About Aurora Capital:

Your Funding Specialists

- Apply in minutes

- Applying won’t affect your credit score

- Free, no obligation quote

FCA

Accredited

Award winner ‘Best

SME Broker 2020’

Brokered over £75M

in the past 5 years

Independent

and unbiased

Relationships with over

50 Leading Lenders

Access The Best

Business Finance Options

Navigate our range of business funding options to find out more

We’re independent, fast and flexible. Aurora Capital offers speedy funding solutions to an array of businesses across a wide range of sectors, from hospitality, retail and leisure, to manufacturing, construction, transport and more.

Securing business funding:

How it works

We understand that timing is key when you’re looking to find funding options for your business,so our process is as quick and as streamlined as possible.

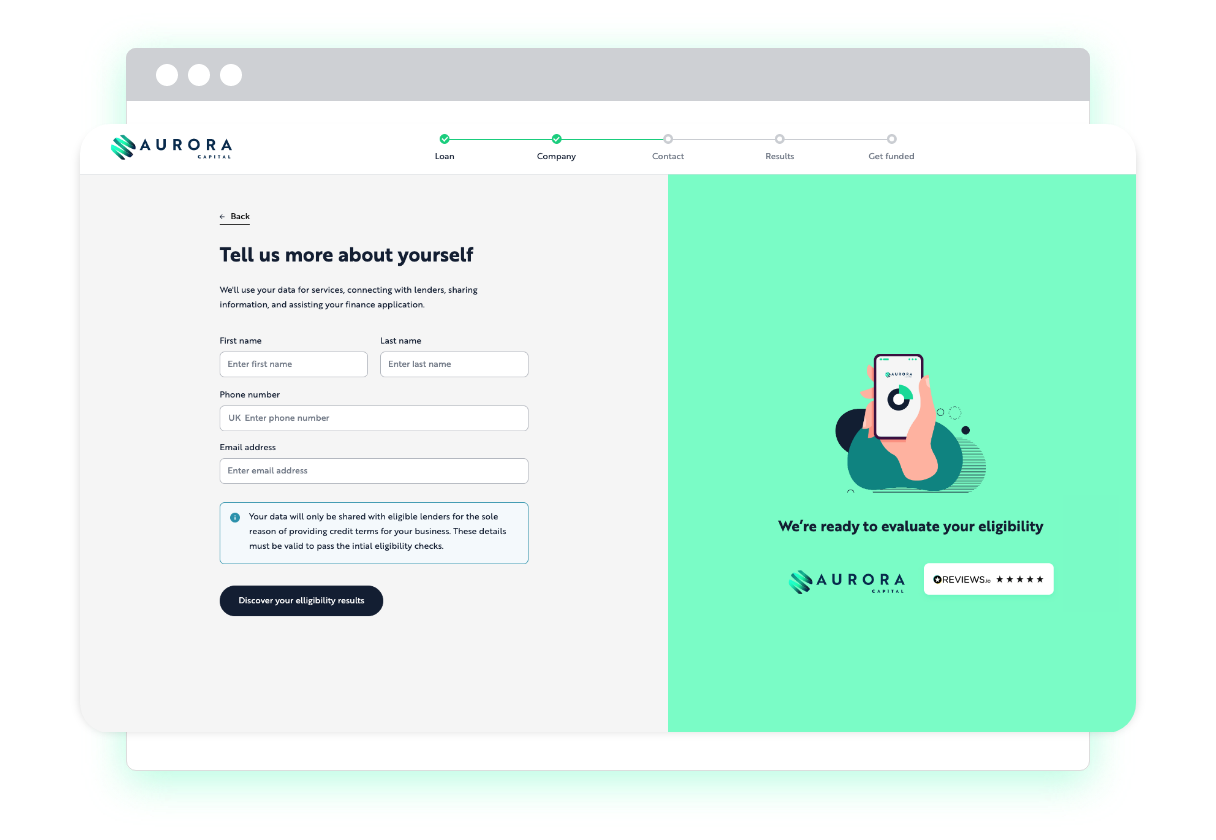

1

Apply Online in minutes

We cater to any sized business, so to apply for business funding, we only need you to share basic information about your company. Your application will take a few minutes, and our experts are always happy to assist with any questions you have about specific loan types or alternative finance options.

2

Get Matched in hours

Our LendTech technology will compare our trusted panel of lenders and match you with your most suitable finance option. Each business funding option is different, and we’ll help to make sure you’re fully clued up on the terms and conditions as well as indicative repayment details.

3

Get Funded in days

One of our funding specialists will discuss the available options with you and guide you through the process from application to approval. Once approved, the funds can be deposited in a matter of hours.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers

Over 500 UK Businesses Have Financed Their Goals By Borrowing £75 Million Through Aurora Capital.

£75 MILLION

LENT TO BUSINESSES

Experts In Business Funding

Over the last 6 years we have specialised in business funding and have an in-depth knowledge of the whole market. We eat, sleep and breathe business funding, and there’s no application we can’t handle!

Offering The Quickest Loans

We understand that sometimes, time is of the essence when applying for business funding. Many of our lenders can pay out within 24 hours of approval, and we will always strive to match any timelines you are working to.

Completely

Independent

We are totally independent, meaning we can give unbiased advice when determining what funding solution is best for your business going forward. We have a panel of over 50 lenders enabling us to scour the market for the top deals.

Providing Funding Nationwide

Aurora Capital can work across the whole of the UK (including Northern Ireland) to get you the funding that best suits your business needs.

Offering The Personal Touch

A dedicated account manager will look after your application from start to finish, and provide on-going support from thereafter.

Get your free,

no obligation quote today!

Apply in Minutes

Free, no obligation quote

Applying won’t affect your credit score

Prefer to talk? Call us on