Apply For a UK Bridging Loan To Help You

Grow

Purchase Stock

Employ Staff

Expand

Pay Suppliers

Bridging loans can help you ‘bridge the gap’ between an immediate cash requirement and a future influx of cash.

- Apply in minutes

- Applying won’t affect your credit score

- Free, no obligation quote

6.90%

Interest rates per annum

£100,000 +

UK Based

No early settlement fees

£5k - £500k

Funding requirement

Our lending partners

Bridging Loans

A bridging loan can be a fast short-term solution to help your business cover an immediate cash need while you wait for incoming money. Learn everything you need to know about how they work, and compare rates and funding options from top bridging loan lenders with Aurora Capital.

What is a bridging loan?

A bridging loan is a short-term loan usually used to help a business buy or renovate a property.

It is designed to bridge the gap between a debt and incoming cash, for example, when you’re waiting for the funds from a sale to come through.

Bridging loans are a type of secured loan, which means you will need to put up an asset as collateral.

Key features of bridging loans

- Suitability: Any business that has a commercial or residential property to secure against.

- Purpose: Bridging loans can have several purposes, but are commonly used for property refurbishments.

- Amount: Bridging finance loans range from £25k – £15m. We can usually lend up to 75% LTV.

- Term: Up to 24 months. This will depend on the equity left in the property and how much you need.

- Cost: Interest rates from 0.55% per month.

- Security: Security can be taken as either a 1st, 2nd or equitable charge of a residential or commercial property depending on your circumstances.

- Speed: Decisions can be made within 24 hours.

A bridging loan can provide your business with a large sum that you repay over a short period of time, often just a few months. The loan is usually repaid when you can get a longer-term loan, like a commercial mortgage, or when you receive funds following the sale of an asset.

Here are a couple of examples of how bridging loans can work:

- Bridging loans for property refurbishment: A property development firm purchasing premises needing extensive refurbishment may need help to secure a mortgage. With a bridging loan, the developer could secure the funds they need to refurbish the property. They can then sell the property, use the proceeds to repay the lender, and still have profit to spare.

- Bridging loans for property purchases: If a business is caught in a property chain, it may be unable to make a big purchase until a sale has been made at the other end. In this situation, a commercial bridging loan can help keep the chain from breaking. Once the sale is completed, the funds can then be used to repay the loan.

- Quick property purchases: Bridge loans can also be used for property purchases where sales need to be completed quickly. The loan is secured against the available equity in the property and then repaid when it is sold.

It’s possible to borrow between £25,000 and £15 million with a bridging loan, but the amount you can get will depend largely on the equity you have in the property you’re using as security.

Most bridging loans are offered at around 70% or 80% LTV, which means you could potentially borrow 80% of your property’s equity.

For example, if the property is worth £500,000, at an LTV of 80%, you could borrow up to £400,000 minus any outstanding mortgage balance you have.

However, most lenders will also consider other factors, such as the state of your business’s finances, when determining how much they are willing to lend you.

There are several types of bridging finance available. Each type has slightly different criteria, and the right option for you will depend on your security and the loan term you want. The types of bridging loans include:

- Open bridging loans: An open bridging loan has no set repayment date, but you may be expected to repay it within one or two years. An open bridge loan may be a good option if you don’t yet have a defined exit strategy, but they usually come with higher interest rates.

- Closed bridging loans: A closed bridging loan has a fixed repayment date. This type of loan is best if you have an exit strategy, such as a pending property sale. It is usually the cheaper option, as the lender is exposed to less risk.

- First-charge bridging loans: A bridging loan will be a ‘first charge’ if you own the property or asset against which you’re securing the loan outright. This means it will be repaid first in the event of repossession.

- Second-charge bridging loans: If the property already has a loan secured on it, such as an outstanding mortgage, the bridging loan will be a ‘second charge’. This means the bridging loan will only be repaid once the first-charge mortgage has been cleared if the property is repossessed.

You can also choose to pay a fixed or variable rate of interest. A variable rate fluctuates based on factors like the Bank of England base rate, which means your payments could go up or down.

A fixed rate will remain the same for the loan term, so you will always know what your repayments will be. As bridging loans are short-term, the risks of fluctuating interest rates are reduced, but a fixed rate could still offer the security of knowing your repayments won’t change.

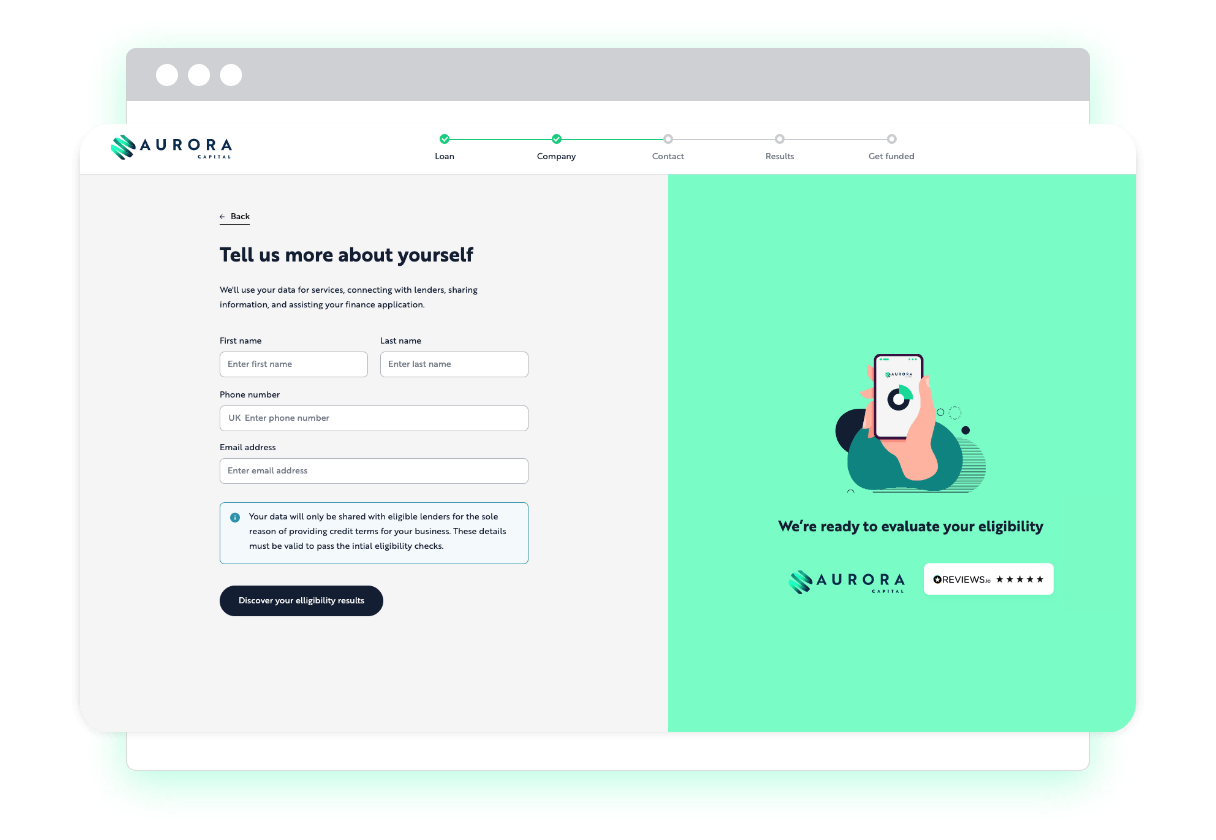

When applying for a loan, you first need to:

- Decide how much you need to borrow – only apply for what you need to avoid burdening your business with more debt than is necessary

- Think about how long you will need to repay the loan and if you need an open or closed bridge loan

- Make sure you have all of the documents you need to submit as part of the application

- Find and compare bridging loan quotes with Aurora Capital

When you start your application with Aurora Capital, you’ll be asked to provide an overview of your project including what you need the funds for.

You’ll also need to provide some additional details and documentation, including:

- Proof of identity

- Last six months of bank statements

- Latest company accounts

- Personal and business information

We will then match you with a lender who will assess your circumstances and determine whether you qualify for the loan.

The lender may need additional information about the property; for example, they may need to conduct a valuation. They may also require further clarification regarding the purpose of your loan or see evidence of your exit strategy, which is information about how you plan to repay the loan.

Once accepted for the loan, you can receive your funds in a matter of days and start your project.

If your business has a commercial or residential property to use as security, you can get a bridging loan.

Here is a list of the security we can lend against with bridging finance:

- Residential property

- Residential developments

- Commercial property

- Commercial developments

- Mixed-use property schemes

- Offices

- Retail property

- Farm and agricultural land

- Residential and commercial investment property

You may also need to have a detailed plan outlining how you will be spending funds and the desired outcome of your project. This will help the lender assess the level of risk of lending to you – if your project is considered high risk, you may not be accepted.

You and your business will also need to meet the rest of the lender’s eligibility criteria, including:

- You will need to be a UK resident

- Your business must be registered in the UK

- Your business will need to have been operating for at least six months

- You must have no adverse credit on your business or personal credit files, i.e. CCJs, bankruptcies, liquidations, or IVAs

There are several factors to consider when deciding whether a bridging loan is right for you, and it is important to consider other types of loans depending on your circumstances.

Bridging loans can be a fast and flexible option, especially if you need funds to complete a project quickly. However, they can be risky, so it’s important you understand the pros and cons before making an application.

Pros of bridging loans

- Flexibility: A business bridging loan is not limited to one purpose. While they are commonly used in the property sector as a mortgage shortcut, bridging finance can also be suitable for various other purposes depending on what is agreed with your lender.

- Transaction speed: You can access funds faster than with most other loans. It’s a good option for emergencies, but can also help with short-term projects or times when your business is waiting for a promised cash influx.

- Controlled interest: Since bridging loans are short-term, the interest is more controlled than in other funding options. Repaying within a relatively short timeframe means you have complete oversight and can budget your repayments more easily.

Cons of bridging loans

- Higher borrowing costs: The interest rates offered by bridging loan lenders can be higher than other loans, and there are often additional fees to pay.

- Pressure to repay: The short terms offered by most bridging lenders may pressure you to repay the loan quickly. For this reason, it’s vital that you have a clear repayment plan and exit strategy in place.

- Assets at risk: Bridging loans are secured against an asset, usually property, which will be at risk if you default on the loan. The lender can repossess your property to cover the repayments if you can no longer make them.

Before applying for a bridging loan, it is worth considering your options first to make sure you choose the right loan for your business. Alternative funding options include:

- Unsecured business loans: These loans do not need to be secured against a business asset, which reduces the risk, but they can be more difficult to get than a bridging loan.

- Secured business loans: These differ from bridging loans because they are repaid over a longer period of time, often several years. They are less flexible but usually come with lower rates of interest.

- Remortgaging: You can remortgage your property and withdraw the funds you need from equity rather than using a bridging loan.

If you want more personalised advice on what kind of loan might be right for you, you can always speak to our professional advisors.

A bridging loan is a short-term loan usually used to help a business buy or renovate a property.

It is designed to bridge the gap between a debt and incoming cash, for example, when you’re waiting for the funds from a sale to come through.

Bridging loans are a type of secured loan, which means you will need to put up an asset as collateral.

- Suitability: Any business that has a commercial or residential property to secure against.

- Purpose: Bridging loans can have several purposes, but are commonly used for property refurbishments.

- Amount: Bridging finance loans range from £25k – £15m. We can usually lend up to 75% LTV.

- Term: Up to 24 months. This will depend on the equity left in the property and how much you need.

- Cost: Interest rates from 0.55% per month.

- Security: Security can be taken as either a 1st, 2nd or equitable charge of a residential or commercial property depending on your circumstances.

- Speed: Decisions can be made within 24 hours.

A bridging loan can provide your business with a large sum that you repay over a short period of time, often just a few months. The loan is usually repaid when you can get a longer-term loan, like a commercial mortgage, or when you receive funds following the sale of an asset.

Here are a couple of examples of how bridging loans can work:

- Bridging loans for property refurbishment: A property development firm purchasing premises needing extensive refurbishment may need help to secure a mortgage. With a bridging loan, the developer could secure the funds they need to refurbish the property. They can then sell the property, use the proceeds to repay the lender, and still have profit to spare.

- Bridging loans for property purchases: If a business is caught in a property chain, it may be unable to make a big purchase until a sale has been made at the other end. In this situation, a commercial bridging loan can help keep the chain from breaking. Once the sale is completed, the funds can then be used to repay the loan.

- Quick property purchases: Bridge loans can also be used for property purchases where sales need to be completed quickly. The loan is secured against the available equity in the property and then repaid when it is sold.

It’s possible to borrow between £25,000 and £15 million with a bridging loan, but the amount you can get will depend largely on the equity you have in the property you’re using as security.

Most bridging loans are offered at around 70% or 80% LTV, which means you could potentially borrow 80% of your property’s equity.

For example, if the property is worth £500,000, at an LTV of 80%, you could borrow up to £400,000 minus any outstanding mortgage balance you have.

However, most lenders will also consider other factors, such as the state of your business’s finances, when determining how much they are willing to lend you.

There are several types of bridging finance available. Each type has slightly different criteria, and the right option for you will depend on your security and the loan term you want. The types of bridging loans include:

- Open bridging loans: An open bridging loan has no set repayment date, but you may be expected to repay it within one or two years. An open bridge loan may be a good option if you don’t yet have a defined exit strategy, but they usually come with higher interest rates.

- Closed bridging loans: A closed bridging loan has a fixed repayment date. This type of loan is best if you have an exit strategy, such as a pending property sale. It is usually the cheaper option, as the lender is exposed to less risk.

- First-charge bridging loans: A bridging loan will be a ‘first charge’ if you own the property or asset against which you’re securing the loan outright. This means it will be repaid first in the event of repossession.

- Second-charge bridging loans: If the property already has a loan secured on it, such as an outstanding mortgage, the bridging loan will be a ‘second charge’. This means the bridging loan will only be repaid once the first-charge mortgage has been cleared if the property is repossessed.

You can also choose to pay a fixed or variable rate of interest. A variable rate fluctuates based on factors like the Bank of England base rate, which means your payments could go up or down.

A fixed rate will remain the same for the loan term, so you will always know what your repayments will be. As bridging loans are short-term, the risks of fluctuating interest rates are reduced, but a fixed rate could still offer the security of knowing your repayments won’t change.

When applying for a loan, you first need to:

- Decide how much you need to borrow – only apply for what you need to avoid burdening your business with more debt than is necessary

- Think about how long you will need to repay the loan and if you need an open or closed bridge loan

- Make sure you have all of the documents you need to submit as part of the application

- Find and compare bridging loan quotes with Aurora Capital

When you start your application with Aurora Capital, you’ll be asked to provide an overview of your project including what you need the funds for.

You’ll also need to provide some additional details and documentation, including:

- Proof of identity

- Last six months of bank statements

- Latest company accounts

- Personal and business information

We will then match you with a lender who will assess your circumstances and determine whether you qualify for the loan.

The lender may need additional information about the property; for example, they may need to conduct a valuation. They may also require further clarification regarding the purpose of your loan or see evidence of your exit strategy, which is information about how you plan to repay the loan.

Once accepted for the loan, you can receive your funds in a matter of days and start your project.

If your business has a commercial or residential property to use as security, you can get a bridging loan.

Here is a list of the security we can lend against with bridging finance:

- Residential property

- Residential developments

- Commercial property

- Commercial developments

- Mixed-use property schemes

- Offices

- Retail property

- Farm and agricultural land

- Residential and commercial investment property

You may also need to have a detailed plan outlining how you will be spending funds and the desired outcome of your project. This will help the lender assess the level of risk of lending to you – if your project is considered high risk, you may not be accepted.

You and your business will also need to meet the rest of the lender’s eligibility criteria, including:

- You will need to be a UK resident

- Your business must be registered in the UK

- Your business will need to have been operating for at least six months

- You must have no adverse credit on your business or personal credit files, i.e. CCJs, bankruptcies, liquidations, or IVAs

There are several factors to consider when deciding whether a bridging loan is right for you, and it is important to consider other types of loans depending on your circumstances.

Bridging loans can be a fast and flexible option, especially if you need funds to complete a project quickly. However, they can be risky, so it’s important you understand the pros and cons before making an application.

Pros of bridging loans

- Flexibility: A business bridging loan is not limited to one purpose. While they are commonly used in the property sector as a mortgage shortcut, bridging finance can also be suitable for various other purposes depending on what is agreed with your lender.

- Transaction speed: You can access funds faster than with most other loans. It’s a good option for emergencies, but can also help with short-term projects or times when your business is waiting for a promised cash influx.

- Controlled interest: Since bridging loans are short-term, the interest is more controlled than in other funding options. Repaying within a relatively short timeframe means you have complete oversight and can budget your repayments more easily.

Cons of bridging loans

- Higher borrowing costs: The interest rates offered by bridging loan lenders can be higher than other loans, and there are often additional fees to pay.

- Pressure to repay: The short terms offered by most bridging lenders may pressure you to repay the loan quickly. For this reason, it’s vital that you have a clear repayment plan and exit strategy in place.

- Assets at risk: Bridging loans are secured against an asset, usually property, which will be at risk if you default on the loan. The lender can repossess your property to cover the repayments if you can no longer make them.

Before applying for a bridging loan, it is worth considering your options first to make sure you choose the right loan for your business. Alternative funding options include:

- Unsecured business loans: These loans do not need to be secured against a business asset, which reduces the risk, but they can be more difficult to get than a bridging loan.

- Secured business loans: These differ from bridging loans because they are repaid over a longer period of time, often several years. They are less flexible but usually come with lower rates of interest.

- Remortgaging: You can remortgage your property and withdraw the funds you need from equity rather than using a bridging loan.

If you want more personalised advice on what kind of loan might be right for you, you can always speak to our professional advisors.

Get your free, no

obligation quote Today!

- Apply in minutes

- FREE, no obligation, personalised quote

- FCA regulated

How much do you want to borrow?

Securing business funding:

How it works

We understand that timing is key when you’re looking to find funding options for your business,so our process is as quick and as streamlined as possible.

1

Apply Online in minutes

We cater to any sized business, so to apply for business funding, we only need you to share basic information about your company. Your application will take a few minutes, and our experts are always happy to assist with any questions you have about specific loan types or alternative finance options.

2

Get Matched in hours

Our LendTech technology will compare our trusted panel of lenders and match you with your most suitable finance option. Each business funding option is different, and we’ll help to make sure you’re fully clued up on the terms and conditions as well as indicative repayment details.

3

Get Funded in days

One of our funding specialists will discuss the available options with you and guide you through the process from application to approval. Once approved, the funds can be deposited in a matter of hours.

Prefer to talk? Call us on 01371 870815

4.9/5 based on 100+ by happy customers

Apply for a recovery loan to help your business employ staff

A government backed loan to support businesses affected by the pandemic.

Looking to obtain an unsecured loan for your business?

Business loans up to £500k, without the need to secure on property or assets.

Apply for a secured business loan today and get matched with a lender…

Business loans up to £2M, secured against a UK property by way of 1st or 2nd charge.

It takes minutes to apply, there’s no effect on your credit score.

Acquire new or used equipment, machinery or vehicles and spread the repayments over 1-6 years.

Compare merchant cash advances to help your business purchase stock.

Borrow up to 2x your monthly card sales and repay through a small % of your future takings.

Compare revolving credit facilities to help your business grow.

A pre agreed credit facility, allowing you to dip in and out for future funding requirements.

Spread the payments of your PAYE, VAT or Corp Tax bills.

VAT/TAX loans up to £500k for PAYE payments, quarterly VAT payments or annual Corporation tax payments

Prefer to talk? Call us on 01371 870815

4.9/5 based on 100+ by happy customers

100+ Happy Customers & Counting

bridging loans: FAQs

Yes, bridging loans are often popular for individuals or businesses with adverse credit. They can be a good way to pay off bad debts, giving you time and flexibility to regain control of your finances.

Lenders are willing to offer bridging loans to applicants with poor credit, provided they have a clear exit strategy for repaying the loan.

An exit strategy is a plan detailing how you’re going to pay the bridging loan off. Common exit strategies include:

- Obtaining a mortgage

- Getting a secured loan

- Completing the sale of a property

Most bridge loan lenders want to see your exit strategy as part of your application. At Aurora Capital, we can help you define a realistic and watertight exit strategy.

A bridging loan can provide funds relatively quickly. It is often needed by those who need funds fast, so lenders are usually willing to release the money within a matter of days.

However, the exact timeframe will depend on your application and the lender you choose. If your request is complex, it could take longer for you to receive the funds.

When you apply with Aurora Capital, many of our lenders can make a decision in principle within just 48 hours. This gives those who need it a fast method for obtaining high-value loans.

Yes, it’s possible to repay your bridging loan before the end of the term. Open bridging loans don’t have a set repayment date, so you should aim to pay this type of loan as soon as possible.

If there is an exit fee or early redemption charge, the typical amount would be one month’s interest payment or 1% of the loan.

The cost of your bridging loan depends on several factors, including your credit score, the interest rates available, and the value of what you have secured the loan against.

The fees for a bridging loan typically include:

- An arrangement fee of 2%

- Interest from 0.5% per month to 2% per month

Bridging loan interest rates are typically charged monthly, unlike most business loans, which are charged annually. This means they can be much more expensive. For example, a monthly interest rate of 2% is the equivalent of nearly 27% annually.

You may also need to pay for a valuation of the property offered as security, typically around £400.

You can pay the interest on your bridging loan monthly or roll it up and add it to the final settlement figure at the end.

This depends on the deal and the safety of the planned exit route. If there is an exit or early redemption charge, the typical amount would be one month’s interest payment or 1% of the loan. The minimum is zero.

Below is a list of the security we lend against with bridging finance at Aurora Capital:

- Residential property

- Residential developments

- Commercial property

- Commercial developments

- Mixed-use property schemes

- Offices

- Retail

- Land, farms and agricultural

- Investment property – residential and commercial

- Auction