Apply for a Recovery Loan To Help You

Grow

Purchase Stock

Employ Staff

Expand

Pay Suppliers

- Apply in minutes

- Applying won’t affect your credit score

- Free, no obligation quote

From 13.7%

Interest rates per annum

£100,000 +

Annual turnover

2 – 6 years

Loan term

£25,001 - £250k

Funding requirement

Our lending partners

About Recovery Loan Scheme(RLS)

What is Recovery Lone Scheme(RLS)?

The Recovery Loan Scheme (RLS) is a government backed scheme aimed at supporting access to finance for UK businesses.

The previous iteration of RLS, which closed on June 30 2022, aimed to support access to finance for UK businesses recovering from the COVID-19 pandemic.

The current iteration, which opened in August 2023 and will run for two years, removed the need for a business to confirm it has been impacted negatively by COVID-19.

RLS is still designed to be used for business purposes, for example, managing cashflow, investment and growth – and it is open to a broad range of businesses, including to those which had previously taken out a CBILS, CLBILS or BBLS.

RLS replaces the Coronavirus Business Interruption Loan Scheme (CBILS), the Coronavirus Large Business Interruption Loan Scheme (CLBILS) and the Bounce Back Loan Scheme (BBLS), all of which closed to new applicants on 31 March 2021.

Businesses have to meet certain criteria in order to access the scheme. Specifically, a business must:

If a lender can offer finance on normal commercial terms without the need to make use of the scheme, they may do so.

Three more things to note:

There are a number of lenders operating under the RLS scheme who can provide varying types and amounts of finance to businesses that need it to grow. At Aurora Capital, we work with a range of lenders, ensuring you’re matched with the right one for you. Compare recovery loans and find a suitable borrower today.

Yes, businesses can apply for finance under the Recovery Loan Scheme (RLS) even if they previously borrowed under BBLS, CBILS or CLBILS. Some businesses may be able to borrow more under the RLS than they did previously – though the maximum depends on the lender’s assessment and the scheme requirements.

After 1 January 2022 the revamped Recovery Loan Scheme allowed businesses to borrow up to a maximum of £2 million (per business) for all types of borrowing, i.e. term loans, overdrafts, invoice finance and asset finance. However, our lenders can only offer up to a maximum of £250k, the minimum loan is £25,001.

Interest rates start from 13.7% per annum, however this can differ from business to business depending on several factors, including; credit, affordability and bank statement conduct.

Most lenders will offer you the ability to spread the term over 6 years and the minimum term is 2 years.

There are two key differences:

The UK Government originally gave lenders an 80% guarantee for applications made under the Recovery Loan Scheme – until the end of 2021. The revamped scheme, announced at the Autumn Budget 2021, saw the government reducing the guarantee to 70% for applications made on or after 1 January 2022. This 70% remains for applications until the scheme closes in 2024.

The guarantee means that if a business defaults on the loan, the lender can recoup 70% of the outstanding value of the loan from the government (or 80% for applications made before 30 December 2021). This guarantee gives lenders confidence to lend to businesses and does not give any guarantee to the borrower. The borrower is always 100% liable for the debt.

Businesses which successfully apply for Recovery Loan Scheme finance can do so for any legitimate business purpose, for example:

Yes, lenders will carry out a credit check and possibly a fraud check. The types of checks may vary between lenders. If you have been refused credit in the past, you may still be eligible for a business recovery loan.

Businesses have to meet certain criteria in order to access the scheme. Specifically, a business must:

If a lender can offer finance on normal commercial terms without the need to make use of the scheme, they may do so.

Three more things to note:

There are a number of lenders operating under the RLS scheme who can provide varying types and amounts of finance to businesses that need it to grow. At Aurora Capital, we work with a range of lenders, ensuring you’re matched with the right one for you. Compare recovery loans and find a suitable borrower today.

Yes, businesses can apply for finance under the Recovery Loan Scheme (RLS) even if they previously borrowed under BBLS, CBILS or CLBILS. Some businesses may be able to borrow more under the RLS than they did previously – though the maximum depends on the lender’s assessment and the scheme requirements.

After 1 January 2022 the revamped Recovery Loan Scheme allowed businesses to borrow up to a maximum of £2 million (per business) for all types of borrowing, i.e. term loans, overdrafts, invoice finance and asset finance. However, our lenders can only offer up to a maximum of £250k, the minimum loan is £25,001.

Interest rates start from 13.7% per annum, however this can differ from business to business depending on several factors, including; credit, affordability and bank statement conduct.

Most lenders will offer you the ability to spread the term over 6 years and the minimum term is 2 years.

There are two key differences:

The UK Government originally gave lenders an 80% guarantee for applications made under the Recovery Loan Scheme – until the end of 2021. The revamped scheme, announced at the Autumn Budget 2021, saw the government reducing the guarantee to 70% for applications made on or after 1 January 2022. This 70% remains for applications until the scheme closes in 2024.

The guarantee means that if a business defaults on the loan, the lender can recoup 70% of the outstanding value of the loan from the government (or 80% for applications made before 30 December 2021). This guarantee gives lenders confidence to lend to businesses and does not give any guarantee to the borrower. The borrower is always 100% liable for the debt.

Businesses which successfully apply for Recovery Loan Scheme finance can do so for any legitimate business purpose, for example:

Yes, lenders will carry out a credit check and possibly a fraud check. The types of checks may vary between lenders. If you have been refused credit in the past, you may still be eligible for a business recovery loan.

Get your free, no

obligation quote Today!

- Apply in minutes

- FREE, no obligation, personalised quote

- FCA regulated

How much do you want to borrow?

Securing business funding:

How it works

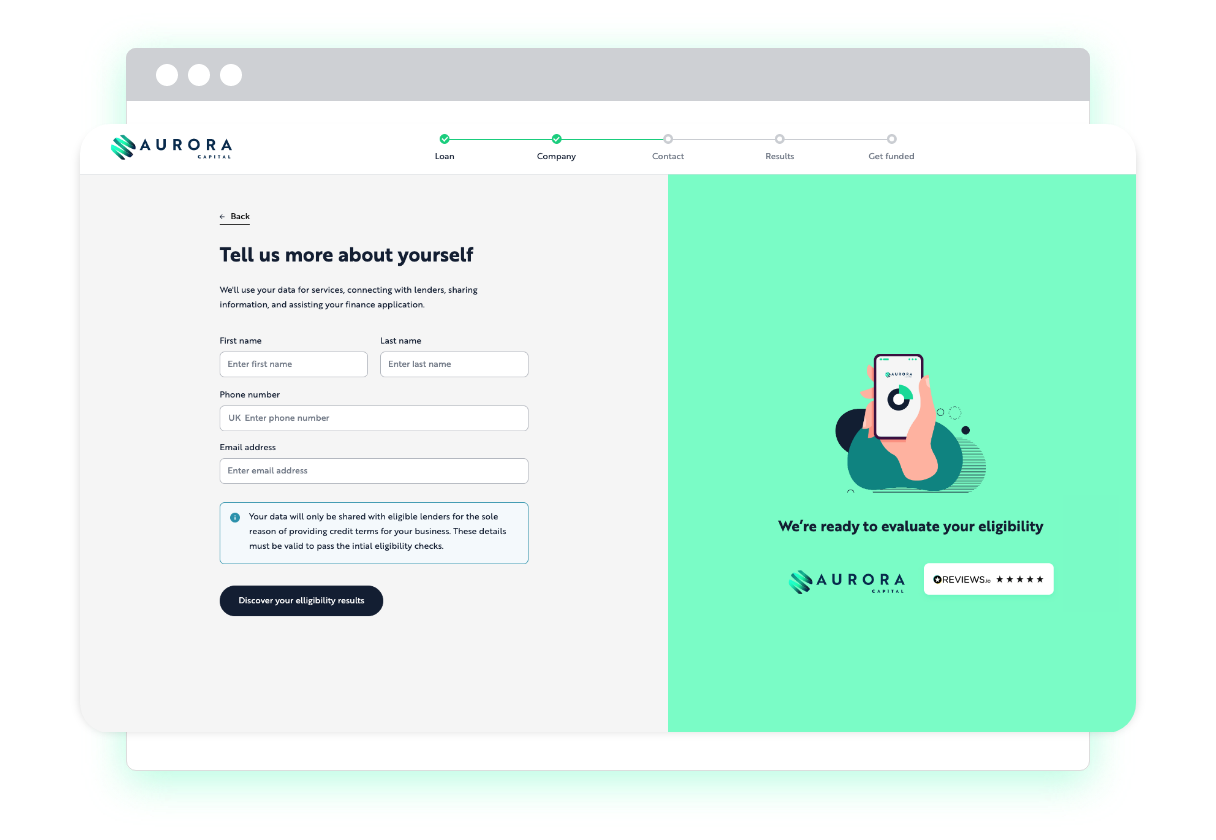

We understand that timing is key when you’re looking to find funding options for your business,so our process is as quick and as streamlined as possible.

1

Apply Online in minutes

We cater to any sized business, so to apply for business funding, we only need you to share basic information about your company. Your application will take a few minutes, and our experts are always happy to assist with any questions you have about specific loan types or alternative finance options.

2

Get Matched in hours

Our LendTech technology will compare our trusted panel of lenders and match you with your most suitable finance option. Each business funding option is different, and we’ll help to make sure you’re fully clued up on the terms and conditions as well as indicative repayment details.

3

Get Funded in days

One of our funding specialists will discuss the available options with you and guide you through the process from application to approval. Once approved, the funds can be deposited in a matter of hours.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers

Navigate our range of business

funding options to find out more

We understand that timing is key when you’re looking to find funding options for your business, so our process is as quick and as streamlined as possible.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers

100+ Happy Customers & Counting

Recovery loans Scheme: FAQs

The maximum amount you can borrow under the RLS depends on whether your business is within the Northern Ireland Protocol scope and the type of finance you are looking to get.

- Asset and invoice finance: £1,000 – £2 million for non-NI Protocol borrowers, £1,000 – £1 million for NI Protocol borrowers

- Set-term loans and overdrafts: £25,001 – £2 million for non-NI Protocol borrowers, £25,001 – £1 million for NI Protocol borrowers

After applying for the Recovery Loan Scheme with Aurora Capital, we’ll be able to advise you how much you are eligible to loan. The RLS gives the lender a government-backed guarantee, making you liable for the total loaned amount.

You can apply for a business recovery loan via Aurora Capital today.

There are a number of different types of recovery scheme loans available depending on your needs, including a term loan, invoice finance, asset finance, and overdrafts.

The interest rate for RLS finance is capped at no more than 14.99% annually.

Lenders may carry out relevant credit and security checks. Businesses in financial difficulty are exempt from the RLS scheme.

As long as you meet the eligibility criteria and your business is not in difficulty and is viable, you can apply for the RLS. It doesn’t matter if you’ve been refused credit, even government credit, before.

The RLS is not the same as a bounce back loan. Both have different eligibility criteria and terms. Having a bounce back loan can limit how much you can borrow through the RLS.

Yes, you can, but the amount you’re entitled to borrow may be limited if you have a CBILS or bounce back loan.

If you are rejected for an RLS by a lender, you can apply again through other accredited lenders or look at an alternative unsecured business loan lender.

The current iteration of the RLS will close in 2024.

Some lenders may require a personal guarantee as part of the application. This is at the discretion of the lender.

RLS funds can be used for most business purposes, including managing cash flow, investing, and refinancing existing schemes like CBILS.

The government guarantee provides lenders with a 70% guarantee against the outstanding debt balance.

Repayment terms vary from lender to lender and depending on the product. Term loans and asset finance can be taken out across a six-year period, whilst overdrafts and invoice finance are available across a three-year period.

Yes, you can access different credit facilities as long as you do not exceed the maximum amount you’re eligible to borrow overall.