Healthcare Business Loans

At Aurora Capital, we help businesses in the healthcare industry secure competitive business loans, so whether you’re looking to expand your clinic, purchase new equipment, or invest money into medical research teams, we can help you access the funding you need.

- Apply in minutes

- Applying won’t affect your credit score

- Free, no obligation quote

from 6.90%

Interest rates per annum

£100,000 +

UK Based

No early settlement fees

£5k - £500k

Funding requirement

Our lending partners

About Healthcare Business Loans

Types of Business Loans for Your Healthcare Business

Every medical business will have different needs and unique reasons for requiring external funding. With this in mind, the type of funding that is suitable for one business may not be suitable for another. At Aurora Capital, we focus on finding businesses the best type of credit to finance their exact needs, and that’s why we provide several types of business loans for medical professionals, each varying in value, eligibility, and use types.

Asset Finance

If your healthcare business is looking to purchase new equipment, but you don’t want to disrupt cash flow or don’t have the necessary funds available, consider an asset finance agreement. This financing option allows small and medium-sized enterprises (SMEs) to use business assets as collateral to secure funds and fuel growth. Asset finance is typically used for assets such as equipment and machinery; as you’ll know, medical and healthcare paraphernalia can be notoriously expensive. It’s also possible to refinance your existing assets – but keep in mind that there are eligibility criteria related to the age and condition of equipment.

Unsecured Business Loans

Unsecured business loans don’t require collateral, but they generally come with higher interest rates than secured loans as a result of the higher risk to the lender. Unsecured business loans are useful for businesses that don’t have valuable assets to offer as security for the loan, or those that simply don’t want to use assets as collateral. This type of funding can be used for a wide range of business purposes, such as increasing marketing efforts, buying new stock, or investing in operational upgrades. Typically, loan amounts ranging from £1,000 to £500,000 can be obtained over a maximum of a six-year period. Learn more about the differences between unsecured and secured business loans.

Recovery Loan Scheme

Recovery loans are a type of borrowing that can aid medical businesses in overcoming financial challenges. This funding option is well-suited to businesses that have faced financial setbacks and need a larger sum of money to move forwards. Typically, loan amounts range from £25,000 to £500,000 and can be borrowed over a period of five years max.

Merchant Cash Advance

Merchant cash advances are a funding solution designed for healthcare businesses that require swift access to cash, but with more manageable repayment terms. Unlike traditional loans, a lender provides upfront cash in exchange for a percentage of future credit and debit card transactions. Repayment of the advance and fees is typically done through daily or weekly automatic deductions from the business’s credit card sales until the loan is fully repaid. The higher the sales, the more the borrower pays back and the faster the loan is repaid.

Do I Need Collateral to Get a Business Loan for a Healthcare Business?

Collateral refers to assets that you pledge as security for a loan. This can include property or assets. In general, lenders prefer to have collateral as a way to minimise their risk in case of defaulted payments; however, not all loans require collateral.

Unsecured business loans don’t require collateral and are therefore more suited to those borrowing less, or those that don’t have assets to use as collateral. However, it should be noted that the lack of collateral often means a personal guarantor will be required to secure the loan, and interest rates will generally be slightly higher.

At Aurora Capital, we understand the unique needs of medical businesses and can help you navigate the often complex lending process. We work with a network of lenders to find the best financing solutions for your business, whether you have collateral or not. Compare funding options to see which may be best for you.

As a healthcare business looking to secure funding for your company, it’s important to understand the eligibility requirements that are typically necessary to obtain external financing. At Aurora Capital, the eligibility that businesses we work with must meet includes:

- UK-based business

- Trading for 6+ months (start-up options are available)

- Annual turnover of £100,000+

- Credit needs of £10,000-£500k

The requirements lenders look for vary depending on the type of funding you are looking for, but there are some general factors that most lenders will look for when assessing your loan application.

- Affordability: Firstly, lenders want evidence that your business can afford a loan. Each lender has a slightly different method of running this test, however below are a few pointers to think about;

- Cash availability – Lenders will evaluate your last 3-6 months bank statements and look at your average daily cash balance to see if the estimated monthly payment is affordable.

- Profit/EBITDA – Lenders will be looking to see if your business is profitable and will likely lend up to 5x the EBITDA figure for the most recent year. If you are not yet profitable, we do still have some other lenders that lend against turnover.

- Balance Sheet – Lenders will be looking to see that you have a healthy balance sheet and one quick test you can run is to look and see if your balance sheet is solvent or not. Being solvent means that you own more assets than you owe in liabilities.

- Credit History: Another important consideration for lenders is your credit score and financial history. A strong credit score and clean financial history will generally make it easier to secure funding and obtain favourable terms, as well as potentially grant you lower APR interest rates. This is both on the business and personal side.

- Collateral: The final major considerations lenders will typically consider are factors such as the size of your business, the industry in which you operate, and the collateral you have available to secure the loan. Again, these can influence borrowing amounts and interest rates.

At Aurora Capital, we understand the unique financing needs of healthcare businesses and can help you navigate the eligibility requirements lenders assess when making a funding decision. We can also help you prepare the relevant documentation needed to bolster your application.

As a healthcare business looking to secure funding for your company, it’s important to understand the eligibility requirements that are typically necessary to obtain external financing. At Aurora Capital, the eligibility that businesses we work with must meet includes:

- UK-based business

- Trading for 6+ months (start-up options are available)

- Annual turnover of £100,000+

- Credit needs of £10,000-£500k

The requirements lenders look for vary depending on the type of funding you are looking for, but there are some general factors that most lenders will look for when assessing your loan application.

- Affordability: Firstly, lenders want evidence that your business can afford a loan. Each lender has a slightly different method of running this test, however below are a few pointers to think about;

- Cash availability – Lenders will evaluate your last 3-6 months bank statements and look at your average daily cash balance to see if the estimated monthly payment is affordable.

- Profit/EBITDA – Lenders will be looking to see if your business is profitable and will likely lend up to 5x the EBITDA figure for the most recent year. If you are not yet profitable, we do still have some other lenders that lend against turnover.

- Balance Sheet – Lenders will be looking to see that you have a healthy balance sheet and one quick test you can run is to look and see if your balance sheet is solvent or not. Being solvent means that you own more assets than you owe in liabilities.

- Credit History: Another important consideration for lenders is your credit score and financial history. A strong credit score and clean financial history will generally make it easier to secure funding and obtain favourable terms, as well as potentially grant you lower APR interest rates. This is both on the business and personal side.

- Collateral: The final major considerations lenders will typically consider are factors such as the size of your business, the industry in which you operate, and the collateral you have available to secure the loan. Again, these can influence borrowing amounts and interest rates.

At Aurora Capital, we understand the unique financing needs of healthcare businesses and can help you navigate the eligibility requirements lenders assess when making a funding decision. We can also help you prepare the relevant documentation needed to bolster your application.

Get your free, no

obligation quote Today!

- Apply in minutes

- FREE, no obligation, personalised quote

- FCA regulated

How much do you want to borrow?

Securing business funding:

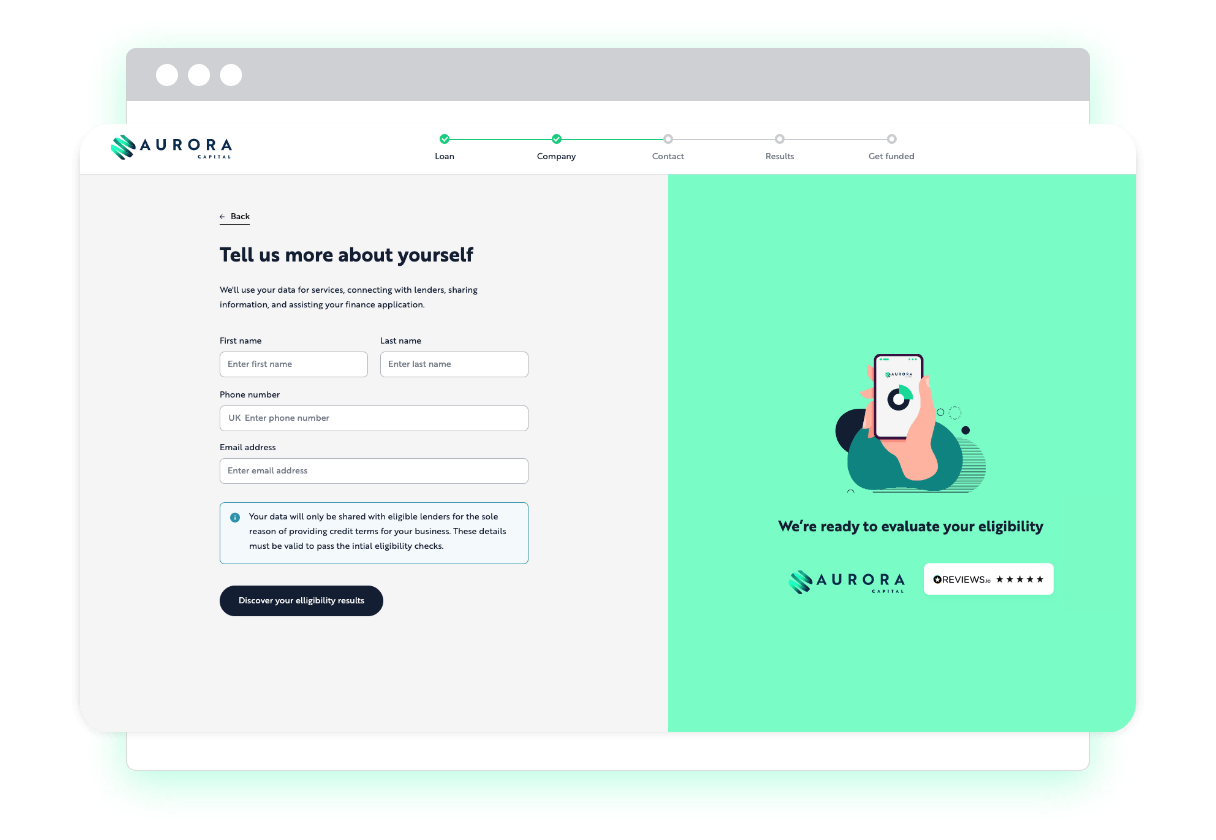

How it works

We understand that timing is key when you’re looking to find funding options for your business,so our process is as quick and as streamlined as possible.

1

Apply Online in minutes

We cater to any sized business, so to apply for business funding, we only need you to share basic information about your company. Your application will take a few minutes, and our experts are always happy to assist with any questions you have about specific loan types or alternative finance options.

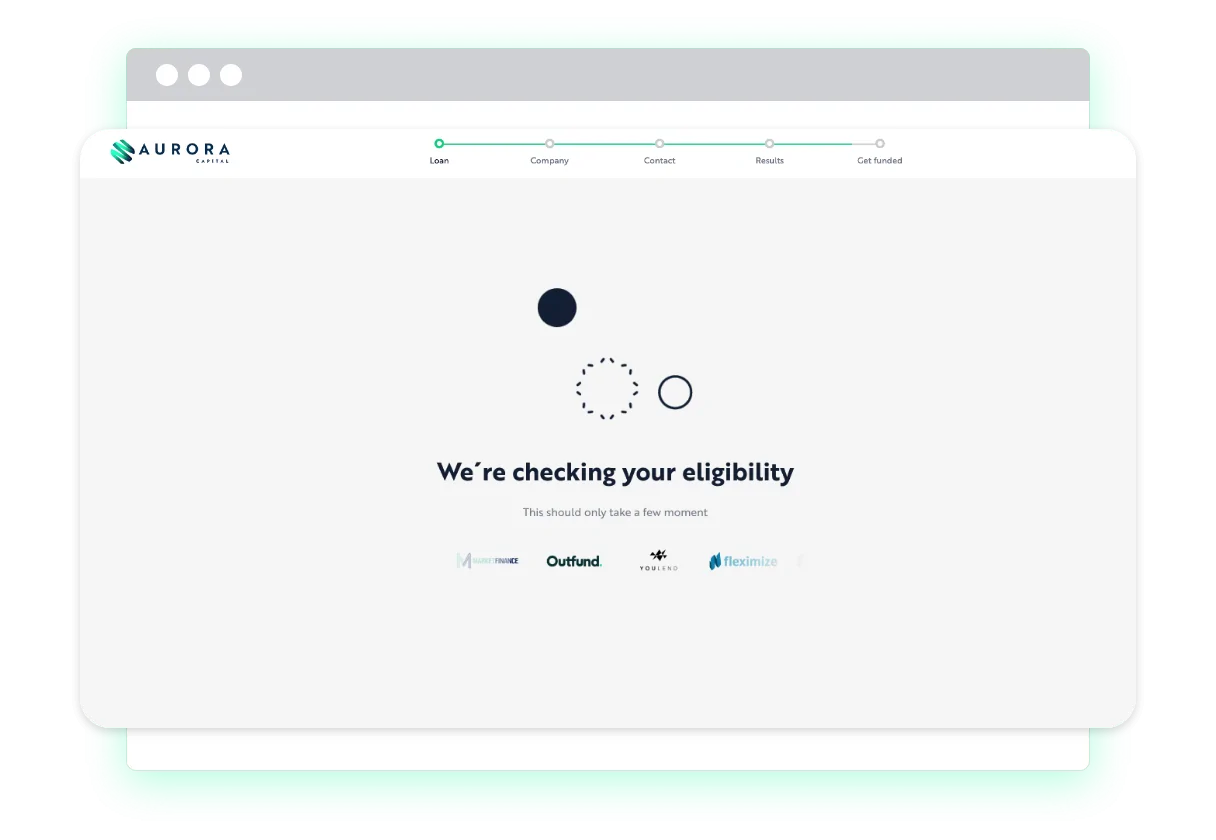

2

Get Matched in hours

Our LendTech technology will compare our trusted panel of lenders and match you with your most suitable finance option. Each business funding option is different, and we’ll help to make sure you’re fully clued up on the terms and conditions as well as indicative repayment details.

3

Get Funded in days

One of our funding specialists will discuss the available options with you and guide you through the process from application to approval. Once approved, the funds can be deposited in a matter of hours.

Prefer to talk? Call us on 01371 870815

4.9/5 based on 100+ by happy customers

Navigate our range of business

funding options to find out more

We understand that timing is key when you’re looking to find funding options for your business, so our process is as quick and as streamlined as possible.

Apply for a recovery loan to help your business employ staff

A government backed loan to support businesses affected by the pandemic.

Looking to obtain an unsecured loan for your business?

Business loans up to £500k, without the need to secure on property or assets.

Apply for a secured business loan today and get matched with a lender…

Business loans up to £2M, secured against a UK property by way of 1st or 2nd charge.

It takes minutes to apply, there’s no effect on your credit score.

Acquire new or used equipment, machinery or vehicles and spread the repayments over 1-6 years.

Compare merchant cash advances to help your business purchase stock.

Borrow up to 2x your monthly card sales and repay through a small % of your future takings.

Compare revolving credit facilities to help your business grow.

A pre agreed credit facility, allowing you to dip in and out for future funding requirements.

Spread the payments of your PAYE, VAT or Corp Tax bills.

VAT/TAX loans up to £500k for PAYE payments, quarterly VAT payments or annual Corporation tax payments

Prefer to talk? Call us on 01371 870815

4.9/5 based on 100+ by happy customers

Key benefits of working with

Aurora Capital

LendTech Technology - Access to 50+ Lenders

At Aurora Capital, we use LendTech technology which gives us access to a vast network of over 50 commercial lenders in the market. Our extensive pool of lenders ensures that we can match you with the most appropriate lender for your specific requirements, who will provide competitive terms and reasonable loan options.

Apply Online in Minutes & Get Funding in Days

We understand that businesses often need funding quickly. For this reason, we offer a fast, simplified service. Once you’ve chosen the appropriate loan for your needs, you can apply online through Aurora Capital, which only takes a few minutes. Our team will then match you with a lender and acquire the necessary funds, often in just a few days.

No Effect on Your Credit Score

Conventional loan and credit applications can damage your credit score, but with Aurora Capital, this isn’t the case. Whether your application is successful or declined, your credit score remains unaffected. This is especially advantageous for newly established businesses trying to establish a credit score, or those with a negative credit history.

LendTech Technology - Access to 50+ Lenders

At Aurora Capital, we use LendTech technology which gives us access to a vast network of over 50 commercial lenders in the market. Our extensive pool of lenders ensures that we can match you with the most appropriate lender for your specific requirements, who will provide competitive terms and reasonable loan options.

Apply Online in Minutes & Get Funding in Days

We understand that businesses often need funding quickly. For this reason, we offer a fast, simplified service. Once you’ve chosen the appropriate loan for your needs, you can apply online through Aurora Capital, which only takes a few minutes. Our team will then match you with a lender and acquire the necessary funds, often in just a few days.

No Effect on Your Credit Score

Conventional loan and credit applications can damage your credit score, but with Aurora Capital, this isn’t the case. Whether your application is successful or declined, your credit score remains unaffected. This is especially advantageous for newly established businesses trying to establish a credit score, or those with a negative credit history.

100+ Happy Customers & Counting

Healthcare Business: FAQs

Business loans for medical professionals can provide the necessary capital to help healthcare businesses grow and expand. This funding can be used to purchase new equipment, hire additional staff, expand services, or renovate facilities. Loans can also help businesses with cash flow issues, providing them with the funds needed to cover expenses during slow periods. By taking advantage of external funding, healthcare businesses can invest in growth opportunities that might otherwise be out of reach.

Choosing the right funding option can be a daunting task, especially for medical professionals who may not have a background in finance. However, there are several key factors to consider when selecting a funding source. The first is the interest rate, as this will determine the total cost of borrowing. It’s also important to consider the repayment terms and any fees associated with the loan. Additionally, medical professionals should look for lenders who specialise in healthcare financing and have experience working with businesses in the industry.

Think about how long you will need to repay the loan at an affordable rate, as well as what it will be used for, whether you can use collateral as security to reduce interest rates, and who might be a guarantor in the absence of said collateral. Also consider the use case for the money.

At Aurora Capital, we are a finance broker that works with over 50 lenders to provide medical and healthcare businesses with access to a wide range of funding options. With fast and easy applications that take just minutes to complete and with no impact on credit scores, you can quickly get the funding you need to grow your business or practice.

As part of our fast application process, offer decisions are made in days and funds can be available in less than a week. With expertise in healthcare financing and a commitment to exceptional customer service, we are a trusted partner for medical businesses looking to achieve their growth goals.