Explore Finance Options for Your Recruitment Agency

Looking to grow your recruitment agency? Find out more about all the types of recruitment finance available through Aurora Capital to help your agency reach its fullest potential.

- Apply in minutes

- Applying won’t affect your credit score

- Free, no obligation quote

from 6.90%

Interest rates per annum

£100,000 +

UK Based

No early settlement fees

£5k - £500k

Funding requirement

Our lending partners

About Securing Business Loan

What funding options are available for my recruitment company?

Invoice Finance

Invoice finance can issue your recruitment company with a cash flow injection by releasing capital tied up in outstanding and/or unpaid invoices. It is a short-term credit solution that helps businesses operate normally with minimal or no cash flow disruption. This is a good way to remain financially nimble and proactive, as you’re able to navigate the sometimes-lengthy periods between the issuing of an invoice and receipt of payment. Find out more about invoice financingSecured Business Loans

Secured business loans are a popular funding option for recruitment agencies that have valuable assets to offer as collateral. The lender provides a loan in exchange for a security interest in your agency’s assets, which can include property, inventory or equipment. This type of funding can be used to cover a range of costs, from office renovations to hiring additional staff. You can typically borrow £25k – £2m over 15 years. Find out more about secured business loansUnsecured Business Loans

Unsecured business loans, on the other hand, do not require collateral but may have higher interest rates than secured loans as a result. They can be a useful option for recruitment agencies that do not have valuable assets to offer as security against the loan. This type of funding can be used for a variety of purposes, such as expanding your agency’s marketing efforts or investing in technology upgrades. You can usually borrow in the region of £1k – £500k over six years. Find out more about unsecured business loansRevolving Credit Facility

Revolving credit facilities provide access to a line of credit that can be drawn on as needed, similar to an overdraft. This type of funding can be useful for recruitment agencies that have ongoing expenses or that want a safety net, so to speak. You can generally borrow £10k – £2m over two years, and dip into it and pay it off as you go. The more you borrow, the less you have available, but as soon as it’s paid off, the original borrowed amount will be available again. Find out more about revolving credit facilitiesAsset Finance

Asset finance involves using your agency’s assets, such as equipment or vehicles, as collateral to secure funding. This type of funding can be useful for recruitment agencies that need to purchase new assets to support their operations, as well as those that want lower interest rates on credit and are happy to use assets as security against defaulted payments. You can typically borrow £1k – £2m over seven years. Find out more about asset financeHow to use external finance for your recruitment agency growth

Hire Staff

One of the most significant ways that agencies can use recruitment finance is by hiring more staff. With more employees, your agency can take on more clients and expand its business offerings. This could include bringing on specialists to help with candidate sourcing, marketing, or account management. By investing in high-quality staff, your recruitment agency can improve its services and attract more business.Improve Cash Flow

It’s well known that recruitment agencies can have notoriously long payment periods, where you do not receive payment for 60 or even 90 days. Invoice finance is an excellent way to navigate this financial limbo, because it enables you to release and use the capital locked in unpaid invoices.Upgrade Operations

Another way that agencies can use external recruitment finance is by upgrading operations, such as applicant tracking systems. Modernising your technology with equipment loans can help your agency work more efficiently, automate manual tasks, and improve the overall candidate experience. By upgrading to a more sophisticated system, you can track candidate data, automate job postings and manage recruitment campaigns more effectively – freeing up more time to take on more clients.Move Premises

The third more prominent way recruitment agencies can use external finance to grow is to expand their business premises. A larger, more prominent location can help attract more clients, give employees more space to work, and provide a better experience for candidates. Additionally, a more extensive space can help your agency improve its brand image and create a better reputation in the market. Whether it’s hiring more staff, upgrading applicant tracking systems, or expanding their business premises, Aurora Capital can help you find the right funding solution for your needs. Speak to us about your growth plans and learn more about our funding solutions today.Qualifying for recruitment finance largely comes down to the type of credit you’re applying for. Different lines of credit will have different requirements, but as a general rule of thumb, here at Aurora Capital, we work with businesses that meet the following criteria:

- 6+ months trading history

- £100,000+ annual turnover

- UK based

- £10k – £5m funding requirements

- Positive credit history

If you have a low credit score or your recruitment agency is a startup and therefore doesn’t have an extensive history, this doesn’t necessarily mean that you won’t be eligible for secure business funding. We work with a range of lenders that provide finance to companies with adverse credit.

Making an application is the easiest way to find out if you can access a finance product, and at Aurora Capital, applications don’t have a negative impact on your credit score, so there’s all the more reason to submit an application and see what options are available to you.

The amount you can borrow will depend on several factors, including your credit history, asset value, and the type of finance you choose.

Your credit history is one of the most important factors that lenders consider when deciding how much to lend you. If you have a good credit score, you are more likely to be approved for larger loans with better interest rates. On the other hand, if you have a lower credit score, lenders may be more cautious about lending to you, and you may need to provide additional collateral or a guarantor to secure a loan.

Another factor that can impact how much you can borrow is the size of your business; Turnover and Profit. Many lenders will evaluate the strength of your business based on these 2 key metrics. Lenders will be more willing to lend if you have evidence that your business is growing and has the ability to repay the loan.

Finally, the type of finance you choose can also impact how much you can borrow. For example, if you choose a secured loan, you may be able to borrow more money than if you choose an unsecured loan. Similarly, if you choose invoice finance, the amount you can borrow will depend on the value of your outstanding invoices.

At Aurora Capital, we understand that every recruitment agency is different, and we work with our clients to find the finance solution that best meets their needs. Whether you need to borrow a small amount to cover short-term expenses or a larger amount to fund expansion, we can help you find the right finance solution for your recruitment agency.

Wide Lender Network

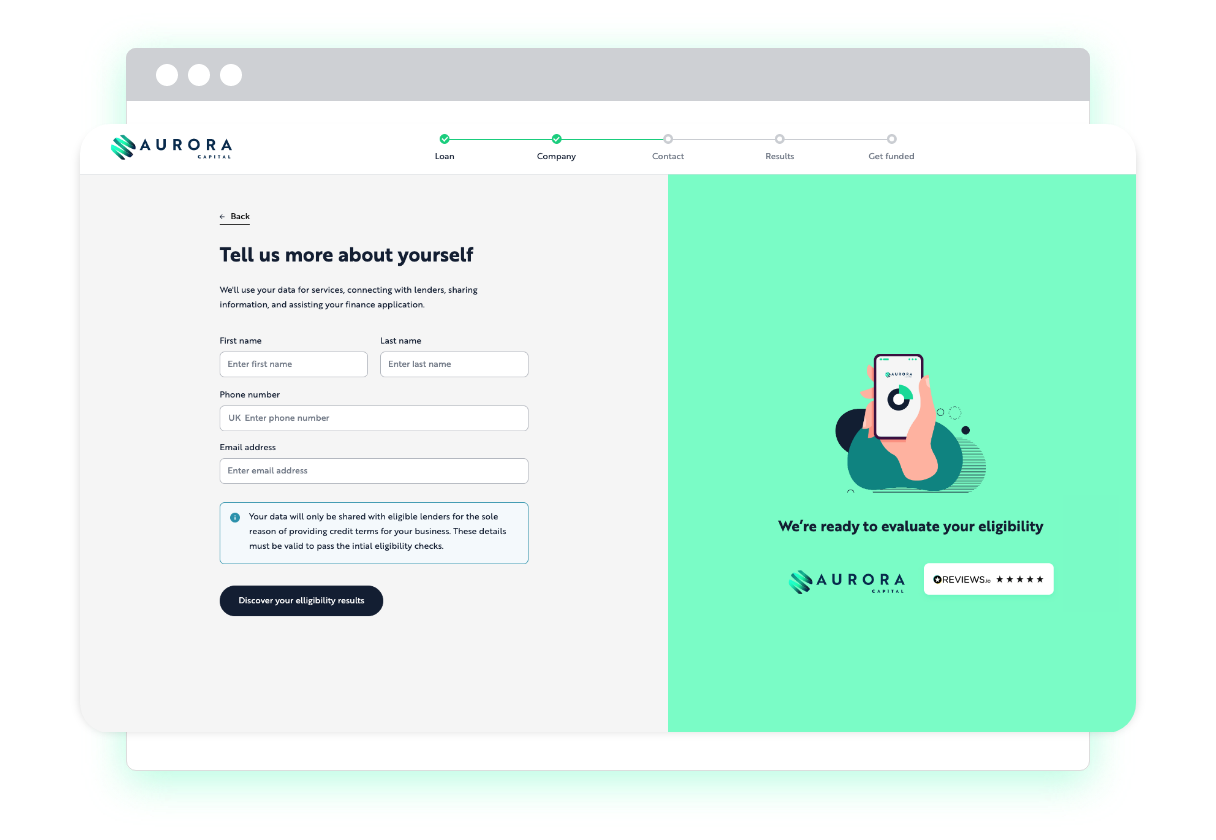

As a broker with over 50+ commercial lenders in our network, we can offer you a wider range of finance options to suit your needs and help you achieve your goals. Our network of lenders includes many who are willing to work with companies that have poor credit histories or are just starting out. This means that even if you’ve been turned down for finance in the past, we may still be able to help.Quick Loan Application

Applying for finance through Aurora Capital is quick and easy, taking just minutes to complete. We offer fast decisions, with many being made in just hours, not days, and if approved, the money can be available in just a few days. Best of all, applying through us won’t impact your credit score, so you can explore your options without any worry.Personalised Service

Whether you need finance to cover day-to-day expenses, invest in new technology, or expand your team, we can help you find the right solution. Our team of experienced brokers will work with you to understand your business and financial needs, and then match you with the lender that offers the best terms and most competitive rates for you.Qualifying for recruitment finance largely comes down to the type of credit you’re applying for. Different lines of credit will have different requirements, but as a general rule of thumb, here at Aurora Capital, we work with businesses that meet the following criteria:

- 6+ months trading history

- £100,000+ annual turnover

- UK based

- £10k – £5m funding requirements

- Positive credit history

If you have a low credit score or your recruitment agency is a startup and therefore doesn’t have an extensive history, this doesn’t necessarily mean that you won’t be eligible for secure business funding. We work with a range of lenders that provide finance to companies with adverse credit.

Making an application is the easiest way to find out if you can access a finance product, and at Aurora Capital, applications don’t have a negative impact on your credit score, so there’s all the more reason to submit an application and see what options are available to you.

The amount you can borrow will depend on several factors, including your credit history, asset value, and the type of finance you choose.

Your credit history is one of the most important factors that lenders consider when deciding how much to lend you. If you have a good credit score, you are more likely to be approved for larger loans with better interest rates. On the other hand, if you have a lower credit score, lenders may be more cautious about lending to you, and you may need to provide additional collateral or a guarantor to secure a loan.

Another factor that can impact how much you can borrow is the size of your business; Turnover and Profit. Many lenders will evaluate the strength of your business based on these 2 key metrics. Lenders will be more willing to lend if you have evidence that your business is growing and has the ability to repay the loan.

Finally, the type of finance you choose can also impact how much you can borrow. For example, if you choose a secured loan, you may be able to borrow more money than if you choose an unsecured loan. Similarly, if you choose invoice finance, the amount you can borrow will depend on the value of your outstanding invoices.

At Aurora Capital, we understand that every recruitment agency is different, and we work with our clients to find the finance solution that best meets their needs. Whether you need to borrow a small amount to cover short-term expenses or a larger amount to fund expansion, we can help you find the right finance solution for your recruitment agency.

Wide Lender Network

As a broker with over 50+ commercial lenders in our network, we can offer you a wider range of finance options to suit your needs and help you achieve your goals. Our network of lenders includes many who are willing to work with companies that have poor credit histories or are just starting out. This means that even if you’ve been turned down for finance in the past, we may still be able to help.Quick Loan Application

Applying for finance through Aurora Capital is quick and easy, taking just minutes to complete. We offer fast decisions, with many being made in just hours, not days, and if approved, the money can be available in just a few days. Best of all, applying through us won’t impact your credit score, so you can explore your options without any worry.Personalised Service

Whether you need finance to cover day-to-day expenses, invest in new technology, or expand your team, we can help you find the right solution. Our team of experienced brokers will work with you to understand your business and financial needs, and then match you with the lender that offers the best terms and most competitive rates for you.Get your free, no

obligation quote Today!

- Apply in minutes

- FREE, no obligation, personalised quote

- FCA regulated

How much do you want to borrow?

Securing business funding:

How it works

We understand that timing is key when you’re looking to find funding options for your business,so our process is as quick and as streamlined as possible.

1

Apply Online in minutes

We cater to any sized business, so to apply for business funding, we only need you to share basic information about your company. Your application will take a few minutes, and our experts are always happy to assist with any questions you have about specific loan types or alternative finance options.

2

Get Matched in hours

Our LendTech technology will compare our trusted panel of lenders and match you with your most suitable finance option. Each business funding option is different, and we’ll help to make sure you’re fully clued up on the terms and conditions as well as indicative repayment details.

3

Get Funded in days

One of our funding specialists will discuss the available options with you and guide you through the process from application to approval. Once approved, the funds can be deposited in a matter of hours.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers

Navigate our range of business

funding options to find out more

We understand that timing is key when you’re looking to find funding options for your business, so our process is as quick and as streamlined as possible.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers

Key benefits of working with

Aurora Capital

LendTech Technology - Access to 50+ Lenders

At Aurora Capital, we use LendTech technology which gives us access to a vast network of over 50 commercial lenders in the market. Our extensive pool of lenders ensures that we can match you with the most appropriate lender for your specific requirements, who will provide competitive terms and reasonable loan options.

Apply Online in Minutes & Get Funding in Days

We understand that businesses often need funding quickly. For this reason, we offer a fast, simplified service. Once you’ve chosen the appropriate loan for your needs, you can apply online through Aurora Capital, which only takes a few minutes. Our team will then match you with a lender and acquire the necessary funds, often in just a few days.

No Effect on Your Credit Score

Conventional loan and credit applications can damage your credit score, but with Aurora Capital, this isn’t the case. Whether your application is successful or declined, your credit score remains unaffected. This is especially advantageous for newly established businesses trying to establish a credit score, or those with a negative credit history.

LendTech Technology - Access to 50+ Lenders

At Aurora Capital, we use LendTech technology which gives us access to a vast network of over 50 commercial lenders in the market. Our extensive pool of lenders ensures that we can match you with the most appropriate lender for your specific requirements, who will provide competitive terms and reasonable loan options.

Apply Online in Minutes & Get Funding in Days

We understand that businesses often need funding quickly. For this reason, we offer a fast, simplified service. Once you’ve chosen the appropriate loan for your needs, you can apply online through Aurora Capital, which only takes a few minutes. Our team will then match you with a lender and acquire the necessary funds, often in just a few days.

No Effect on Your Credit Score

Conventional loan and credit applications can damage your credit score, but with Aurora Capital, this isn’t the case. Whether your application is successful or declined, your credit score remains unaffected. This is especially advantageous for newly established businesses trying to establish a credit score, or those with a negative credit history.

100+ Happy Customers & Counting

Recruitment agency finance FAQs: FAQs

Before you apply for credit, it’s important to understand what lenders look for when evaluating loan applications. Here are some common red flags that lenders may look for:

- Poor credit score – Lenders will typically check your credit score to determine your creditworthiness. If your score is low, it may be a red flag that you’re a risky borrower.

- High debt-to-income ratio – This is the amount of debt you have compared to your income. If your ratio is too high, it may indicate that you’re overextended and may struggle to repay the loan.

- Inconsistent income – Lenders want to see a stable income that can support loan repayments. If your income is inconsistent or unreliable, it may be a red flag.

- Lack of collateral – If you’re applying for a secured loan, lenders will want to see that you have collateral to secure the loan. If you don’t have any, it may be a red flag that you’re a risky borrower.

- Poor business performance – Lenders may look at your business’s financial performance to determine whether you’re a good candidate for a loan. If your business is struggling or has a history of poor performance, it may be a red flag.

There are lenders that work with businesses with adverse credit histories, meaning that whilst there may be red flags, you might not necessarily get turned down. That being said, it’s useful to know what lenders look for so you can make your application as strong as possible and increase your chances of getting approved.

- Check your credit report – Make sure your credit report is accurate and up-to-date. If you notice any errors, dispute them and get them resolved.

- Pay down debt – If you have high balances on credit cards or loans, paying them down can help improve your credit score.

- Make payments on time – Late payments can have a negative impact on your credit score. Make sure you’re making payments on time to avoid any penalties.

- Don’t apply for too much credit – Applying for multiple loans or lines of credit at once can lower your credit score. Only apply for credit when you need it.