Apply For A Unsecured Business Loan To Help Your Business Get Started

- Check your businesses eligibility in seconds.

- Submitting an application will not affect your credit score.

- Can obtain decisions in as quick as 24 hours.

“Aurora makes it very simple and easy to get funding for my business. Their team is proactive, moves with great speed, and is highly professional.”

Stephen verified customer

How much do

you want to borrow?

Choose the amount you want to borrow

- Check your businesses eligibility in seconds.

- Submitting an application will not affect your credit score.

- Can obtain decisions in as quick as 24 hours.

“Aurora makes it very simple and easy to get funding for my business. Their team is proactive, moves with great speed, and is highly professional.”

The data you are about to submit may be used in the course of us providing our services to you. By submitting this Form, you consent to appoint us, Timali Limited, the Broker, on the terms set out in our Terms & Conditions and Privacy Policy. We will liaise with lenders who may agree to provide a finance facility for your business, facilitate the exchange of information and data between you and such lenders and to provide general advice and reasonable assistance with completing an application that may be required to apply for, process and receive a finance facility referred to herein.

from 8.9%

Interest rates per annum

£50,000 +

Annual turnover

1 month – 6 years

Companies only

£10k - £2M

Funding requirement

Our lending partners

About Unsecured Business Loan

Am I eligible to apply?

Businesses have to meet certain criteria in order to apply for an Unsecured Business Loan. Specifically, a business must:

- Turnover above £10k per month

- Trading for longer than 6 months

- Be a UK Ltd company

- Pass minimum credit checks

How much can I borrow?

The maximum any one lender can offer is £500k and this will depend on several different factors such as affordability, credit and trading time. The minimum a lender can offer is £5k.

Most lenders will offer you the ability to spread the term over 6 years and the minimum term is just a couple of months for shorter term requests.

Businesses which successfully apply for an Unsecured Business Loan can do so for any legitimate business purpose, for example:

- managing cash flow

- buying equipment

- meeting a one-off cost

- helping with payroll

- investing in, for example, marketing

- growing the business.

Most lenders will offer you the ability to spread the term over 6 years and the minimum term is just a couple of months for shorter term requests.

Businesses which successfully apply for an Unsecured Business Loan can do so for any legitimate business purpose, for example:

- managing cash flow

- buying equipment

- meeting a one-off cost

- helping with payroll

- investing in, for example, marketing

- growing the business.

Get your free, no

obligation quote Today!

- Apply in minutes

- FREE, no obligation, personalised quote

- FCA regulated

How much do you want to borrow?

Securing business funding:

How it works

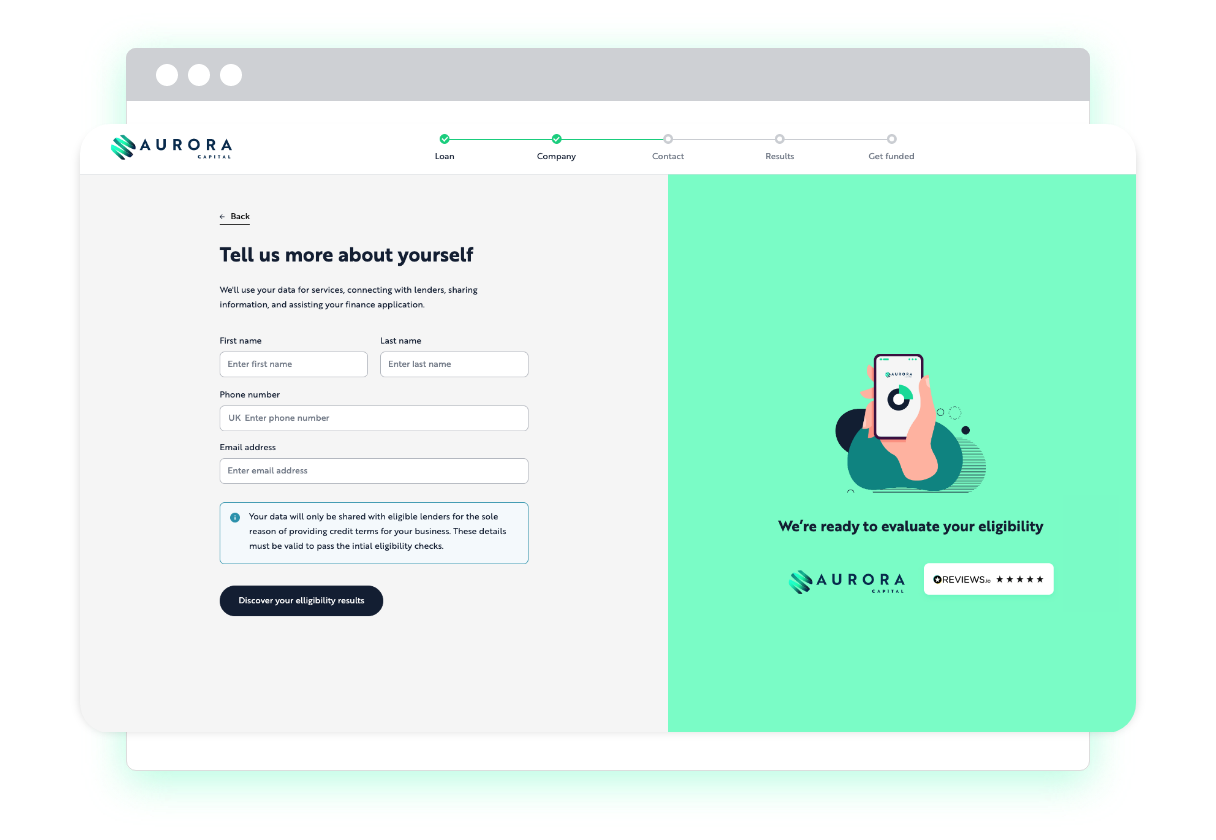

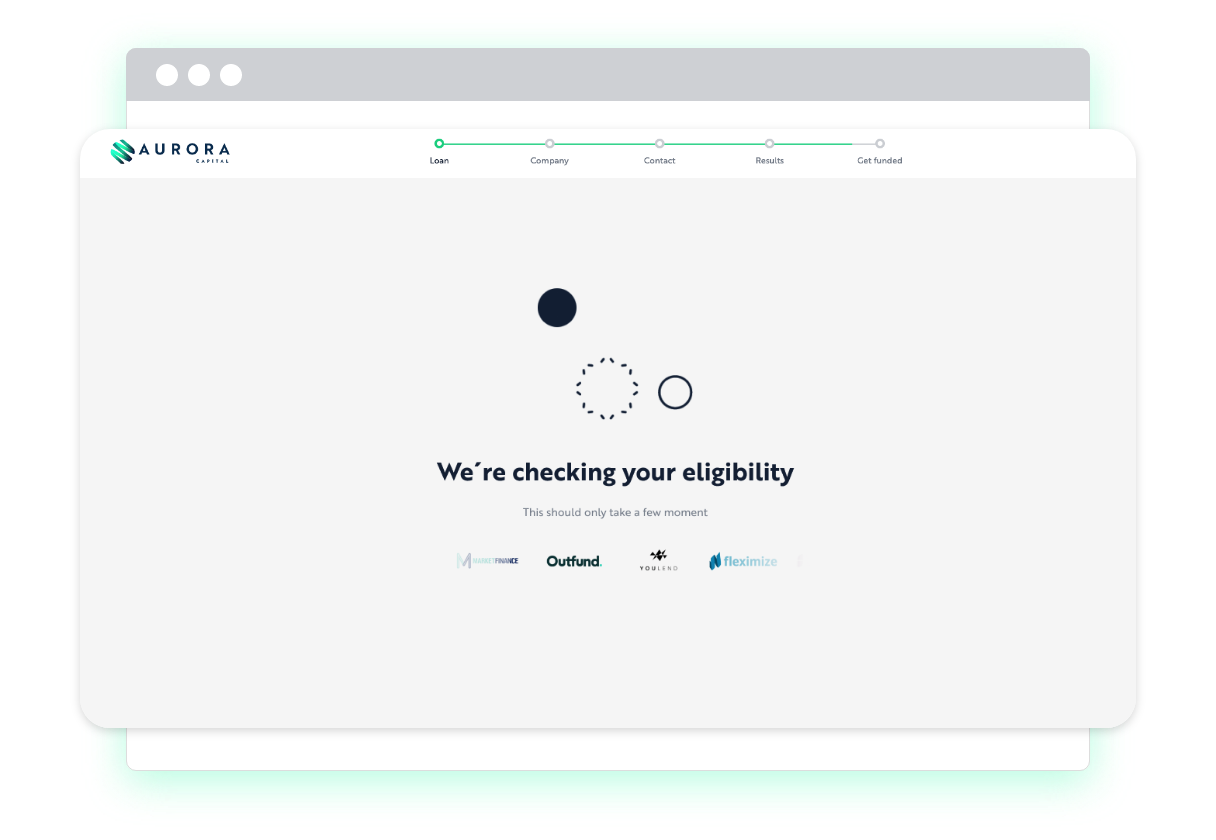

We understand that timing is key when you’re looking to find funding options for your business,so our process is as quick and as streamlined as possible.

1

Apply Online in minutes

We cater to any sized business, so to apply for business funding, we only need you to share basic information about your company. Your application will take a few minutes, and our experts are always happy to assist with any questions you have about specific loan types or alternative finance options.

2

Get Matched in hours

Our LendTech technology will compare our trusted panel of lenders and match you with your most suitable finance option. Each business funding option is different, and we’ll help to make sure you’re fully clued up on the terms and conditions as well as indicative repayment details.

3

Get Funded in days

One of our funding specialists will discuss the available options with you and guide you through the process from application to approval. Once approved, the funds can be deposited in a matter of hours.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers

Aurora Capital

is here to help you

Navigate our range of business funding options to find out more

Navigate our range of business

funding options to find out more

We understand that timing is key when you’re looking to find funding options for your business, so our process is as quick and as streamlined as possible.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers

100+ Happy Customers & Counting

Frequently asked questions

Comparing all of these options from this many lenders, while weighing up the pros and cons of each, could take you days or even weeks. We take the time, hassle, and risk out of sourcing funding from lenders, so you can get on with running your business.

This depends on a few things, including how long you have been trading for, the affordability of the loan and credit status of both your business and the shareholders. Either make an application online to check your eligibility or speak to one of our team to discuss this further.

This will all depend on what lender and what product you decide to apply for. We have access to over 50 lenders with 8 different financial solutions between them all. Either make an application online to check your eligibility or speak to one of our team to discuss this further.

Once we receive all the required information, we aim to come back to you within 24 hours. However, all lenders have slightly different time frames, so please speak to your account manager to discuss this further.

To submit an application all that we will require are some basic details about the business and its owners, which can be supplied through our easy-to-use online form. In addition to this, we will require the latest set of company accounts and bank statements to assess affordability.

One of our account managers will guide you through the whole process and manage your application from start to finish. If you are unsure of anything, please drop us a call.

When you apply for finance through Aurora Capital, we will run a soft credit check to run the initial eligibility. If we submit your application to one of our lenders, they are obliged to run a hard credit check that could have an effect on your credit score.

A soft credit check is a way for lenders and brokers to check your credit history, without leaving a record on your file. When companies run a soft credit check on you, no-one else can see this record.

A hard credit check, also known as a full credit check, is used by lenders to see detailed information on your credit file before deciding whether to lend to you. Lenders are obliged to run a hard credit check in accordance with the FCA. This type of credit check is recorded on your credit file and can be seen by others.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers