you get where you need to be.

Some of the most common types of wholesale funding options we provide are:

- Secured business loans

- Unsecured business loans

- Merchant cash advances

- Revolving credit facilities

- Invoice finance

If you want to find out more about which credit solution could be best for your business, contact us.

Get your free, no

obligation quote Today!

- Apply in minutes

- FREE, no obligation, personalised quote

- FCA regulated

How much do you want to borrow?

Securing business funding:

How it works

We understand that timing is key when you’re looking to find funding options for your business,so our process is as quick and as streamlined as possible.

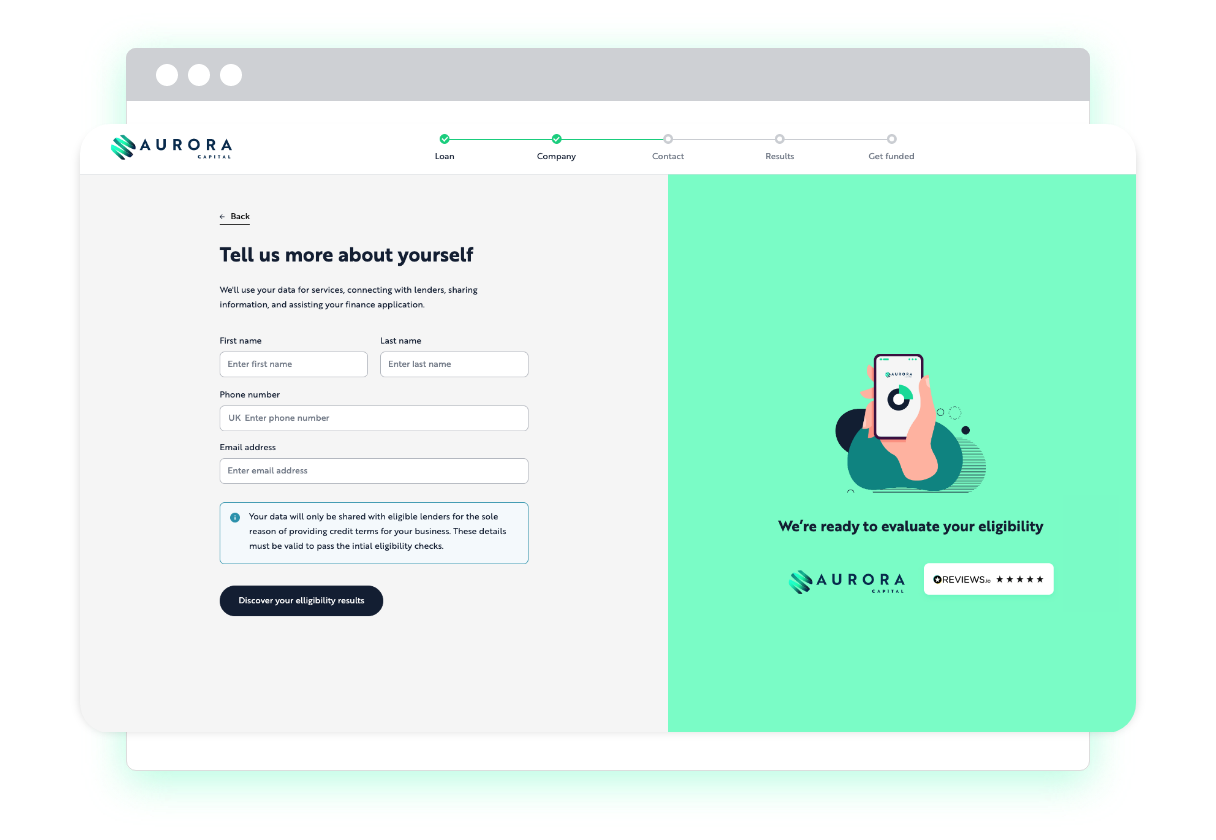

1

Apply Online in minutes

We cater to any sized business, so to apply for business funding, we only need you to share basic information about your company. Your application will take a few minutes, and our experts are always happy to assist with any questions you have about specific loan types or alternative finance options.

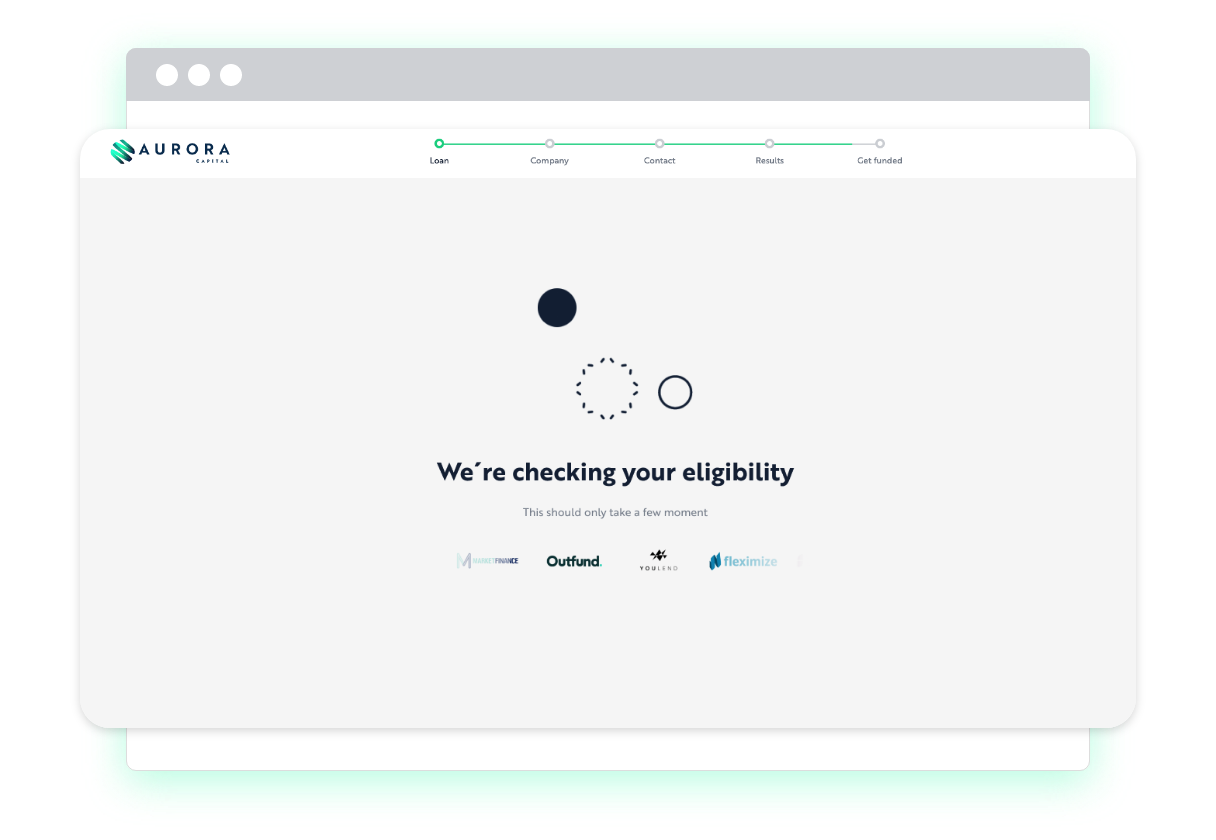

2

Get Matched in hours

Our LendTech technology will compare our trusted panel of lenders and match you with your most suitable finance option. Each business funding option is different, and we’ll help to make sure you’re fully clued up on the terms and conditions as well as indicative repayment details.

3

Get Funded in days

One of our funding specialists will discuss the available options with you and guide you through the process from application to approval. Once approved, the funds can be deposited in a matter of hours.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers

Navigate our range of business

funding options to find out more

We understand that timing is key when you’re looking to find funding options for your business, so our process is as quick and as streamlined as possible.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers

Key benefits of working with

Aurora Capital

LendTech Technology - Access to 50+ Lenders

At Aurora Capital, we use LendTech technology which gives us access to a vast network of over 50 commercial lenders in the market. Our extensive pool of lenders ensures that we can match you with the most appropriate lender for your specific requirements, who will provide competitive terms and reasonable loan options.

Apply Online in Minutes & Get Funding in Days

We understand that businesses often need funding quickly. For this reason, we offer a fast, simplified service. Once you’ve chosen the appropriate loan for your needs, you can apply online through Aurora Capital, which only takes a few minutes. Our team will then match you with a lender and acquire the necessary funds, often in just a few days.

No Effect on Your Credit Score

Conventional loan and credit applications can damage your credit score, but with Aurora Capital, this isn’t the case. Whether your application is successful or declined, your credit score remains unaffected. This is especially advantageous for newly established businesses trying to establish a credit score, or those with a negative credit history.

LendTech Technology - Access to 50+ Lenders

At Aurora Capital, we use LendTech technology which gives us access to a vast network of over 50 commercial lenders in the market. Our extensive pool of lenders ensures that we can match you with the most appropriate lender for your specific requirements, who will provide competitive terms and reasonable loan options.

Apply Online in Minutes & Get Funding in Days

We understand that businesses often need funding quickly. For this reason, we offer a fast, simplified service. Once you’ve chosen the appropriate loan for your needs, you can apply online through Aurora Capital, which only takes a few minutes. Our team will then match you with a lender and acquire the necessary funds, often in just a few days.

No Effect on Your Credit Score

Conventional loan and credit applications can damage your credit score, but with Aurora Capital, this isn’t the case. Whether your application is successful or declined, your credit score remains unaffected. This is especially advantageous for newly established businesses trying to establish a credit score, or those with a negative credit history.

100+ Happy Customers & Counting

Wholesale funding: FAQs

The amount you can borrow depends on the type of finance you go for. Generally, we assist businesses with borrowing needs between £10,000 and £2 million, but lower and higher amounts are available (collateral depending).

At Aurora Capital, lending decisions are made quickly. Applying online takes just minutes and decisions are generally made within 48 hours, with money often in your account in just a few days.

No, applying for wholesale funding through Aurora Capital will not impact your credit score.

The requirements you need to meet will depend on the lender and the type of finance, but as a general rule of thumb, we only work with UK-based businesses that have been trading for six months and have an annual turnover of £100,000+.