Compare Asset Finance to Help Your Business

Grow

Purchase Stock

Employ Staff

Expand

Pay Suppliers

It takes minutes to apply, there’s no effect on your credit score, and you can obtain decisions within 24 hours.

- Apply in minutes

- Applying won’t affect your credit score

- Free, no obligation quote

from 6%

Interest rates per annum

LEASING & HP

Finance options

1 – 6 YEARS

Loan term

SOFT & HARD

Assets Financed

Our lending partners

Asset Finance Loans

If you need to purchase new equipment or assets but don’t want to impede your cash flow or don’t have the immediate capital available to fund such a purchase, an asset finance agreement could be the solution you’re looking for. Learn more about how asset finance could help you invest in your business without compromising your cash flow, and compare rates from top asset finance lenders with Aurora Capital.

What is Asset Finance?

Asset finance uses business assets as a way to secure finance to help established companies to fund big projects or cover a surge in growth. Asset finance relates to loans that are offered to businesses to purchase or lease new/used equipment or machinery.

When you need such assets, but don’t want to make a large cash payment to buy them outright, asset finance can support your purchase. It does this by spreading the cost over time, usually up to 6 years. You make smaller, regular payments during a fixed term. Fees and interest are charged in addition to the cost of the asset. You have full use of the asset throughout the term.

Equipment leasing and hire purchase are common examples of asset finance.

Key features of asset finance

- Suitability: Businesses looking to purchase any asset without the need for upfront capital. We can also look into refinancing any existing assets.

- Purpose: Used to either lease or purchase an asset.

- Amount: Loans ranging from £1k – £2m, subject to the type of asset and affordability.

- Term: Up to 7 years, depending on the type of asset and credit worthiness of the business.

- Cost: Variable, depending on the asset.

- Security: The asset will be secured until a full repayment has been made. Some lenders may also ask for a personal guarantee.

- Speed: Applications can be processed within 24 hours from receiving a full proposal.

Asset finance allows SMEs to acquire much needed capital to help expand and grow the business without affecting cash flow. Asset finance also allows companies to release much needed capital from already-owned equipment or machinery.

There are several reasons why this type of borrowing can be beneficial, with the fact it provides fast access to funds at the top of the list. Due to the fact the loan is secured against collateral, you have a higher chance of your application being approved if you have assets to secure the loan against, and this can really speed up the process. If you need to invest in new equipment quickly or if you need a cash injection rapidly, asset finance is an efficient method.

Another reason to choose asset finance is that it can often work out to be a cheaper form of business finance overall. Asset finance rates are fixed which makes monthly payments predictable and more affordable in the long-run, allowing you to aid your cash flow and keep things ticking over smoothly.

There are two types of assets that a business can finance: hard and soft assets. An important factor to consider when it comes to deciding whether an asset is hard or soft is its resale value. Hard assets still have value if they are used, whereas soft assets typically have a low resale value.

- Hard assets: These are typically machines such as agricultural machinery, vehicles, or manufacturing equipment.

- Soft assets: These assets can be catering equipment, gymnasium equipment, medical equipment, or IT software.

While we can finance all sorts of assets for almost any business, most lenders will have a preference over what they can finance.

The asset finance product you choose for your business will depend on whether you are looking to own, rent or release cash tied up in already owned assets. We can help you make the right decision.

Hire Purchase

Hire purchase (HP) of vehicles, plant, or equipment for your business is a similar process to buying a new kitchen or furniture for your home.

HP allows your company to buy a new or used asset in instalments instead of paying a large, upfront sum. It’s a simpler form of asset finance than equipment leasing, and you end up owning the asset once you finish making the payments.

In most cases, the asset appears as a positive item on your balance sheet from the start of the agreement, but the provider owns the asset until the last instalment is paid. This means you cannot sell the asset during the term. A small fee, called the Purchase Option Fee is often required to transfer ownership of the asset to you. This may be as low as £1. With hire purchase, you are responsible for the asset’s upkeep.

Equipment Leasing

A finance lease is an agreement where a leasing firm buys a business asset on behalf of your company and then rents it out to you. Over a fixed term you rent the equipment from a vendor or a leasing firm and make regular scheduled payments for the use of the asset. At the end of the rental period, you can extend the lease, return the asset to the lender, upgrade the item, or buy it outright by making a balloon payment. Depending on the size of your company and its needs, you can rent everything from laptops and printers to commercial vehicles and machinery.

Because equipment lease agreements are based on the depreciation of the asset, not the full cost price, monthly lease payments are typically less than hire purchase. However, if you opt to purchase the equipment by making a balloon payment, it may work out more expensive than if you’d purchased the equipment outright.

Equipment leasing can offer potential tax advantages as you can offset 100% of the regular monthly payments you make against your corporation tax bill.

Asset Refinance

Asset refinance, sometimes called asset-based lending, or sale and hire purchase back. In this type of agreement, you sell a hard asset to a specialist finance company for an agreed lump sum. You then lease back the asset from the finance provider – which repays the lump sum. This circular arrangement allows you to free up a large sum of cash, pay it back in small increments over a long period of time, and use the asset during the repayment period.

At the end of the repayment period, the loan may be cleared, but the finance company now owns the asset. You may choose to continue to rent the asset, walk away from the asset, or buy it back for an agreed sum.

Asset finance is generally a short-term funding solution for businesses who either need to purchase some equipment or machinery or that wish to release cash by using existing assets.

As with most types of borrowing, the better your credit history is, the better your chances of acceptance are, especially if you want to go down the hire purchase route. Lenders will generally be looking to see if you can afford the repayments laid out in your terms, as well as what the risk of lending to you is.

Most businesses with a turnover exceeding £10,000 will be able to apply for asset finance, but if you’re unsure which option best suits your needs, don’t hesitate to contact our team.

Asset finance allows SMEs to acquire much needed capital to help expand and grow the business without affecting cash flow. Asset finance also allows companies to release much needed capital from already-owned equipment or machinery.

There are several reasons why this type of borrowing can be beneficial, with the fact it provides fast access to funds at the top of the list. Due to the fact the loan is secured against collateral, you have a higher chance of your application being approved if you have assets to secure the loan against, and this can really speed up the process. If you need to invest in new equipment quickly or if you need a cash injection rapidly, asset finance is an efficient method.

Another reason to choose asset finance is that it can often work out to be a cheaper form of business finance overall. Asset finance rates are fixed which makes monthly payments predictable and more affordable in the long-run, allowing you to aid your cash flow and keep things ticking over smoothly.

There are two types of assets that a business can finance: hard and soft assets. An important factor to consider when it comes to deciding whether an asset is hard or soft is its resale value. Hard assets still have value if they are used, whereas soft assets typically have a low resale value.

- Hard assets: These are typically machines such as agricultural machinery, vehicles, or manufacturing equipment.

- Soft assets: These assets can be catering equipment, gymnasium equipment, medical equipment, or IT software.

While we can finance all sorts of assets for almost any business, most lenders will have a preference over what they can finance.

The asset finance product you choose for your business will depend on whether you are looking to own, rent or release cash tied up in already owned assets. We can help you make the right decision.

Hire Purchase

Hire purchase (HP) of vehicles, plant, or equipment for your business is a similar process to buying a new kitchen or furniture for your home.

HP allows your company to buy a new or used asset in instalments instead of paying a large, upfront sum. It’s a simpler form of asset finance than equipment leasing, and you end up owning the asset once you finish making the payments.

In most cases, the asset appears as a positive item on your balance sheet from the start of the agreement, but the provider owns the asset until the last instalment is paid. This means you cannot sell the asset during the term. A small fee, called the Purchase Option Fee is often required to transfer ownership of the asset to you. This may be as low as £1. With hire purchase, you are responsible for the asset’s upkeep.

Equipment Leasing

A finance lease is an agreement where a leasing firm buys a business asset on behalf of your company and then rents it out to you. Over a fixed term you rent the equipment from a vendor or a leasing firm and make regular scheduled payments for the use of the asset. At the end of the rental period, you can extend the lease, return the asset to the lender, upgrade the item, or buy it outright by making a balloon payment. Depending on the size of your company and its needs, you can rent everything from laptops and printers to commercial vehicles and machinery.

Because equipment lease agreements are based on the depreciation of the asset, not the full cost price, monthly lease payments are typically less than hire purchase. However, if you opt to purchase the equipment by making a balloon payment, it may work out more expensive than if you’d purchased the equipment outright.

Equipment leasing can offer potential tax advantages as you can offset 100% of the regular monthly payments you make against your corporation tax bill.

Asset Refinance

Asset refinance, sometimes called asset-based lending, or sale and hire purchase back. In this type of agreement, you sell a hard asset to a specialist finance company for an agreed lump sum. You then lease back the asset from the finance provider – which repays the lump sum. This circular arrangement allows you to free up a large sum of cash, pay it back in small increments over a long period of time, and use the asset during the repayment period.

At the end of the repayment period, the loan may be cleared, but the finance company now owns the asset. You may choose to continue to rent the asset, walk away from the asset, or buy it back for an agreed sum.

Asset finance is generally a short-term funding solution for businesses who either need to purchase some equipment or machinery or that wish to release cash by using existing assets.

As with most types of borrowing, the better your credit history is, the better your chances of acceptance are, especially if you want to go down the hire purchase route. Lenders will generally be looking to see if you can afford the repayments laid out in your terms, as well as what the risk of lending to you is.

Most businesses with a turnover exceeding £10,000 will be able to apply for asset finance, but if you’re unsure which option best suits your needs, don’t hesitate to contact our team.

Get your free, no

obligation quote Today!

- Apply in minutes

- FREE, no obligation, personalised quote

- FCA regulated

How much do you want to borrow?

Securing business funding:

How it works

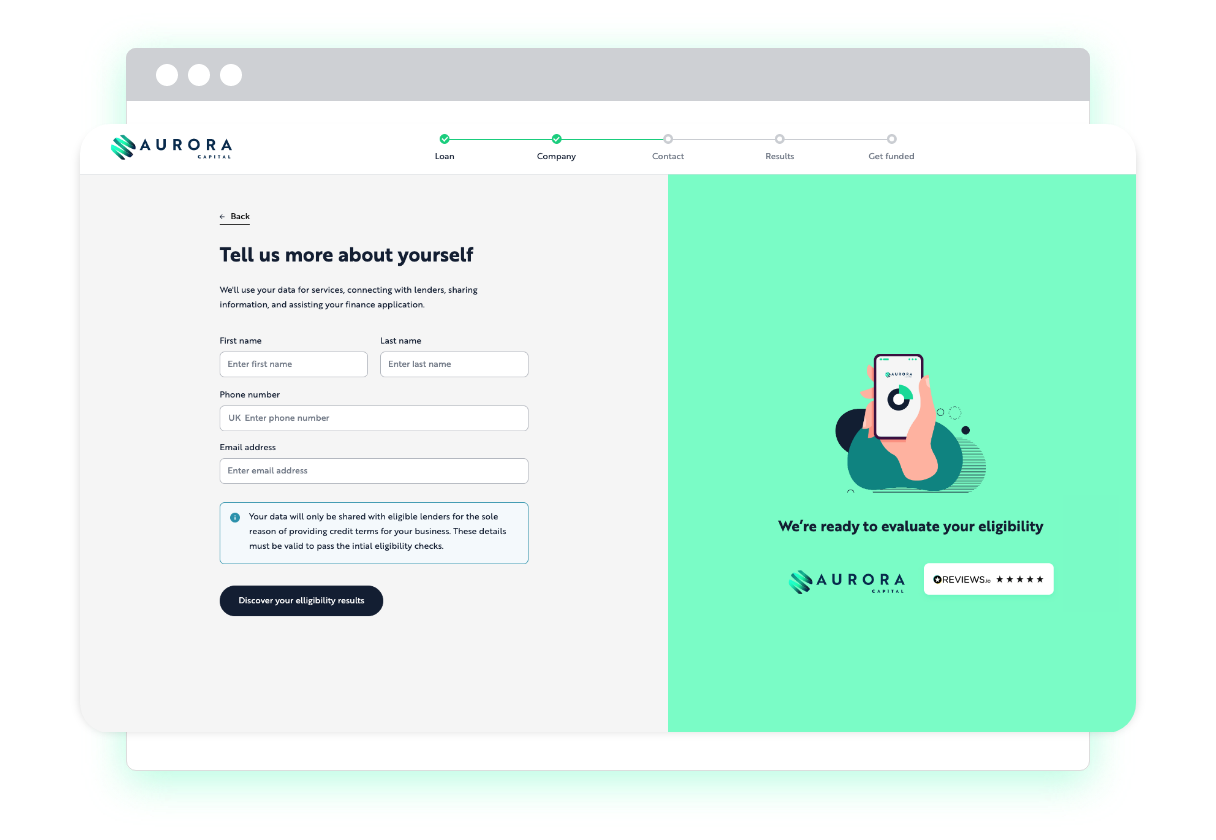

We understand that timing is key when you’re looking to find funding options for your business,so our process is as quick and as streamlined as possible.

1

Apply Online in minutes

We cater to any sized business, so to apply for business funding, we only need you to share basic information about your company. Your application will take a few minutes, and our experts are always happy to assist with any questions you have about specific loan types or alternative finance options.

2

Get Matched in hours

Our LendTech technology will compare our trusted panel of lenders and match you with your most suitable finance option. Each business funding option is different, and we’ll help to make sure you’re fully clued up on the terms and conditions as well as indicative repayment details.

3

Get Funded in days

One of our funding specialists will discuss the available options with you and guide you through the process from application to approval. Once approved, the funds can be deposited in a matter of hours.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers

Navigate our range of business

funding options to find out more

We understand that timing is key when you’re looking to find funding options for your business, so our process is as quick and as streamlined as possible.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers

100+ Happy Customers & Counting

Asset Finance: FAQs

Asset finance is usually provided for anywhere between 1-7 years. The asset finance company recoups the purchase cost of the asset over the agreed period, plus interest. The length of time the finance is provided for also depends on how long the asset is going to be ‘usable’ for, as well as how quickly the lender wants the money back. As a business borrower, you’ll have to show that your business can afford to make the agreed payments.

The amount you can borrow will depend on your business and time you have been trading. However, as a general rule, we finance equipment with a value of £1k upwards. The amount you are able to borrow will also depend on what type of asset you are trying to finance or refinance.

Yes you can, however there are certain criteria surrounding the age and condition of equipment that we will refinance. This can include the type of equipment and the date that you purchased it.

Lease finance is a way of renting an asset over a certain period of time. With this type of finance, you will never own the asset, and you will have to return it at the end of the term. Lease finance allows businesses to keep up with new technologies without the need to sell at the end of the term.

We lend to all types of businesses. Whether you’ve been established for decades or months, we can provide asset finance for businesses of all sizes, in all sectors. Industrial sector businesses such as those in plant, packaging, printing, processing, agriculture, construction, and technology can all make use of asset financing and are among the most common types of businesses to apply.

Hire purchase is a straightforward way of purchasing an asset and spreading the cost over time with affordable monthly repayments. You will be responsible for the maintenance and associated costs, as you will have full ownership of the asset once your finance term ends.

As funding specialists, Aurora Capital provides SMEs with business loans that are suited directly to their needs. Over the years we have built up relationships with multiple lenders who can provide fast and flexible business funding, meaning we can offer a wide array of business loan types with numerous benefits and competitive rates.

Finding the right funding is often a long-winded process, with plenty of variables to consider from all the different providers. Our finance experts can help, providing you with a list of the best deals and rates.