Construction Finance

A lot of the construction industry requires upfront capital, but what funding options are available if you don’t have immediate access to the cash you need? Learn more about the construction finance products available through Aurora Capital to help fund your next project or the expansion of your business.

- Apply in minutes

- Applying won’t affect your credit score

- Free, no obligation quote

from 6.90%

Interest rates per annum

£100,000 +

UK Based

No early settlement fees

£5k - £500k

Funding requirement

Our lending partners

About Securing Business Loan

Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia.

Types of Finance for Your Construction Business

Unsecured Business Loans

Unsecured business loans don’t require collateral, but they typically have higher interest rates than secured loans due to the increased risk to the lender. This also means you can’t borrow as much as you can with a secured loan, but you can still access a substantial amount of credit. Unsecured loans are ideal for construction businesses that lack valuable assets to offer as security or that choose not to use them as collateral. They are equally as versatile as secured loans, meaning they can be used for anything business related. The loan amounts usually range from £1,000 to £500,000 and can be repaid over a maximum period of six years. Find out more about unsecured business loansRevolving Credit Facility

Revolving credit facilities offer construction businesses a flexible credit line that functions similarly to an overdraft. This funding option can be beneficial for construction businesses that require a financial cushion for unexpected expenses or cash flow challenges. Revolving credit facilities usually have loan amounts ranging from £10,000 to £2 million and can be borrowed over a two-year period. The available credit decreases as more funds are borrowed, but once the borrowed amount is repaid, the original amount becomes available again and can be used repeatedly as needed. This can be ideal if you unexpectedly need to borrow money to replace equipment, for example, as you don’t need to apply for new credit each time. Find out more about revolving credit facilitiesRecovery Loans

Recovery loans are a financing option that can assist construction businesses in overcoming financial difficulties. This type of borrowing is suitable for businesses that have encountered financial setbacks and require a larger sum of money to move forward. The loan amounts usually range from £25,000 to £2 million and can be borrowed over a maximum period of six years. Find out more about recovery loansAsset Finance

When it comes time to purchase new equipment or assets, but you don’t want to impede your cash flow or don’t have the necessary funds immediately available, an asset finance agreement could be for you. This allows SMEs to use business assets as a way to secure finance and facilitate growth. Usually, it refers to assets such as equipment and machinery; for instance, if you run a plant hire company and want to purchase a new vehicle, but you don’t have the cash readily available, you can take out asset finance in order to make the purchase. You can also use asset finance to refinance assets your company already owns – however, there are eligibility criteria regarding the age and condition of equipment that can be refinanced. Find out more about asset financingUsing Finance for Construction Equipment

Finance is often used by construction businesses to purchase equipment; whether it’s buying new machinery or replacing broken equipment. Hire purchase (by way of asset finance) is a common financing option that construction businesses typically consider when looking to purchase equipment.

Asset finance is an ideal option for businesses looking to expand. An asset finance agreement allows you to purchase new assets – usually equipment or machinery, but sometimes also ‘soft’ assets like intellectual property – if your company doesn’t have the funds immediately available to do so. In this way, your company is able to purchase the assets (a new bulldozer or excavator, say) required to ensure future growth.

On the other hand, unsecured loans are an option for businesses that don’t have valuable assets to offer as collateral. While unsecured loans come with higher interest rates than secured loans, they are easier to obtain and don’t require the borrower to provide any collateral. Unsecured loans are suitable for businesses that need to finance smaller equipment purchases, such as tools or vehicles, and are looking for a quick and easy financing solution.

Careful consideration should be given to the type of financing option that best suits your business needs, taking into account the size of the purchase, available assets, and the urgency of the equipment. If you’re unsure what type of construction finance is most suitable for buying equipment, speak to one of our team members today.

As a construction business owner seeking external funding, it’s crucial to understand the eligibility requirements that lenders typically require. At Aurora Capital, we work with UK-based construction businesses that have been trading for at least 6 months (start-up options are available). Your business must have an annual turnover of £100,000 or more, and credit needs ranging from £10,000 to £500k. These requirements ensure that your business is financially stable and has a reliable income stream to repay the loan.

We do have some products for new businesses that haven’t been trading for six months, so don’t hesitate to reach out if this applies to you.

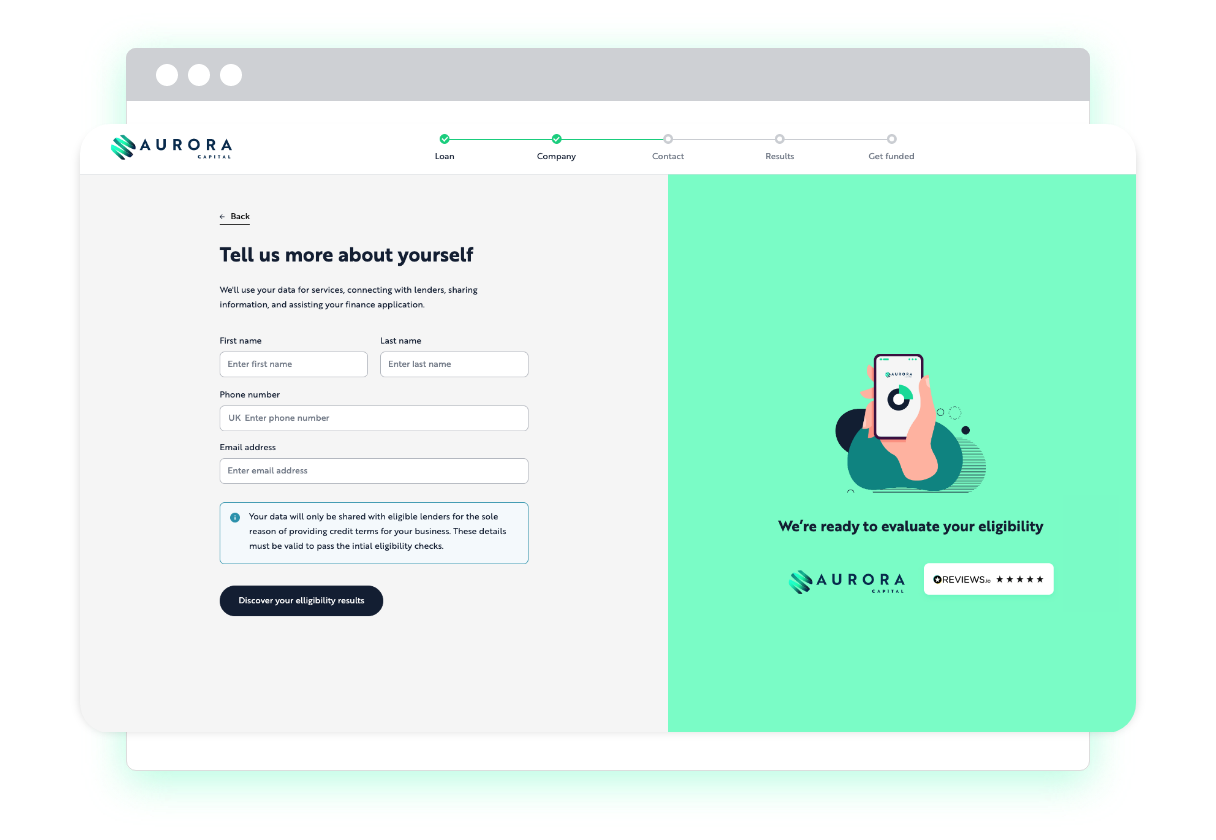

At Aurora Capital, the application process for construction finance is straightforward. When you know what type of funding is best for you, you can apply online. Filling out the form only takes a few minutes, and the application has no impact on your credit score. When your application is in, we will expertly match you with lenders with the most competitive terms. It takes just days to process the paperwork, and funds can be in your account in less than a week.

This being said, depending on the type of finance you’re opting for, there may be a few additional steps to consider, and some general know-how about what lenders will expect to evaluate when assessing your application. Some of the main things to keep in mind and be prepared for include:

- A Clear Requirement for Funding: If you’re taking out a large sum of credit, many lenders will want to understand how you are going to utilise this in the business. It’s always good to have a breakdown of what you are intending to use the funds for.

- Credit History: Your credit history will almost certainly be assessed so lenders can get a feel for your reliability and affordability. If you have an adverse credit history, some lenders may still work with you, so don’t hesitate to submit an application – applying through Aurora Capital has no effect on your credit history.

- Collateral: For larger credit amounts, it’s likely lenders will want to secure the loan against collateral, so they may assess what assets you have, their value, and whether they could be used to recover funds if needed.

If you have any questions about the application process, speak to a member of our team today.

Generally speaking, applying for construction credit is easy with Aurora Capital, but there are some general best practices to keep in mind:

- Only borrow what you need – A lot of businesses go wrong when they ask to borrow more money than they need. It’s easier to get approval to borrow smaller sums of money and keep adding to it, especially if your credit history isn’t great. Only apply for what you need, and no more.

- Prepare your paperwork – Make sure you have your accounts information and a business plan ready to go should a lender ask for it. This will speed up the application process.

- Assess future affordability – When choosing a finance product, assess the repayment terms thoroughly. If monthly repayments are high, will you be able to keep up with them if your business experiences a quiet period?

We can guide you through the application process and help you prepare. Speak to one of our brokers to find out more.

As a construction business owner seeking external funding, it’s crucial to understand the eligibility requirements that lenders typically require. At Aurora Capital, we work with UK-based construction businesses that have been trading for at least 6 months (start-up options are available). Your business must have an annual turnover of £100,000 or more, and credit needs ranging from £10,000 to £500k. These requirements ensure that your business is financially stable and has a reliable income stream to repay the loan.

We do have some products for new businesses that haven’t been trading for six months, so don’t hesitate to reach out if this applies to you.

At Aurora Capital, the application process for construction finance is straightforward. When you know what type of funding is best for you, you can apply online. Filling out the form only takes a few minutes, and the application has no impact on your credit score. When your application is in, we will expertly match you with lenders with the most competitive terms. It takes just days to process the paperwork, and funds can be in your account in less than a week.

This being said, depending on the type of finance you’re opting for, there may be a few additional steps to consider, and some general know-how about what lenders will expect to evaluate when assessing your application. Some of the main things to keep in mind and be prepared for include:

- A Clear Requirement for Funding: If you’re taking out a large sum of credit, many lenders will want to understand how you are going to utilise this in the business. It’s always good to have a breakdown of what you are intending to use the funds for.

- Credit History: Your credit history will almost certainly be assessed so lenders can get a feel for your reliability and affordability. If you have an adverse credit history, some lenders may still work with you, so don’t hesitate to submit an application – applying through Aurora Capital has no effect on your credit history.

- Collateral: For larger credit amounts, it’s likely lenders will want to secure the loan against collateral, so they may assess what assets you have, their value, and whether they could be used to recover funds if needed.

If you have any questions about the application process, speak to a member of our team today.

Generally speaking, applying for construction credit is easy with Aurora Capital, but there are some general best practices to keep in mind:

- Only borrow what you need – A lot of businesses go wrong when they ask to borrow more money than they need. It’s easier to get approval to borrow smaller sums of money and keep adding to it, especially if your credit history isn’t great. Only apply for what you need, and no more.

- Prepare your paperwork – Make sure you have your accounts information and a business plan ready to go should a lender ask for it. This will speed up the application process.

- Assess future affordability – When choosing a finance product, assess the repayment terms thoroughly. If monthly repayments are high, will you be able to keep up with them if your business experiences a quiet period?

We can guide you through the application process and help you prepare. Speak to one of our brokers to find out more.

Get your free, no

obligation quote Today!

- Apply in minutes

- FREE, no obligation, personalised quote

- FCA regulated

How much do you want to borrow?

Securing business funding:

How it works

We understand that timing is key when you’re looking to find funding options for your business,so our process is as quick and as streamlined as possible.

1

Apply Online in minutes

We cater to any sized business, so to apply for business funding, we only need you to share basic information about your company. Your application will take a few minutes, and our experts are always happy to assist with any questions you have about specific loan types or alternative finance options.

2

Get Matched in hours

Our LendTech technology will compare our trusted panel of lenders and match you with your most suitable finance option. Each business funding option is different, and we’ll help to make sure you’re fully clued up on the terms and conditions as well as indicative repayment details.

3

Get Funded in days

One of our funding specialists will discuss the available options with you and guide you through the process from application to approval. Once approved, the funds can be deposited in a matter of hours.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers

Navigate our range of business

funding options to find out more

We understand that timing is key when you’re looking to find funding options for your business, so our process is as quick and as streamlined as possible.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers

Key benefits of working with

Aurora Capital

LendTech Technology - Access to 50+ Lenders

At Aurora Capital, we use LendTech technology which gives us access to a vast network of over 50 commercial lenders in the market. Our extensive pool of lenders ensures that we can match you with the most appropriate lender for your specific requirements, who will provide competitive terms and reasonable loan options.

Apply Online in Minutes & Get Funding in Days

We understand that businesses often need funding quickly. For this reason, we offer a fast, simplified service. Once you’ve chosen the appropriate loan for your needs, you can apply online through Aurora Capital, which only takes a few minutes. Our team will then match you with a lender and acquire the necessary funds, often in just a few days.

No Effect on Your Credit Score

Conventional loan and credit applications can damage your credit score, but with Aurora Capital, this isn’t the case. Whether your application is successful or declined, your credit score remains unaffected. This is especially advantageous for newly established businesses trying to establish a credit score, or those with a negative credit history.

LendTech Technology - Access to 50+ Lenders

At Aurora Capital, we use LendTech technology which gives us access to a vast network of over 50 commercial lenders in the market. Our extensive pool of lenders ensures that we can match you with the most appropriate lender for your specific requirements, who will provide competitive terms and reasonable loan options.

Apply Online in Minutes & Get Funding in Days

We understand that businesses often need funding quickly. For this reason, we offer a fast, simplified service. Once you’ve chosen the appropriate loan for your needs, you can apply online through Aurora Capital, which only takes a few minutes. Our team will then match you with a lender and acquire the necessary funds, often in just a few days.

No Effect on Your Credit Score

Conventional loan and credit applications can damage your credit score, but with Aurora Capital, this isn’t the case. Whether your application is successful or declined, your credit score remains unaffected. This is especially advantageous for newly established businesses trying to establish a credit score, or those with a negative credit history.

100+ Happy Customers & Counting

Construction Funding: FAQs

The amount you can borrow will depend on a number of factors, including your credit history, your annual turnover, your monthly overheads and affordability, how long your credit terms are, and the type of finance you opt for. At Aurora Capital, we generally work with businesses that need to borrow in the region of £10k to £500k.

Many businesses rely on external funding to help them grow and thrive, and construction companies are no different. When you take out a business loan, you can plug temporary cash flow gaps, keep your operations going as normal, invest in new equipment and staff to take on more projects, and increase the reach of your business overall.

As a construction company, you need access to flexible funding options to fuel your growth and take on new projects. At Aurora Capital, we understand your needs and have partnered with over 50 lenders to provide you with a diverse range of financing solutions.

Our streamlined application process is quick and easy, taking just a few minutes to complete. Plus, our applications have no impact on your credit score. With our fast decision-making process, you’ll receive an offer in just a few days and funds can be available in less than a week.

As experts in construction financing and with a commitment to exceptional customer service, we are a trusted partner for construction businesses looking to achieve their growth goals. Partner with Aurora Capital today and take your business to the next level.