Pub and Restaurant

Business Loans

Does your pub or restaurant business need a quick cash injection to overcome a short-term cash flow issue, renovate your premises, or expand your offering? If so, we have the solution for you. Learn more about the wide range of restaurant business loans on offer through Aurora Capital and apply online today.

- Apply in minutes

- Applying won’t affect your credit score

- Free, no obligation quote

from 6.90%

Interest rates per annum

£100,000 +

UK Based

No early settlement fees

£5k - £500k

Funding requirement

Our lending partners

About Pub and Restaurant Business Loan

What Finance Options Does Your Pub or Restaurant Have?

For pub and restaurant businesses, obtaining external funding can be vital to support growth and expansion, but not all credit lines are created equal, and it’s crucial to find the right solution that meets your specific needs.

At Aurora Capital, we specialise in identifying the most suitable funding solutions for this sector. We acknowledge that your funding needs may differ, so we offer a wide range of business loan options with varying eligibility requirements, funding amounts, and usage flexibility.

Whether you need to address a temporary cash flow challenge or secure financing to purchase new equipment or inventory, we have a funding solution that can meet your needs.

Asset Finance

Inevitably, sometimes your restaurant business will need to purchase new things, such as kitchen equipment, furniture, and so on. While these things can be expensive, it isn’t necessary to disrupt cash flow; asset finance allows you to acquire those assets, even if you don’t have the necessary funds readily available. Effectively, asset finance means you use business assets as collateral to secure funds and fuel growth, and it is seen by many as the best way to purchase restaurant-related equipment.

Unsecured Business Loans

Unsecured business loans can be an excellent alternative as they don’t require collateral, but it’s important to note that unsecured loans often have higher interest rates than secured loans, because lenders assume more risk due to the absence of collateral. Although you may not be able to borrow as much with an unsecured loan as you would with a secured loan, you can still obtain a significant amount of credit. Unsecured loans are versatile and can be used for any business-related expenses, making them an appropriate funding option for restaurants. These loans typically range from £1,000 to £500,000 and can be repaid over a maximum of six years.

Recovery Loan Scheme

Recovery loans can offer essential assistance in overcoming financial difficulties. This form of borrowing is suitable for businesses that have encountered setbacks and need a significant amount of money to get back on track. Recovery loans usually range from £25,000 to £2 million and can be borrowed for a maximum period of six years.

Merchant Cash Advance

Merchant cash advances can be an excellent solution for restaurants and pubs that experience fluctuations in revenue. Repayment of the advance and associated fees is typically made through automatic daily or weekly deductions from your credit card sales until the loan is entirely paid off. For instance, the lender may agree to deduct 10% of every card transaction until the loan and interest charges are fully repaid. As sales increase, the amount repaid grows, resulting in quicker loan repayment.

Securing Pub and Restaurant Financing: The Importance of Business Loans

- Staffing and Expenses: During quiet periods, it can be challenging to cover overhead expenses, such as rent, utilities and staff salaries. A business loan can provide the necessary funds to pay these costs and keep your restaurant running smoothly.

- Renovations and Expansion: As your pub/restaurant grows, you may want to renovate or expand your establishment. A business loan can help finance these projects, allowing you to create a more inviting and modern environment for your customers.

- Purchasing Inventory: To run a successful pub/restaurant, you need to have a constant supply of fresh and high-quality ingredients. However, purchasing inventory can be expensive, particularly for smaller establishments or at times when there are food shortages. A business loan can help cover these costs, allowing you to focus on providing excellent food and service to your customers.

- Marketing and Advertising: In today’s competitive market, it’s vital to invest in marketing and advertising to promote your pub/restaurant and attract new customers. A business loan can help fund these efforts, allowing you to expand your reach and grow your customer base.

No matter your needs, there is a funding option to help you achieve your goals.

How do unsecured loans work?

An unsecured business loan works in the same way as a regular business loan where repayments are made monthly, weekly or daily depending on your agreement. Loan terms can be anywhere between one month to six years according to your business needs.

The loan can be used for almost any expense in the best interest of the business. Businesses usually use these loans for growth and development, refurbishment, capital expenditure or stock. Some business owners and borrowers also use unsecured loans to consolidate other types of debt they have if the loan terms are more favourable.

Unlike secured loans, ‘unsecured’ means your loan is not secured against any personal or business assets, such as property, equipment, vehicles or machinery. An unsecured loan will most likely require a personal guarantee from one or multiple directors.

To make the most of restaurant business loans, you need to have a solid growth plan and execute it effectively. Here are some tips for maximising your commercial loan:

- Develop a Clear Growth Plan: Identify the areas you want to expand, such as adding new menu items or renovating your premises. Develop a clear growth plan that outlines the costs and expected returns of each initiative.

- Prioritise Investments: Prioritise the investments that are most likely to generate a return on investment (ROI). For example, investing in new kitchen equipment can increase productivity and reduce costs, while investing in decor may not directly generate revenue, but it can aid repeat business due to a comfortable environment.

- Monitor Cash Flow: Keep a close eye on your cash flow and ensure that you have enough money to cover operating costs, loan repayments and growth initiatives. Consider using accounting software to track your cash flow and identify areas for improvement.

- Evaluate Marketing Strategies: Evaluate your current marketing strategies and consider investing in new approaches that can attract more customers, such as social media advertising or email marketing campaigns.

- Leverage Technology: Leverage technology to improve operational efficiency and enhance customer experience. Consider investing in POS systems, online ordering platforms, or loyalty programs.

With a solid growth plan and effective execution, your restaurant business can thrive and reach new heights.

Commercial grade restaurant equipment and fit-outs are expensive, and a lot of restaurant owners don’t have the immediate capital available in case something needs replacing. Financing can help you purchase the equipment you need without draining your cash reserves or disrupting your daily operations. Here are some tips on how to use business loans for restaurant equipment financing:

- Determine your needs: Before applying for a loan, assess your equipment needs. Make a list of the equipment you need, including the type, brand, and model number. Consider your budget, the age and condition of your existing equipment, and any regulatory requirements.

- Research your options: Once you know what you need, research your finance options. Compare rates, terms, and fees to get the best deals (we can help you with this and match you with the most competitive lenders).

- Apply for credit: Once you’ve found a suitable lender, complete the loan application process. Be prepared to provide detailed financial information about your business if needed, including income statements, balance sheets, and cash flow statements. The lender may also require information about the equipment you plan to purchase, depending on the type of finance you’re applying for (e.g., asset finance).

- Purchase the equipment: Once you’ve secured financing, purchase the equipment you need from a reputable supplier. Make sure the equipment meets all regulatory requirements and comes with a warranty.

After this, you can pay your loan in the agreed timeframe with the predetermined repayment terms. If you have any questions about the equipment finance process, speak to a member of our team.

Leasing:

Leasing equipment can provide you with access to high-quality equipment while reducing upfront costs. Leases typically include maintenance and repair services which can be advantageous, and some agreements offer flexibility in the way of allowing you to upgrade to newer equipment at the end of the lease term. Leasing is also the most tax efficient way of borrowing, as you are able to offset the whole payment against your tax liability.

Hire Purchase:

Financing equipment via a hire purchase agreement can be a good option for restaurants that are looking to own the equipment outright at the end of the agreement. You will likely need to have put down at least a 10% deposit, as well as pay all of the VAT upfront, so bear this in mind when deciding which option is best for the business.

Considerations:

When deciding between leasing and HP, it’s essential to consider factors like your restaurant’s financial situation, long-term equipment needs, and whether you want to own the piece of kit at the end of the agreement. If you need to conserve cash flow, you may benefit from leasing, but if you have the capital to put down a deposit, you may prefer this route as it is more cost effective in the long run.

Our team of finance experts can help you assess your equipment financing options and determine the best approach for your restaurant’s unique needs.

Before you take out any type of business loan, it’s important to understand the interest rates and repayment methods associated with your loan in order to manage your finances effectively. Here are some key factors to keep in mind, although do remember that these can vary from lender to lender:

- Interest Rates: The interest rate is the cost of borrowing the money from the lender. It’s essential to compare interest rates between different lenders to ensure you’re getting the best deal. The interest rate can be fixed or variable. A fixed rate remains the same throughout the loan’s term, while a variable rate can fluctuate based on market conditions.

- Repayment Methods: There are various repayment methods available to restaurant owners, such as monthly payments, weekly payments, or automatic deductions from credit card sales. It’s crucial to select a repayment method that aligns with your business’s cash flow to avoid any financial strain.

- Early Repayment: Some lenders may allow you to repay your loan early without penalty. This can save you money on interest charges and help you pay off the loan faster. However, it’s essential to check if there are any prepayment penalties before agreeing to the loan terms.

- Late Payment Fees: It’s important to be aware of any late payment fees associated with your loan. Late payments can negatively impact your credit score and result in additional fees.

By understanding the interest rates and repayment methods associated with your loan, you can effectively manage your finances and ensure you can repay your loan on time.

- Develop a Clear Growth Plan: Identify the areas you want to expand, such as adding new menu items or renovating your premises. Develop a clear growth plan that outlines the costs and expected returns of each initiative.

- Prioritise Investments: Prioritise the investments that are most likely to generate a return on investment (ROI). For example, investing in new kitchen equipment can increase productivity and reduce costs, while investing in decor may not directly generate revenue, but it can aid repeat business due to a comfortable environment.

- Monitor Cash Flow: Keep a close eye on your cash flow and ensure that you have enough money to cover operating costs, loan repayments and growth initiatives. Consider using accounting software to track your cash flow and identify areas for improvement.

- Evaluate Marketing Strategies: Evaluate your current marketing strategies and consider investing in new approaches that can attract more customers, such as social media advertising or email marketing campaigns.

- Leverage Technology: Leverage technology to improve operational efficiency and enhance customer experience. Consider investing in POS systems, online ordering platforms, or loyalty programs.

With a solid growth plan and effective execution, your restaurant business can thrive and reach new heights.

Commercial grade restaurant equipment and fit-outs are expensive, and a lot of restaurant owners don’t have the immediate capital available in case something needs replacing. Financing can help you purchase the equipment you need without draining your cash reserves or disrupting your daily operations. Here are some tips on how to use business loans for restaurant equipment financing:

- Determine your needs: Before applying for a loan, assess your equipment needs. Make a list of the equipment you need, including the type, brand, and model number. Consider your budget, the age and condition of your existing equipment, and any regulatory requirements.

- Research your options: Once you know what you need, research your finance options. Compare rates, terms, and fees to get the best deals (we can help you with this and match you with the most competitive lenders).

- Apply for credit: Once you’ve found a suitable lender, complete the loan application process. Be prepared to provide detailed financial information about your business if needed, including income statements, balance sheets, and cash flow statements. The lender may also require information about the equipment you plan to purchase, depending on the type of finance you’re applying for (e.g., asset finance).

- Purchase the equipment: Once you’ve secured financing, purchase the equipment you need from a reputable supplier. Make sure the equipment meets all regulatory requirements and comes with a warranty.

After this, you can pay your loan in the agreed timeframe with the predetermined repayment terms. If you have any questions about the equipment finance process, speak to a member of our team.

Leasing:

Leasing equipment can provide you with access to high-quality equipment while reducing upfront costs. Leases typically include maintenance and repair services which can be advantageous, and some agreements offer flexibility in the way of allowing you to upgrade to newer equipment at the end of the lease term. Leasing is also the most tax efficient way of borrowing, as you are able to offset the whole payment against your tax liability.Hire Purchase:

Financing equipment via a hire purchase agreement can be a good option for restaurants that are looking to own the equipment outright at the end of the agreement. You will likely need to have put down at least a 10% deposit, as well as pay all of the VAT upfront, so bear this in mind when deciding which option is best for the business.Considerations:

When deciding between leasing and HP, it’s essential to consider factors like your restaurant’s financial situation, long-term equipment needs, and whether you want to own the piece of kit at the end of the agreement. If you need to conserve cash flow, you may benefit from leasing, but if you have the capital to put down a deposit, you may prefer this route as it is more cost effective in the long run. Our team of finance experts can help you assess your equipment financing options and determine the best approach for your restaurant’s unique needs.

- Interest Rates: The interest rate is the cost of borrowing the money from the lender. It’s essential to compare interest rates between different lenders to ensure you’re getting the best deal. The interest rate can be fixed or variable. A fixed rate remains the same throughout the loan’s term, while a variable rate can fluctuate based on market conditions.

- Repayment Methods: There are various repayment methods available to restaurant owners, such as monthly payments, weekly payments, or automatic deductions from credit card sales. It’s crucial to select a repayment method that aligns with your business’s cash flow to avoid any financial strain.

- Early Repayment: Some lenders may allow you to repay your loan early without penalty. This can save you money on interest charges and help you pay off the loan faster. However, it’s essential to check if there are any prepayment penalties before agreeing to the loan terms.

- Late Payment Fees: It’s important to be aware of any late payment fees associated with your loan. Late payments can negatively impact your credit score and result in additional fees.

By understanding the interest rates and repayment methods associated with your loan, you can effectively manage your finances and ensure you can repay your loan on time.

Get your free, no

obligation quote Today!

- Apply in minutes

- FREE, no obligation, personalised quote

- FCA regulated

How much do you want to borrow?

Securing business funding:

How it works

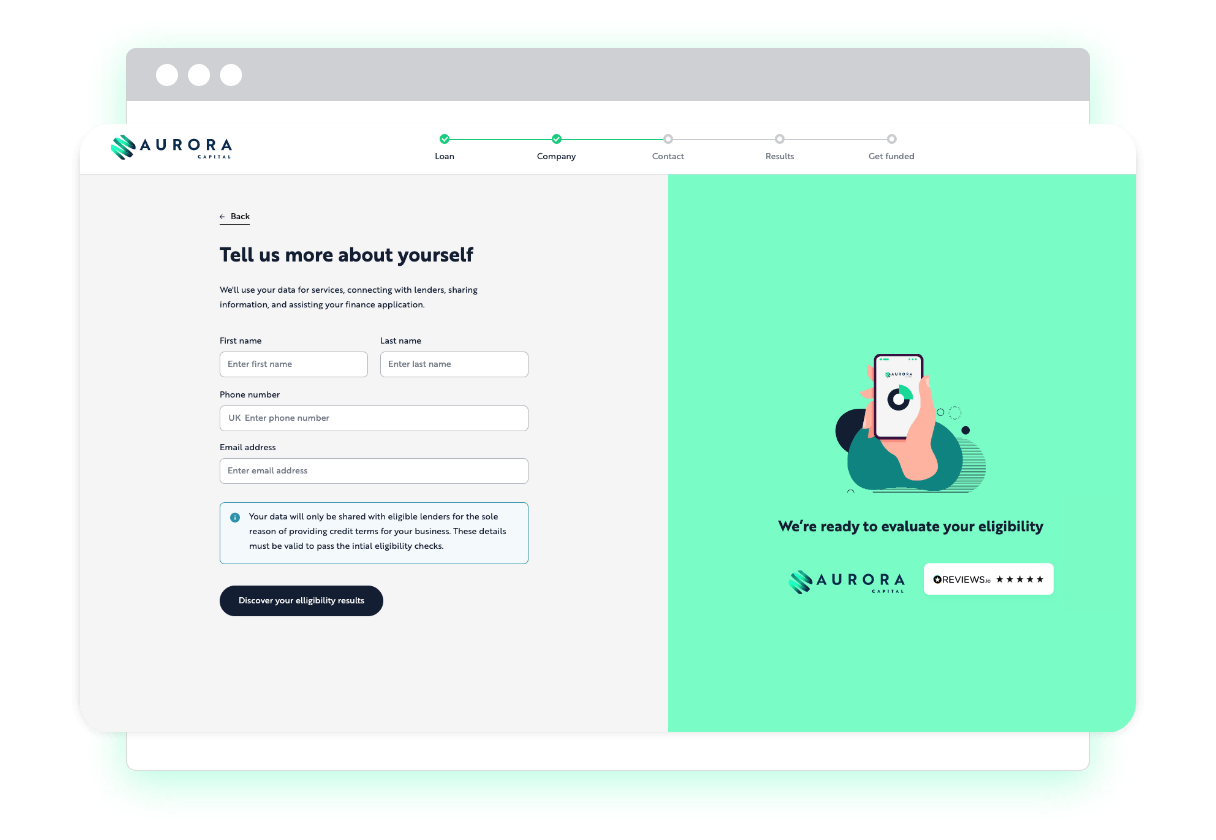

We understand that timing is key when you’re looking to find funding options for your business,so our process is as quick and as streamlined as possible.

1

Apply Online in minutes

We cater to any sized business, so to apply for business funding, we only need you to share basic information about your company. Your application will take a few minutes, and our experts are always happy to assist with any questions you have about specific loan types or alternative finance options.

2

Get Matched in hours

Our LendTech technology will compare our trusted panel of lenders and match you with your most suitable finance option. Each business funding option is different, and we’ll help to make sure you’re fully clued up on the terms and conditions as well as indicative repayment details.

3

Get Funded in days

One of our funding specialists will discuss the available options with you and guide you through the process from application to approval. Once approved, the funds can be deposited in a matter of hours.

Prefer to talk? Call us on 01371 870815

4.9/5 based on 100+ by happy customers

Navigate our range of business

funding options to find out more

We understand that timing is key when you’re looking to find funding options for your business, so our process is as quick and as streamlined as possible.

Apply for a recovery loan to help your business employ staff

A government backed loan to support businesses affected by the pandemic.

Looking to obtain an unsecured loan for your business?

Business loans up to £500k, without the need to secure on property or assets.

Apply for a secured business loan today and get matched with a lender…

Business loans up to £2M, secured against a UK property by way of 1st or 2nd charge.

It takes minutes to apply, there’s no effect on your credit score.

Acquire new or used equipment, machinery or vehicles and spread the repayments over 1-6 years.

Compare merchant cash advances to help your business purchase stock.

Borrow up to 2x your monthly card sales and repay through a small % of your future takings.

Compare revolving credit facilities to help your business grow.

A pre agreed credit facility, allowing you to dip in and out for future funding requirements.

Spread the payments of your PAYE, VAT or Corp Tax bills.

VAT/TAX loans up to £500k for PAYE payments, quarterly VAT payments or annual Corporation tax payments

Prefer to talk? Call us on 01371 870815

4.9/5 based on 100+ by happy customers

Key benefits of working with

Aurora Capital

LendTech Technology - Access to 50+ Lenders

At Aurora Capital, we use LendTech technology which gives us access to a vast network of over 50 commercial lenders in the market. Our extensive pool of lenders ensures that we can match you with the most appropriate lender for your specific requirements, who will provide competitive terms and reasonable loan options.

Apply Online in Minutes & Get Funding in Days

We understand that businesses often need funding quickly. For this reason, we offer a fast, simplified service. Once you’ve chosen the appropriate loan for your needs, you can apply online through Aurora Capital, which only takes a few minutes. Our team will then match you with a lender and acquire the necessary funds, often in just a few days.

No Effect on Your Credit Score

Conventional loan and credit applications can damage your credit score, but with Aurora Capital, this isn’t the case. Whether your application is successful or declined, your credit score remains unaffected. This is especially advantageous for newly established businesses trying to establish a credit score, or those with a negative credit history.

LendTech Technology - Access to 50+ Lenders

At Aurora Capital, we use LendTech technology which gives us access to a vast network of over 50 commercial lenders in the market. Our extensive pool of lenders ensures that we can match you with the most appropriate lender for your specific requirements, who will provide competitive terms and reasonable loan options.

Apply Online in Minutes & Get Funding in Days

We understand that businesses often need funding quickly. For this reason, we offer a fast, simplified service. Once you’ve chosen the appropriate loan for your needs, you can apply online through Aurora Capital, which only takes a few minutes. Our team will then match you with a lender and acquire the necessary funds, often in just a few days.

No Effect on Your Credit Score

Conventional loan and credit applications can damage your credit score, but with Aurora Capital, this isn’t the case. Whether your application is successful or declined, your credit score remains unaffected. This is especially advantageous for newly established businesses trying to establish a credit score, or those with a negative credit history.

100+ Happy Customers & Counting

Pub and Restaurant business loans: FAQs

The amount you can borrow with a pub/restaurant business loan depends on several factors, such as your credit score, revenue, and the type of loan. Generally, at Aurora Capital, we work with lenders offering loans ranging from £10k to £500k.

The interest rate for a pub/restaurant business loan varies based on the lender, the loan amount, and your creditworthiness, with most lenders starting from around 7.5% per annum.

The time it takes to get approved for a pub/restaurant business loan varies based on the lender and the loan type. At Aurora Capital, our application process is fast, with most lenders approving applications in 48 hours. That being said, it’s essential to prepare all the necessary documentation, such as accounting information and a business plan if needed, to prevent any stalls in the process.

The collateral requirements for a pub/restaurant business loan vary based on the lender and the loan type. Some lenders may require collateral such as equipment, property, or inventory, while others may offer unsecured loans where no collateral is needed.