Apply for an Unsecured Business Loan To Help You Grow Purchase Stock Employ Staff Expand Pay Suppliers

Looking to obtain an unsecured loan for your business? We can help. We work with hundreds of lenders to get you the best loan terms possible.

- Apply in minutes

- Applying won’t affect your credit score

- Free, no obligation quote

From 8.9%

Interest rates per annum

£50,000 +

Annual turnover

1 month – 6 years

Companies only

£10k - £2M

Funding requirement

Our lending partners

About Securing Business Loan

What is an unsecured business loan?

An unsecured business loan allows businesses young and old to borrow money with an agreed payment schedule and interest rate. The term ‘unsecured’ means that applicants aren’t required to secure the loan against any commercial or residential property or assets; however, some lenders may ask for a personal guarantee.

Unsecured business loans can be used for many different purposes, but they must be used within the business and cannot be taken out for personal use.

Typical uses include:

- Cash Flow

- Business Growth

- Stock Purchase

- Settling Bills

- Refinancing existing debt

Unsecured loans are usually fast to arrange, competitively priced, and are ideal for SMEs who don’t own many assets or who don’t want to put their assets up as collateral. With a variety of unsecured lenders offering loans up to £500k over a maximum term of six years, there are options for a wide variety of funding solutions.

On the whole, unsecured loans are easier to secure and more accessible to a wider range of businesses.

Seeking a loan of more than £500k? Look into our secured business loans instead.

All companies that have been trading for at least six months and have a monthly turnover of more than £10k can apply for an unsecured business loan. You do not need to be a homeowner with all unsecured lenders, but some lenders may require you to hold assets under your name.

Each lender will assess your personal and commercial credit files to determine your credit profile. This means that if you have any outstanding CCJs, this could affect your application. Therefore, we advise that you settle these before submitting an application. Liquidations, bankruptcies and IVAs may also affect your application.

An unsecured business loan works in the same way as a regular business loan where repayments are made monthly, weekly or daily depending on your agreement. Loan terms can be anywhere between one month to six years according to your business needs.

The loan can be used for almost any expense in the best interest of the business. Businesses usually use these loans for growth and development, refurbishment, capital expenditure or stock. Some business owners and borrowers also use unsecured loans to consolidate other types of debt they have if the loan terms are more favourable.

Unlike secured loans, ‘unsecured’ means your loan is not secured against any personal or business assets, such as property, equipment, vehicles or machinery. An unsecured loan will most likely require a personal guarantee from one or multiple directors.

All lenders work slightly differently from each other, but most will either lend on a percentage of your turnover or a multiple of profit.

Turnover

Usually, they will only lend a maximum of 40% of annual turnover. So, if your annual revenue is £500,000, you will be able to borrow up to £200,000.

Profit

Some lenders will also look at a debt service coverage ratio to work out how much you can borrow. There are several factors that can affect this such as existing borrowing, depreciation and tax payments.

Lenders will look into your historical financial data and your credit profile to assess your affordability. Loans typically range from £5k – £500k.

Our lenders can work very quickly in most cases, with our quickest approval being just a matter of minutes. However, this all depends on how quickly we can obtain the necessary documents to assess each proposal.

A secured business loan uses your assets as security, usually this is a commercial or residential property.

If you can’t repay your secured loan, the lender can sell the assets to recoup the cost of the loan, which reduces their risk.

With an unsecured loan, on the other hand, the lender has no tangible security and therefore cares much more about your business profile, for example, your business turnover, trading history and credit score. The lender may also look at your personal credit history and personal assets and might ask for a personal guarantee.

Unsecured lending is usually slightly more expensive than secured lending because the lender is taking on more risk. Lenders might also offer shorter terms and smaller amounts.

Unsecured business loans are usually simpler and quicker to arrange, compared to secured loans, because there’s no need for the lender to inspect or value any assets. These valuations involve legal costs, which you’ll have to pay upfront. By contrast, an unsecured loan doesn’t usually involve any additional upfront costs.

| Unsecured loan | Secured loan |

Secured against collateral | No | Yes |

Credit history | Good credit score favourable | More flexible on credit scores |

Payable interest | From 9% per annum | Lower rate |

Personal guarantee | Might be required | Might be required |

Time to acquire | Within 48 hours | Can take up to 6 weeks to secure |

All companies that have been trading for at least six months and have a monthly turnover of more than £10k can apply for an unsecured business loan. You do not need to be a homeowner with all unsecured lenders, but some lenders may require you to hold assets under your name.

Each lender will assess your personal and commercial credit files to determine your credit profile. This means that if you have any outstanding CCJs, this could affect your application. Therefore, we advise that you settle these before submitting an application. Liquidations, bankruptcies and IVAs may also affect your application.

An unsecured business loan works in the same way as a regular business loan where repayments are made monthly, weekly or daily depending on your agreement. Loan terms can be anywhere between one month to six years according to your business needs.

The loan can be used for almost any expense in the best interest of the business. Businesses usually use these loans for growth and development, refurbishment, capital expenditure or stock. Some business owners and borrowers also use unsecured loans to consolidate other types of debt they have if the loan terms are more favourable.

Unlike secured loans, ‘unsecured’ means your loan is not secured against any personal or business assets, such as property, equipment, vehicles or machinery. An unsecured loan will most likely require a personal guarantee from one or multiple directors.

All lenders work slightly differently from each other, but most will either lend on a percentage of your turnover or a multiple of profit.

Turnover

Usually, they will only lend a maximum of 40% of annual turnover. So, if your annual revenue is £500,000, you will be able to borrow up to £200,000.

Profit

Some lenders will also look at a debt service coverage ratio to work out how much you can borrow. There are several factors that can affect this such as existing borrowing, depreciation and tax payments.

Lenders will look into your historical financial data and your credit profile to assess your affordability. Loans typically range from £5k – £500k.

Our lenders can work very quickly in most cases, with our quickest approval being just a matter of minutes. However, this all depends on how quickly we can obtain the necessary documents to assess each proposal.

A secured business loan uses your assets as security, usually this is a commercial or residential property.

If you can’t repay your secured loan, the lender can sell the assets to recoup the cost of the loan, which reduces their risk.

With an unsecured loan, on the other hand, the lender has no tangible security and therefore cares much more about your business profile, for example, your business turnover, trading history and credit score. The lender may also look at your personal credit history and personal assets and might ask for a personal guarantee.

Unsecured lending is usually slightly more expensive than secured lending because the lender is taking on more risk. Lenders might also offer shorter terms and smaller amounts.

Unsecured business loans are usually simpler and quicker to arrange, compared to secured loans, because there’s no need for the lender to inspect or value any assets. These valuations involve legal costs, which you’ll have to pay upfront. By contrast, an unsecured loan doesn’t usually involve any additional upfront costs.

| Unsecured loan | Secured loan |

Secured against collateral | No | Yes |

Credit history | Good credit score favourable | More flexible on credit scores |

Payable interest | From 9% per annum | Lower rate |

Personal guarantee | Might be required | Might be required |

Time to acquire | Within 48 hours | Can take up to 6 weeks to secure |

Get your free, no

obligation quote Today!

- Apply in minutes

- FREE, no obligation, personalised quote

- FCA regulated

How much do you want to borrow?

Securing business funding:

How it works

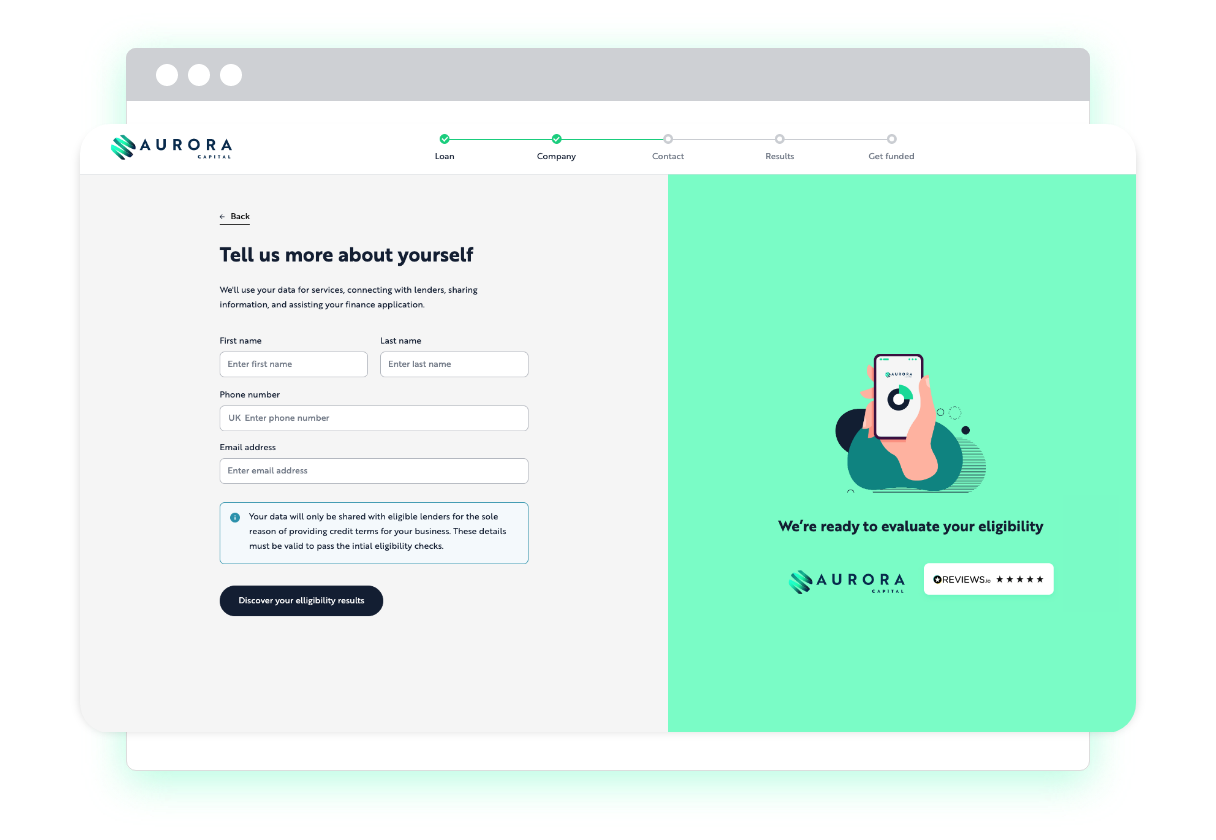

We understand that timing is key when you’re looking to find funding options for your business,so our process is as quick and as streamlined as possible.

1

Apply Online in minutes

We cater to any sized business, so to apply for business funding, we only need you to share basic information about your company. Your application will take a few minutes, and our experts are always happy to assist with any questions you have about specific loan types or alternative finance options.

2

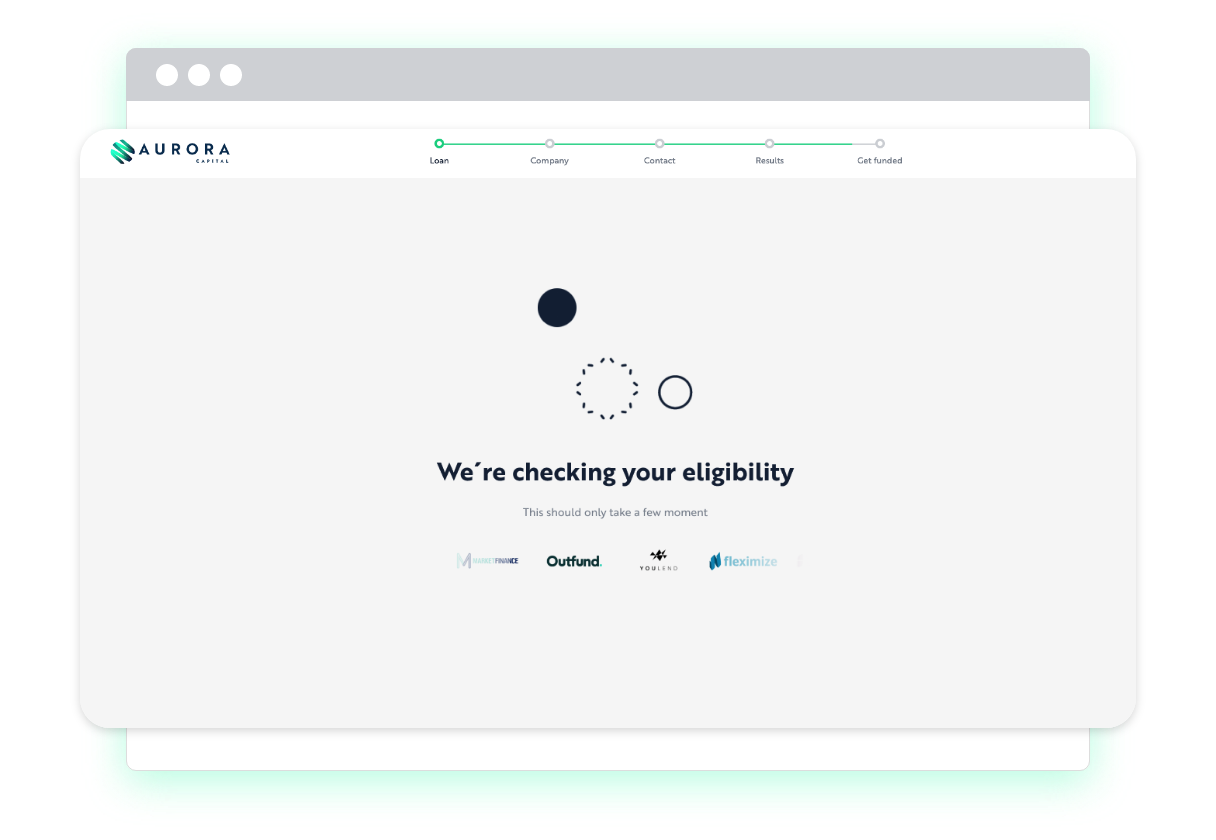

Get Matched in hours

Our LendTech technology will compare our trusted panel of lenders and match you with your most suitable finance option. Each business funding option is different, and we’ll help to make sure you’re fully clued up on the terms and conditions as well as indicative repayment details.

3

Get Funded in days

One of our funding specialists will discuss the available options with you and guide you through the process from application to approval. Once approved, the funds can be deposited in a matter of hours.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers

Navigate our range of business

funding options to find out more

We understand that timing is key when you’re looking to find funding options for your business, so our process is as quick and as streamlined as possible.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers

100+ Happy Customers & Counting

Unsecured business loans: FAQs

Lenders will look into your historical financial data and your credit profile to assess your affordability. Loans typically range from £1k – £500k.

Unlike a secured loan, where you will have to put tangible assets up as security, unsecured loans do not require this. As the name suggests, you don’t need to have any assets behind you, meaning tenants can also apply for this loan.

Unsecured loans can be sourced a lot quicker than other loans, sometimes within 48 hours, as there is no need to obtain a valuation on your assets. Although rates are likely to be more expensive than a commercial mortgage, interest rates can still be very competitive.

In addition to this, with an unsecured loan, most lenders will not penalise you for settling early. Therefore, if your business is performing better than expected you can pay off your loan before the maturity date and save yourself interest on the deal. Some lenders will also allow you to make over-repayments any time throughout the contract, free of charge.

We can look to assist companies that have been trading for longer than 6 months and have a minimum monthly turnover of £10,000. Unsecured loans are not available for start-ups.

Yes, your credit score will be checked. Once your application is submitted, and with your permission, we will run credit checks on the business, as well as its directors/shareholders. If you have bad credit, this doesn’t automatically mean that you won’t be approved, but your chances are higher the better your credit is. This is because the loan isn’t secured against property or assets, so there is a higher risk for the lender.

This will vary from lender to lender, however you can expect interest rates to start from 5% per annum. Some lenders may also charge an admin fee – this will be a percentage of the loan amount and will likely be deducted from the loan, so there is no need for any upfront fees to be paid.

Yes, like any line of credit, your credit score may affect your application for an unsecured loan with some lenders.

If your business is in need of finance and you have a poor personal or business credit score, we still have lenders that could assist. This will all depend on your individual circumstance and why you have poor credit. If you have any unpaid CCJs, recent liquidations, bankruptcies or IVA’s it is less likely that unsecured lenders will approve your deal. However, there are plenty of other options available to companies with poor credit, such as a merchant cash advance or secured loan.

Unsecured startup loans are not available to small businesses. Instead, a secured loan would be better or a specific startup loan.

As business lending specialists, we can match you with a lender from our panel of providers across all types of business financing. When you apply for an unsecured business loan through Aurora Capital, we’ll take your information and find the lender who is best suited to your requirements and who is offering the best terms. We have unparalleled access to the entire business finance market, allowing us to guarantee the very best loan deals for our clients, every time.

When you take out an unsecured loan, you’ll agree to payment terms and interest rates payable over the course of your loan or at the end of the term. If you can’t meet your monthly repayments, each lender will have a different loan recovery process. When you apply, you can learn more about different payment terms and collections.

When you apply with Aurora Capital, a decision for your application can be received in as little as 24 hours.

Small business loans can be both secured and unsecured depending on your needs and available assets or property.