Apply For Business Van Finance To Help You

Buy a Van

Lease a Van

Grow

Expand

Van finance can help you get a vehicle for your business if you don’t have the funds to purchase one.

- Apply in minutes

- Applying won’t affect your credit score

- Free, no obligation quote

6.90%

Interest rates per annum

£100,000 +

UK Based

No early settlement fees

£5k - £500k

Funding requirement

Our lending partners

Van Finance

Using van finance can help your business get the work vehicle it needs to grow and thrive. Learn everything you need to know about how it works and see your funding options from top van finance providers with Aurora Capital.

What is van finance?

Van finance is a way of borrowing money from banks and financial institutions if your small business needs a van but can’t afford one immediately.

The work van that you use day-to-day is considered a business asset. Van finance can allow you to spread the cost of your work vehicle over time.

There are several different types of van finance available, and it can be difficult to determine which is best for your business. We break down everything you need to know about van finance so you can make the right decision.

Bridging loans are a type of secured loan, which means you will need to put up an asset as collateral.

Types of business van finance

There are a number of different van finance options available, including:

Business loan

It’s possible to use a standard unsecured business loan to purchase your van. Your business will need to borrow enough to cover the cost of the van upfront and then repay the loan over the agreed-upon term.

This option means there will be no usage restrictions, such as driving a certain number of miles each year. However, using a loan to buy your van can be more expensive and less flexible than other options.

Hire purchase

With hire purchase (HP), you put down a small deposit and then spread the remaining cost of the van over an agreed term. The deposit can be paid by cash, or you may be able to part exchange an old vehicle, provided you own it outright.

Your monthly payments will be based on the value of the vehicle, the interest rate charged, and the size of the deposit you put down.

You will own the vehicle outright at the end of the agreed term. HP agreements don’t usually come with any mileage limits, but there may be additional fees to pay at the end of the term.

Finance lease

Finance lease agreements are a flexible way of leasing a work vehicle. Your business can hire the vehicle for a specific period of time, and at the end of the agreement, you will have the option to:

- Purchase the van for a pre-agreed sum (known as a balloon payment)

- Sell the vehicle on the lender’s behalf and get a percentage of the proceeds

- Extend the term of the lease and continue the agreement

You can reclaim up to 100% of the VAT charged on your monthly payments, including mileage, maintenance, and any service costs.

When deciding whether to lease or buy a business van, consider the pros and cons of each option.

The right option for your business depends on your financial situation, operational needs, and long-term plans. Here’s a breakdown to help you decide which is best.

Leasing a van

Pros

- Lower upfront costs: Leasing usually requires a smaller initial deposit than buying a van outright, which can help maintain your cash flow.

- Flexibility: Leasing allows you to more easily change vehicle if you need to upgrade or change your van.

- Tax advantages: If your business is VAT registered, you may be able to claim back up to 100% of the VAT on lease payments.

- No depreciation: When leasing, you don’t have to worry about the vehicle losing value over time.

Cons

- You won’t own the van: At the end of the lease agreement, you won’t own the vehicle unless you make a final balloon payment (depending on the lease type).

- Mileage limits: Leases often come with mileage restrictions, for example, 8,000 miles per year, and exceeding these can result in extra charges.

- Additional costs: Some lease agreements include maintenance, but others don’t, meaning you may have to pay for any upkeep costs.

Buying a van

Pros

- Ownership: Once the finance agreement is complete or if you buy the van outright with cash, it is yours, so you have complete control over how and when it’s used.

- No restrictions: You can drive the van as much as you like without worrying about mileage limits or wear and tear charges.

- Cost-effective in the long term: Although buying a van is more expensive upfront, it can be cheaper over the long term, especially if you plan to keep the vehicle for a long time.

Cons

- Higher upfront costs: Buying outright or through finance often requires a larger deposit and higher monthly payments compared to leasing.

- Depreciation: Your van’s value will depreciate over time, and its resale value will vary depending on age, mileage, and condition.

- Less flexibility: If the needs of your business change and you need a different vehicle, selling your van can be more complicated than simply returning or upgrading a leased vehicle.

Which option is best for your business depends on several factors:

- Cash flow: Leasing might be a better option if you need to keep your monthly expenses as low as possible.

- Usage: Buying could offer more flexibility and avoid extra mileage fees if you plan to drive the van frequently or over long distances.

- Long-term plans: If you want to upgrade your vehicle regularly, leasing may be more convenient, but if you’re looking for a long-term asset, buying is likely more cost-effective.

Take time to consider your business needs and budget before making a decision, and consult with a finance specialist like Aurora Capital if you’re unsure which option is best for you.

Van finance in the UK is available to businesses of all sizes, whether micro, small, medium, or large. To be eligible for most types of business finance, your business will need to:

- Be registered in the UK

- Have been operating for at least two years for certain loans

- Have a good credit rating

Loan amounts and interest rates offered on van finance products differ based on several factors, including:

- Your income and expenditures

- Your credit history

- Whether or not you are securing the loan against an asset

Yes, you can get van finance if you or your business has bad credit. However, you may need to pay a higher deposit or interest rate.

The lender will check your credit record as part of your application, so it’s worth checking your score before you apply. If it’s low, there may be things you can do to improve it, like correcting any errors or updating your details.

Van finance is a way of borrowing money from banks and financial institutions if your small business needs a van but can’t afford one immediately.

The work van that you use day-to-day is considered a business asset. Van finance can allow you to spread the cost of your work vehicle over time.

There are several different types of van finance available, and it can be difficult to determine which is best for your business. We break down everything you need to know about van finance so you can make the right decision.

Bridging loans are a type of secured loan, which means you will need to put up an asset as collateral.

There are a number of different van finance options available, including:

Business loan

It’s possible to use a standard unsecured business loan to purchase your van. Your business will need to borrow enough to cover the cost of the van upfront and then repay the loan over the agreed-upon term.

This option means there will be no usage restrictions, such as driving a certain number of miles each year. However, using a loan to buy your van can be more expensive and less flexible than other options.

Hire purchase

With hire purchase (HP), you put down a small deposit and then spread the remaining cost of the van over an agreed term. The deposit can be paid by cash, or you may be able to part exchange an old vehicle, provided you own it outright.

Your monthly payments will be based on the value of the vehicle, the interest rate charged, and the size of the deposit you put down.

You will own the vehicle outright at the end of the agreed term. HP agreements don’t usually come with any mileage limits, but there may be additional fees to pay at the end of the term.

Finance lease

Finance lease agreements are a flexible way of leasing a work vehicle. Your business can hire the vehicle for a specific period of time, and at the end of the agreement, you will have the option to:

- Purchase the van for a pre-agreed sum (known as a balloon payment)

- Sell the vehicle on the lender’s behalf and get a percentage of the proceeds

- Extend the term of the lease and continue the agreement

You can reclaim up to 100% of the VAT charged on your monthly payments, including mileage, maintenance, and any service costs.

When deciding whether to lease or buy a business van, consider the pros and cons of each option.

The right option for your business depends on your financial situation, operational needs, and long-term plans. Here’s a breakdown to help you decide which is best.

Leasing a van

Pros

- Lower upfront costs: Leasing usually requires a smaller initial deposit than buying a van outright, which can help maintain your cash flow.

- Flexibility: Leasing allows you to more easily change vehicle if you need to upgrade or change your van.

- Tax advantages: If your business is VAT registered, you may be able to claim back up to 100% of the VAT on lease payments.

- No depreciation: When leasing, you don’t have to worry about the vehicle losing value over time.

Cons

- You won’t own the van: At the end of the lease agreement, you won’t own the vehicle unless you make a final balloon payment (depending on the lease type).

- Mileage limits: Leases often come with mileage restrictions, for example, 8,000 miles per year, and exceeding these can result in extra charges.

- Additional costs: Some lease agreements include maintenance, but others don’t, meaning you may have to pay for any upkeep costs.

Buying a van

Pros

- Ownership: Once the finance agreement is complete or if you buy the van outright with cash, it is yours, so you have complete control over how and when it’s used.

- No restrictions: You can drive the van as much as you like without worrying about mileage limits or wear and tear charges.

- Cost-effective in the long term: Although buying a van is more expensive upfront, it can be cheaper over the long term, especially if you plan to keep the vehicle for a long time.

Cons

- Higher upfront costs: Buying outright or through finance often requires a larger deposit and higher monthly payments compared to leasing.

- Depreciation: Your van’s value will depreciate over time, and its resale value will vary depending on age, mileage, and condition.

- Less flexibility: If the needs of your business change and you need a different vehicle, selling your van can be more complicated than simply returning or upgrading a leased vehicle.

Which option is best for your business depends on several factors:

- Cash flow: Leasing might be a better option if you need to keep your monthly expenses as low as possible.

- Usage: Buying could offer more flexibility and avoid extra mileage fees if you plan to drive the van frequently or over long distances.

- Long-term plans: If you want to upgrade your vehicle regularly, leasing may be more convenient, but if you’re looking for a long-term asset, buying is likely more cost-effective.

Take time to consider your business needs and budget before making a decision, and consult with a finance specialist like Aurora Capital if you’re unsure which option is best for you.

Van finance in the UK is available to businesses of all sizes, whether micro, small, medium, or large. To be eligible for most types of business finance, your business will need to:

- Be registered in the UK

- Have been operating for at least two years for certain loans

- Have a good credit rating

Loan amounts and interest rates offered on van finance products differ based on several factors, including:

- Your income and expenditures

- Your credit history

- Whether or not you are securing the loan against an asset

Yes, you can get van finance if you or your business has bad credit. However, you may need to pay a higher deposit or interest rate.

The lender will check your credit record as part of your application, so it’s worth checking your score before you apply. If it’s low, there may be things you can do to improve it, like correcting any errors or updating your details.

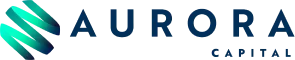

Get your free, no

obligation quote Today!

- Apply in minutes

- FREE, no obligation, personalised quote

- FCA regulated

How much do you want to borrow?

Securing business funding:

How it works

We understand that timing is key when you’re looking to find funding options for your business,so our process is as quick and as streamlined as possible.

1

Apply Online in minutes

We cater to any sized business, so to apply for business funding, we only need you to share basic information about your company. Your application will take a few minutes, and our experts are always happy to assist with any questions you have about specific loan types or alternative finance options.

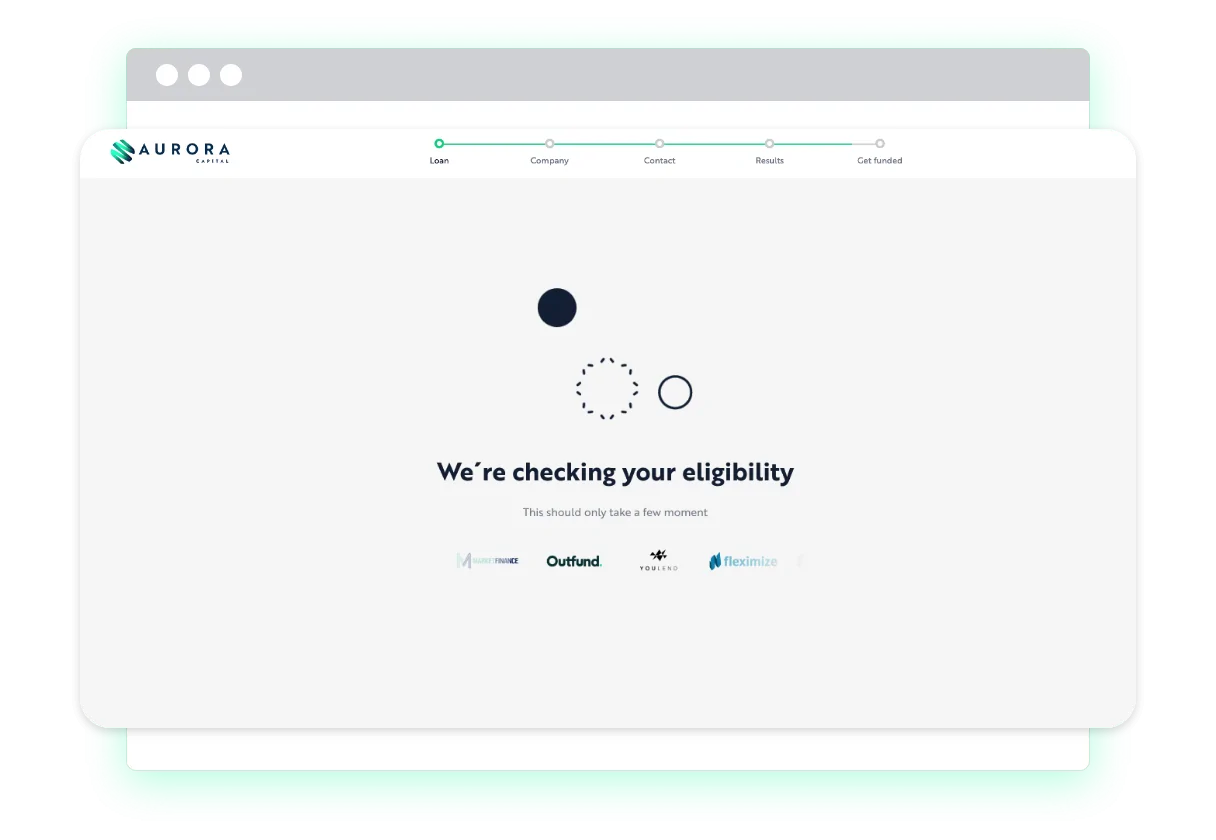

2

Get Matched in hours

Our LendTech technology will compare our trusted panel of lenders and match you with your most suitable finance option. Each business funding option is different, and we’ll help to make sure you’re fully clued up on the terms and conditions as well as indicative repayment details.

3

Get Funded in days

One of our funding specialists will discuss the available options with you and guide you through the process from application to approval. Once approved, the funds can be deposited in a matter of hours.

Prefer to talk? Call us on 01371 870815

4.9/5 based on 100+ by happy customers

Apply for a recovery loan to help your business employ staff

A government backed loan to support businesses affected by the pandemic.

Looking to obtain an unsecured loan for your business?

Business loans up to £500k, without the need to secure on property or assets.

Apply for a secured business loan today and get matched with a lender…

Business loans up to £2M, secured against a UK property by way of 1st or 2nd charge.

It takes minutes to apply, there’s no effect on your credit score.

Acquire new or used equipment, machinery or vehicles and spread the repayments over 1-6 years.

Compare merchant cash advances to help your business purchase stock.

Borrow up to 2x your monthly card sales and repay through a small % of your future takings.

Compare revolving credit facilities to help your business grow.

A pre agreed credit facility, allowing you to dip in and out for future funding requirements.

Spread the payments of your PAYE, VAT or Corp Tax bills.

VAT/TAX loans up to £500k for PAYE payments, quarterly VAT payments or annual Corporation tax payments

Prefer to talk? Call us on 01371 870815

4.9/5 based on 100+ by happy customers

100+ Happy Customers & Counting

Van Finance FAQs

Getting van finance without putting down a deposit is possible, but these products usually come with higher interest rates. Not providing a deposit also means you will need to borrow more, and you’ll need to pay more in interest over the term of the agreement.

If you purchase your work van using a business loan, you shouldn’t need to put down a deposit, as you will buy the vehicle outright using the loan proceeds.

You can use van finance for most commercial vans; however, some lenders may have restrictions. For example, some products may only be available for vans up to 3.5 tonnes.

When you buy a van through a finance lease or high purchase agreement, the finance company owns the vehicle for the term of the agreement.

You will become the owner either at the end of the agreement or after you have paid the agreed balloon payment, depending on what van finance option you have chosen.

Yes, most business van finance agreements can be used to buy or lease new or secondhand commercial vehicles.

Some van finance agreements include mileage limits, but not all. For example, most hire purchase agreements don’t include mileage restrictions because you will own the van at the end of the term.

Finance lease agreements often include limits, but these can be extended or reduced based on your usage. A higher mileage limit will cost you more, but you could pay less by choosing a lower limit.

In most cases, there is no reason why you can’t use your business van for personal use, provided your van insurance policy covers it. However, there may be tax considerations as you may need to pay Benefit In Kind to HMRC if your van isn’t used solely for business purposes.