Apply for an Unsecured Business Loan To Help You Grow Purchase Stock Employ Staff Expand Pay Suppliers

Looking to obtain an unsecured loan for your business? We can help. We work with hundreds of lenders to get you the best loan terms possible.

- Apply in minutes

- Applying won’t affect your credit score

- Free, no obligation quote

6.90%

Interest rates per annum

£100,000 +

UK Based

No early settlement fees

£5k - £500k

Funding requirement

Our lending partners

About Securing Business Loan

Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia.

Am I eligible for an unsecured business loan?

Each lender will assess your personal and commercial credit files to determine your credit profile. This means that if you have any outstanding CCJs, this could affect your application. Therefore, we advise that you settle these before submitting an application. Liquidations, bankruptcies and IVAs may also affect your application.

What is an unsecured business loan?

- Cash Flow

- Business Growth

- Stock Purchase

- Settling Bills

- Refinancing existing debt

How do unsecured loans work?

An unsecured business loan works in the same way as a regular business loan where repayments are made monthly, weekly or daily depending on your agreement. Loan terms can be anywhere between one month to six years according to your business needs.

The loan can be used for almost any expense in the best interest of the business. Businesses usually use these loans for growth and development, refurbishment, capital expenditure or stock. Some business owners and borrowers also use unsecured loans to consolidate other types of debt they have if the loan terms are more favourable.

Unlike secured loans, ‘unsecured’ means your loan is not secured against any personal or business assets, such as property, equipment, vehicles or machinery. An unsecured loan will most likely require a personal guarantee from one or multiple directors.

Each lender will assess your personal and commercial credit files to determine your credit profile. This means that if you have any outstanding CCJs, this could affect your application. Therefore, we advise that you settle these before submitting an application. Liquidations, bankruptcies and IVAs may also affect your application.

Get your free, no

obligation quote Today!

- Apply in minutes

- FREE, no obligation, personalised quote

- FCA regulated

How much do you want to borrow?

Securing business funding:

How it works

We understand that timing is key when you’re looking to find funding options for your business,so our process is as quick and as streamlined as possible.

1

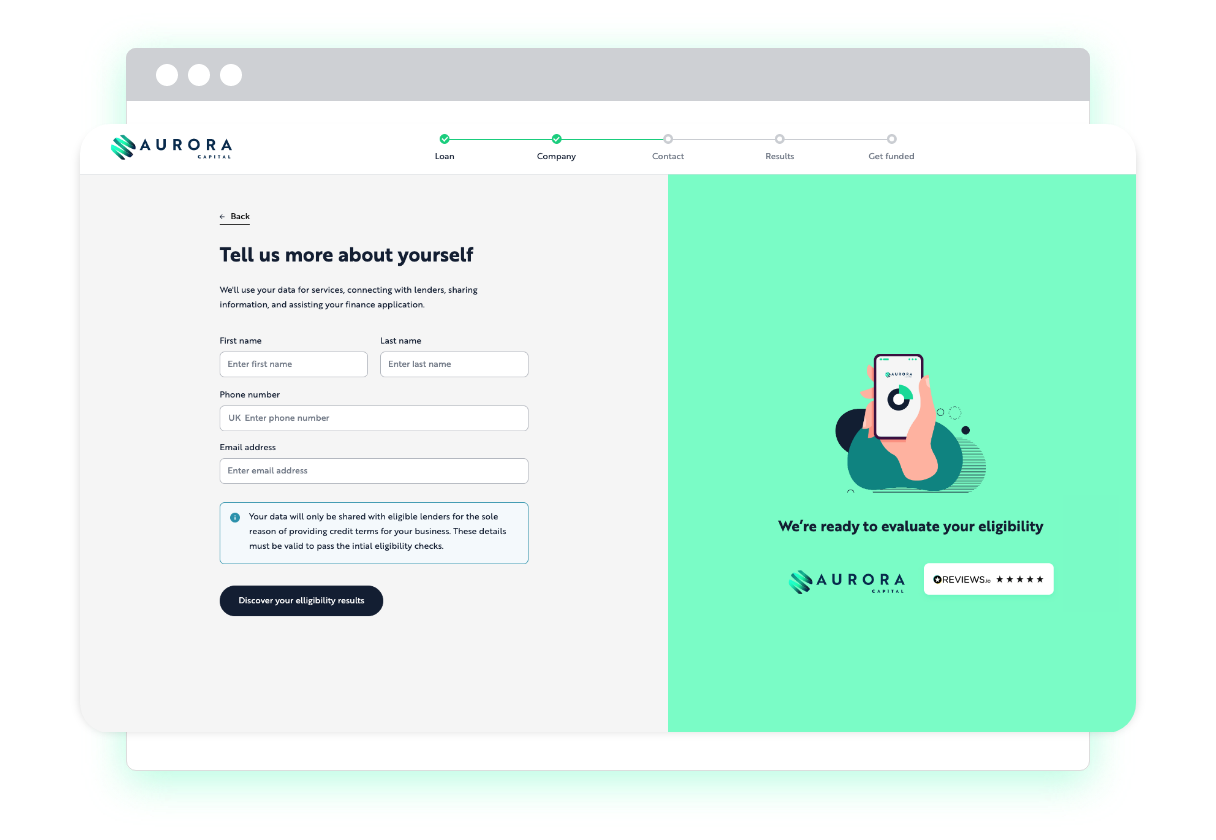

Apply Online in minutes

We cater to any sized business, so to apply for business funding, we only need you to share basic information about your company. Your application will take a few minutes, and our experts are always happy to assist with any questions you have about specific loan types or alternative finance options.

2

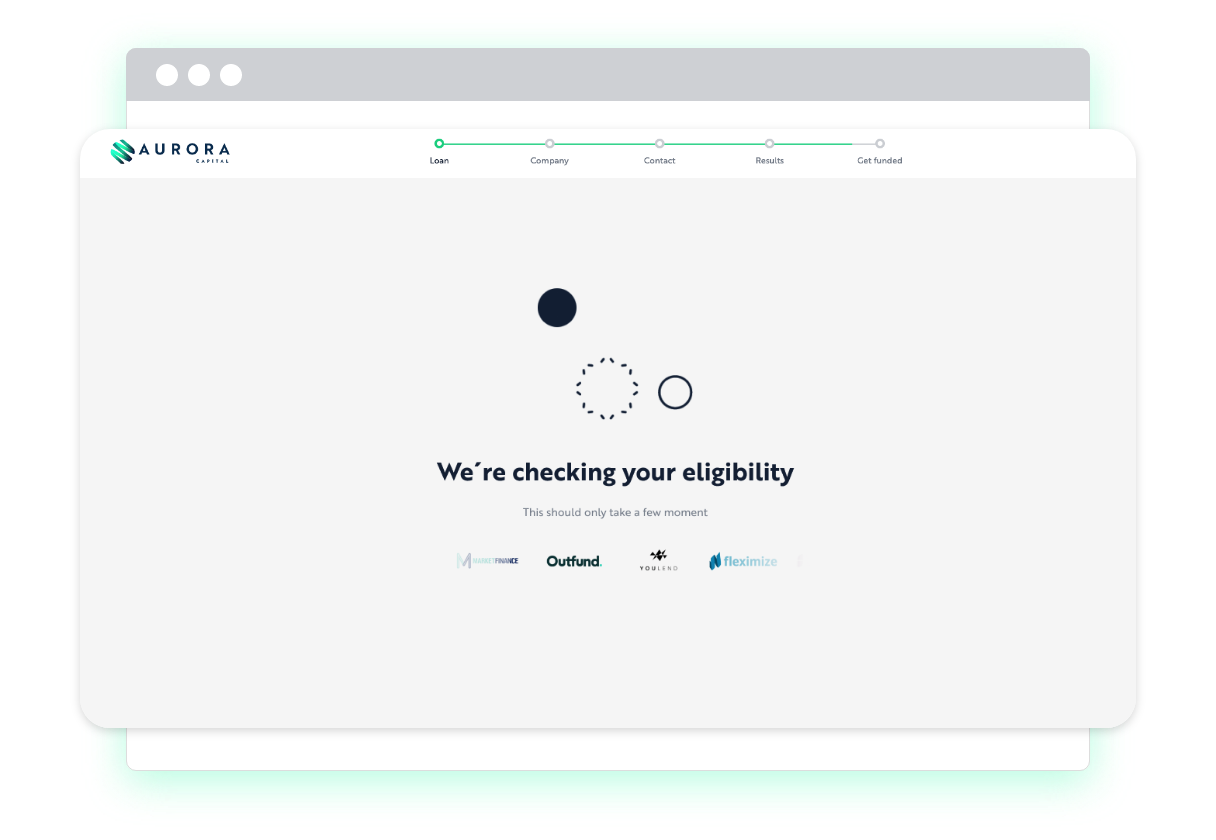

Get Matched in hours

Our LendTech technology will compare our trusted panel of lenders and match you with your most suitable finance option. Each business funding option is different, and we’ll help to make sure you’re fully clued up on the terms and conditions as well as indicative repayment details.

3

Get Funded in days

One of our funding specialists will discuss the available options with you and guide you through the process from application to approval. Once approved, the funds can be deposited in a matter of hours.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers

Navigate our range of business

funding options to find out more

We understand that timing is key when you’re looking to find funding options for your business, so our process is as quick and as streamlined as possible.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers

100+ Happy Customers & Counting

Unsecured business loans: FAQs

Excepteur sint occaecat cupidatat non proidentExcepteur sint occaecat cupidatat.

Lenders will look into your historical financial data and your credit profile to assess your affordability. Loans typically range from £1k – £500k.

Aurora Capital compare over 50 commercial lenders using our LendTech Technology. This allows us to offer a range of different financial solutions designed to fit the needs and circumstances of your business.

Aurora Capital compare over 50 commercial lenders using our LendTech Technology. This allows us to offer a range of different financial solutions designed to fit the needs and circumstances of your business.

Aurora Capital compare over 50 commercial lenders using our LendTech Technology. This allows us to offer a range of different financial solutions designed to fit the needs and circumstances of your business.

Aurora Capital compare over 50 commercial lenders using our LendTech Technology. This allows us to offer a range of different financial solutions designed to fit the needs and circumstances of your business.

Aurora Capital compare over 50 commercial lenders using our LendTech Technology. This allows us to offer a range of different financial solutions designed to fit the needs and circumstances of your business.

Aurora Capital compare over 50 commercial lenders using our LendTech Technology. This allows us to offer a range of different financial solutions designed to fit the needs and circumstances of your business.