Compare Invoice Finance to Help Your Business

Grow

Purchase Stock

Employ Staff

Expand

Pay Suppliers

It takes minutes to apply, there’s no effect on your credit score, and you can obtain decisions within 24 hours.

- Apply in minutes

- Applying won’t affect your credit score

- Free, no obligation quote

6.90%

Interest rates per annum

£100,000 +

UK Based

No early settlement fees

£5k - £500k

Funding requirement

Our lending partners

Business Invoice Finance

Invoice finance can provide your business with a cash flow injection by releasing capital tied up in unpaid invoices. Discover the different invoice financing options and prepare to grow your business by having quicker access to the funds you’re owed.

What is invoice finance?

It’s a type of business loan that allows your company to release money from unpaid invoices. An invoice finance provider advances you a percentage of the cash value of invoices you’re waiting to be paid by your customers.

It can take up to 90 days to complete an invoice, which can impact your business’s cash flow. Invoice finance can give you quick access to the money you’re owed, sometimes within 48 hours, so your business operations aren’t impacted.

The invoice finance providers we work with can pay up to 90% of the value of your invoices the minute they are raised. Once the invoice payment has been settled, you will receive the balance minus interest and fees.

Key features

- Suitability: Businesses that have payment terms beyond 30 days and who are selling to other businesses (B2B).

- Purpose: Used to strengthen ongoing cash flow.

- Amount: Up to 90% of invoices can be advanced on day one. This will depend on the number of invoices you have and how long your business has been trading.

- Term: Invoice financing is a rolling facility with no fixed term.

- Cost: Between 1% and 4% of the invoice value. Some products charge an annual or subscription fee.

- Security: Some invoice funding solutions will be unsecured, but they may ask for a personal guarantee.

- Speed: Applications can be processed and funding arranged within 48 hours.

Here’s an example of how invoice finance works:

- A business sets up an invoice finance facility to help maintain the company’s day-to-day working capital.

- The business owner issues an invoice for £10,000. The invoice is for work that has already been completed on 30-day credit.

- The invoice finance company agrees to advance 90% of the invoice value upfront and the rest when the customer settles in full.

- The business receives £9,000 as soon as the invoice is raised.

- The customer then settles the invoice 30 days later, paying £ 10,000 into an escrow account held by the lender.

- The invoice finance company then pays the business the remaining £1,000, minus their fees.

Invoice financing allows the business to unlock the cash tied up in the invoice for a small fee. This can assist the business’s day-to-day running and free up capital for potential growth plans.

There are several different types of invoice loans you can choose from. Which option is right for your business depends on the level of control and involvement you want. Here are the main types of invoice finance available:

Invoice factoring

Invoice factoring, also known as debt factoring, is a type of invoice financing in which a third party (the factoring company) manages your whole sales ledger.

The factoring company can lend you up to 90% of the value of all your invoices. They will then collect payment for your invoices directly from your customers, deduct the fee, and pay you the remaining balance.

This option is usually used by companies with an annual turnover of under £3m. It is important to understand that your customers will probably be aware that you are using an invoice factoring company.

Invoice finance factoring safeguards you against falling into debt because clients are not paying or are paying late, allowing you to keep your business running smoothly.

Invoice discounting

Invoice discounting is similar to factoring, but the main difference is that you remain in control of your sales ledger. That means you are responsible for collecting payments and communicating with your customers.

This option is more commonly used by larger businesses with a turnover of more than £3m. You send the finance provider your invoices as orders are fulfilled.

The invoice discounting company will then deposit a percentage of the invoice to your business account. Once the agreed percentage has been paid, you can collect the remaining balance from your client when it is due.

Depending on your contract, the discounting company will claim its fees from this remaining balance, or you can send it directly to them.

Selective invoice finance

Selective invoice finance is a way to release capital on one single invoice rather than your whole ledger and quickly increase your cash flow.

Also known as single invoice finance, it’s helpful when your business is waiting on one specific large invoice. With this option, you can improve your cash flow quickly when you need to and only pay one fee.

Your business selects an individual invoice which needs to be processed quickly. You then provide the details to the financing company and agree on any rates and fees.

Once the financing company verifies the invoice, it will advance you a percentage of the invoice value upfront, usually up to 90%. When your client pays the remaining balance of the invoice, the selective invoice financing company will collect the debt and provide you with the rest of the payment minus its fee.

Companies that sell goods or services business to business on credit terms should be eligible for invoice financing.

You must also ensure your invoices are for fully delivered goods or services. The ideal customer for invoice finance borrowing raises more than five invoices a month to other business customers.

Some lenders also stipulate that your business must have a minimum yearly turnover of at least £250,000.

Sectors that deal with sales to the general public, like retail, for example, are not eligible for invoice financing. It is also unavailable if your company bills its B2B services in advance.

If you have a poor business credit score, there are no guarantees that an invoice finance option will be available to you. However, certain lenders can still work with adverse credit. This will depend on what the adverse credit is and how much it was for.

Invoice finance can be a good option for helping your business manage its cash flow, but it might not be suitable for every situation. It’s worth considering the pros and cons to determine if invoice financing is right for your company.

Pros of invoice finance

- No additional security: The unpaid invoice acts as the collateral for what you borrow, so there is no need to put any of your business assets at risk.

- Flexibility: You can use the funds you receive for whatever your business needs.

- Fast access: Approval for invoice finance can be very quick, and you can be approved and receive funds within 48 hours.

- Consistent: Invoice finance means you’ll receive payment when the invoice is issued, and if you use factoring, the provider will act as a credit controller, too, freeing up your time.

- Scalable: The amount you can access will increase as your business’s turnover increases.

Cons of invoice finance

- Fees: You will need to pay a fee and interest to the lender, which means you will receive less overall than if you waited until the invoice is paid.

- Privacy: With invoice factoring, the provider may act as a credit controller, which means your customers will know you are using invoice finance.

- Dependent on customers: You may be held responsible if your client fails to pay their invoice.

- Overreliance: There is a risk of becoming over-reliant on invoice finance to maintain cash flow, which could result in problems if the facility is withdrawn.

- Limited eligibility: Invoice finance might not be available to your business if it doesn’t raise invoices or operates in a high-risk industry.

Here’s an example of how invoice finance works:

- A business sets up an invoice finance facility to help maintain the company’s day-to-day working capital.

- The business owner issues an invoice for £10,000. The invoice is for work that has already been completed on 30-day credit.

- The invoice finance company agrees to advance 90% of the invoice value upfront and the rest when the customer settles in full.

- The business receives £9,000 as soon as the invoice is raised.

- The customer then settles the invoice 30 days later, paying £ 10,000 into an escrow account held by the lender.

- The invoice finance company then pays the business the remaining £1,000, minus their fees.

Invoice financing allows the business to unlock the cash tied up in the invoice for a small fee. This can assist the business’s day-to-day running and free up capital for potential growth plans.

There are several different types of invoice loans you can choose from. Which option is right for your business depends on the level of control and involvement you want. Here are the main types of invoice finance available:

Invoice factoring

Invoice factoring, also known as debt factoring, is a type of invoice financing in which a third party (the factoring company) manages your whole sales ledger.

The factoring company can lend you up to 90% of the value of all your invoices. They will then collect payment for your invoices directly from your customers, deduct the fee, and pay you the remaining balance.

This option is usually used by companies with an annual turnover of under £3m. It is important to understand that your customers will probably be aware that you are using an invoice factoring company.

Invoice finance factoring safeguards you against falling into debt because clients are not paying or are paying late, allowing you to keep your business running smoothly.

Invoice discounting

Invoice discounting is similar to factoring, but the main difference is that you remain in control of your sales ledger. That means you are responsible for collecting payments and communicating with your customers.

This option is more commonly used by larger businesses with a turnover of more than £3m. You send the finance provider your invoices as orders are fulfilled.

The invoice discounting company will then deposit a percentage of the invoice to your business account. Once the agreed percentage has been paid, you can collect the remaining balance from your client when it is due.

Depending on your contract, the discounting company will claim its fees from this remaining balance, or you can send it directly to them.

Selective invoice finance

Selective invoice finance is a way to release capital on one single invoice rather than your whole ledger and quickly increase your cash flow.

Also known as single invoice finance, it’s helpful when your business is waiting on one specific large invoice. With this option, you can improve your cash flow quickly when you need to and only pay one fee.

Your business selects an individual invoice which needs to be processed quickly. You then provide the details to the financing company and agree on any rates and fees.

Once the financing company verifies the invoice, it will advance you a percentage of the invoice value upfront, usually up to 90%. When your client pays the remaining balance of the invoice, the selective invoice financing company will collect the debt and provide you with the rest of the payment minus its fee.

Companies that sell goods or services business to business on credit terms should be eligible for invoice financing.

You must also ensure your invoices are for fully delivered goods or services. The ideal customer for invoice finance borrowing raises more than five invoices a month to other business customers.

Some lenders also stipulate that your business must have a minimum yearly turnover of at least £250,000.

Sectors that deal with sales to the general public, like retail, for example, are not eligible for invoice financing. It is also unavailable if your company bills its B2B services in advance.

If you have a poor business credit score, there are no guarantees that an invoice finance option will be available to you. However, certain lenders can still work with adverse credit. This will depend on what the adverse credit is and how much it was for.

Invoice finance can be a good option for helping your business manage its cash flow, but it might not be suitable for every situation. It’s worth considering the pros and cons to determine if invoice financing is right for your company.

Pros of invoice finance

- No additional security: The unpaid invoice acts as the collateral for what you borrow, so there is no need to put any of your business assets at risk.

- Flexibility: You can use the funds you receive for whatever your business needs.

- Fast access: Approval for invoice finance can be very quick, and you can be approved and receive funds within 48 hours.

- Consistent: Invoice finance means you’ll receive payment when the invoice is issued, and if you use factoring, the provider will act as a credit controller, too, freeing up your time.

- Scalable: The amount you can access will increase as your business’s turnover increases.

Cons of invoice finance

- Fees: You will need to pay a fee and interest to the lender, which means you will receive less overall than if you waited until the invoice is paid.

- Privacy: With invoice factoring, the provider may act as a credit controller, which means your customers will know you are using invoice finance.

- Dependent on customers: You may be held responsible if your client fails to pay their invoice.

- Overreliance: There is a risk of becoming over-reliant on invoice finance to maintain cash flow, which could result in problems if the facility is withdrawn.

- Limited eligibility: Invoice finance might not be available to your business if it doesn’t raise invoices or operates in a high-risk industry.

Get your free, no

obligation quote Today!

- Apply in minutes

- FREE, no obligation, personalised quote

- FCA regulated

How much do you want to borrow?

Securing business funding:

How it works

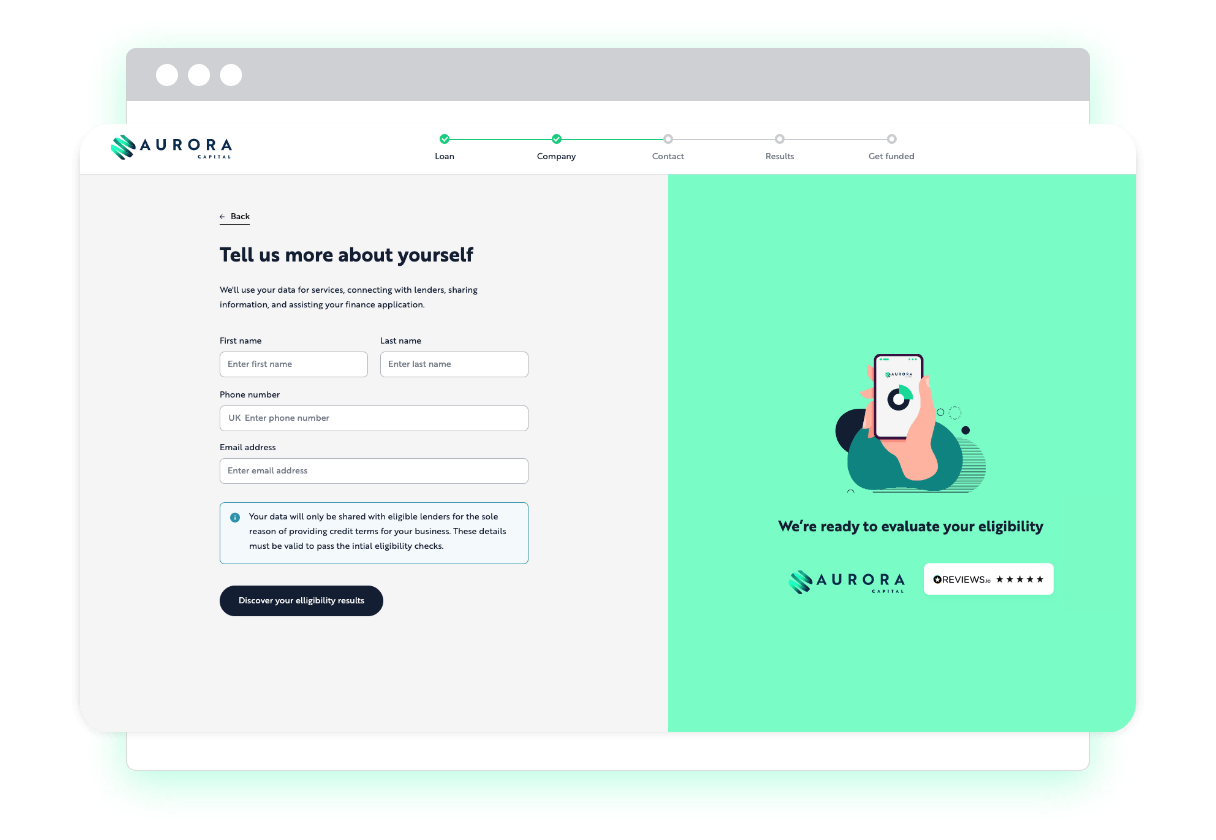

We understand that timing is key when you’re looking to find funding options for your business,so our process is as quick and as streamlined as possible.

1

Apply Online in minutes

We cater to any sized business, so to apply for business funding, we only need you to share basic information about your company. Your application will take a few minutes, and our experts are always happy to assist with any questions you have about specific loan types or alternative finance options.

2

Get Matched in hours

Our LendTech technology will compare our trusted panel of lenders and match you with your most suitable finance option. Each business funding option is different, and we’ll help to make sure you’re fully clued up on the terms and conditions as well as indicative repayment details.

3

Get Funded in days

One of our funding specialists will discuss the available options with you and guide you through the process from application to approval. Once approved, the funds can be deposited in a matter of hours.

Prefer to talk? Call us on 01371 870815

4.9/5 based on 100+ by happy customers

Apply for a recovery loan to help your business employ staff

A government backed loan to support businesses affected by the pandemic.

Looking to obtain an unsecured loan for your business?

Business loans up to £500k, without the need to secure on property or assets.

Apply for a secured business loan today and get matched with a lender…

Business loans up to £2M, secured against a UK property by way of 1st or 2nd charge.

It takes minutes to apply, there’s no effect on your credit score.

Acquire new or used equipment, machinery or vehicles and spread the repayments over 1-6 years.

Compare merchant cash advances to help your business purchase stock.

Borrow up to 2x your monthly card sales and repay through a small % of your future takings.

Compare revolving credit facilities to help your business grow.

A pre agreed credit facility, allowing you to dip in and out for future funding requirements.

Spread the payments of your PAYE, VAT or Corp Tax bills.

VAT/TAX loans up to £500k for PAYE payments, quarterly VAT payments or annual Corporation tax payments

Prefer to talk? Call us on 01371 870815

4.9/5 based on 100+ by happy customers

100+ Happy Customers & Counting

Invoice finance: FAQs

As with all types of lending, there are risks that you should consider before applying for invoice finance. Potential risks include:

- The need for a credit check: This is usually a mandatory part of the application process and will show on your credit report, which can affect your credit rating

- Excess charges: As with all lending options, defaulting on payments can result in excess charges

- Responsibility: If payments are not met, this is your responsibility, regardless of whether your customer has paid their invoice or not

Depending on the lender, fees can be between 1% and 4% of the invoice value. Some products charge an annual fee and a subscription fee.

You meet the basic criteria if you sell goods or services on credit to other creditworthy businesses and your invoices are for fully delivered goods or services.

With invoice finance, your future growth is more important than an extensive credit history.

No. You can choose to have cash advanced for all your invoices or those from select customers. Invoice finance allows you to maintain control over your collections and relationships with your customers.

Some lenders will finance one-off invoices as needed, otherwise known as selective invoice finance.

Since there is no minimum requirement, we encourage you to use invoice finance regularly to keep it active and accessible. You can terminate the agreement anytime, and there are no penalties.

It is possible to get a new lender in place to lend as soon as the contract is open.

Invoice finance is viewed as a standard, progressive business practice for growth-oriented companies.

According to the British Insurance Brokers ‘ Association, it is one of the fastest-growing types of funding and is used by more than 40,000 companies in the UK each year.