Compare Revolving Credit Facilities To Help Your Business Grow Purchase Stock Employ Staff Expand Pay Suppliers

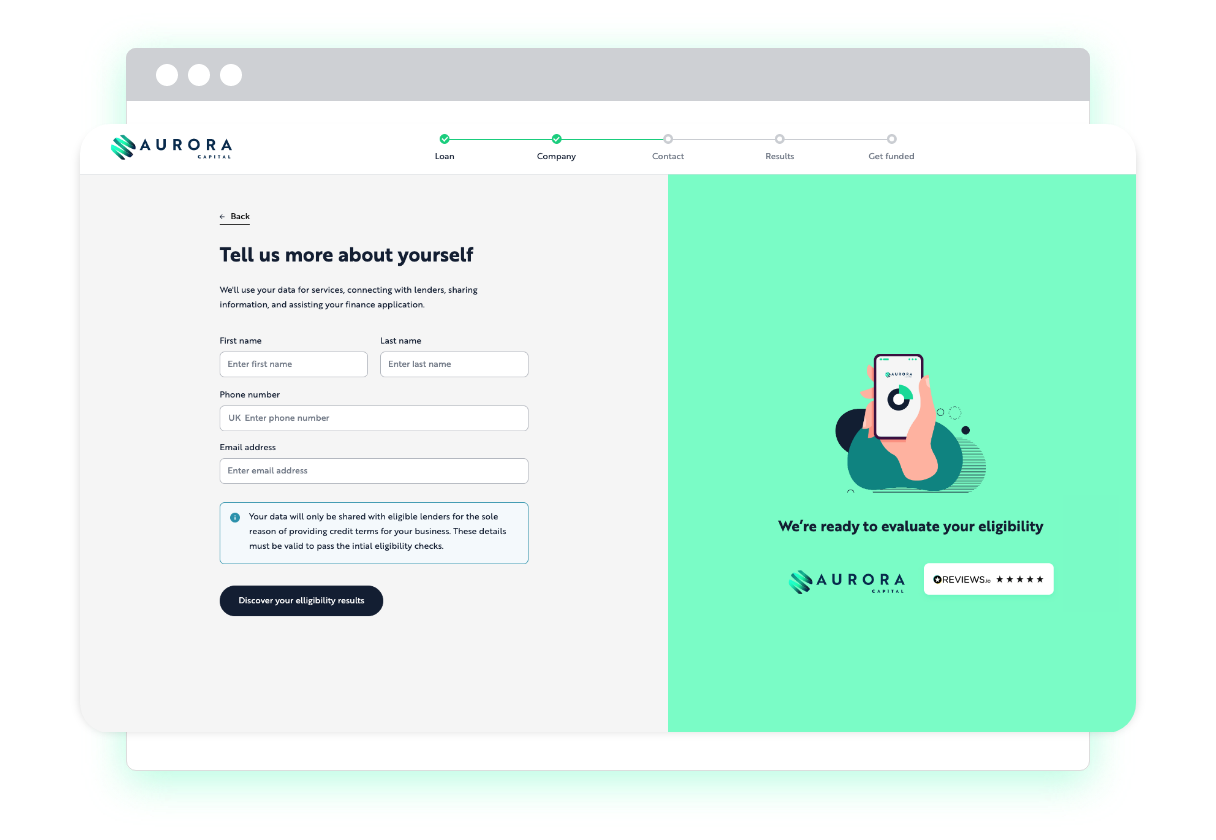

It takes minutes to apply, there’s no effect on your credit score, and you can obtain decisions within 24 hours.

- Apply in minutes

- Applying won’t affect your credit score

- Free, no obligation quote

form 7%

Interest rates per annum

£100,000 +

Annual turnover

Have access to

A pre agreed credit limit

£15k - £2m

Funding requirement

Our lending partners

About Revolving Credit Facility

A revolving credit facility will allow your UK business to access an agreed limit of funds whenever necessary. At Aurora Capital, we can pair your business with a trusted provider of revolving credit so that you can benefit from accelerated business growth.

What is a revolving credit facility?

A revolving credit facility is a line of credit which allows a UK business to access funds whenever necessary – it’s the business loan that keeps on giving! Instead of having to reapply for new credit once you’ve paid it back, revolving credit remains accessible. You’ll agree to a limit with your lender based on affordability tests as well as your credit rating, and then you will have access to that amount until your terms are up (or you decide to end the service).

Most terms for revolving credit facilities last up to 2 years, and providing you have paid on-time throughout, you’ll often be eligible for a renewal. This kind of business loan is comparable to an overdraft, since you can access the revolving credit loan over and over again, as long as you continue to pay off your balance. Unlike a traditional business loan or agreement, you can use revolving credit funds for any type of business expense. Your borrowing isn’t subject to specific spending requirements, so whether you want to refinance a smaller cash agreement over a short term or simply plug a temporary cash flow gap, there’s no limit on what you can spend your balance on.

This business credit line is akin to a financial safety net because, once you have secured the finance, you don’t need to apply again in future. This means, unlike with a traditional business loan which can take a few days or weeks to secure (due to things like your credit score being assessed, interest rates being agreed, and viability being determined), you have access to emergency credit as and when you need it for the duration of your term.

If you run into minor cash flow issues, a revolving credit facility means you can keep things moving without disrupting day to day operations. For example, you might get an unexpected tax bill or have to replace some equipment in a hurry. Revolving credit facilities give you access to immediate funds and offer flexibility by nature, allowing you to tend to your finance needs immediately without waiting on lenders to make a decision.

Key features of revolving credit facilities

- Suitability: Businesses looking for a fixed credit line and the ability to drawdown multiple times a year.

- Purpose: This facility is unrestricted and can be used for any business expense.

- Amount: Loans ranging from £10k – £2m. The amount you can borrow will be calculated after an affordability assessment, and may also depend on the lender.

- Term: Up to 2 years. This will depend on how long the business has been trading for as well as the credit worthiness of the business.

- Cost: Lenders may charge a daily or a monthly interest rate, or alternatively a single fixed fee per drawdown, without ongoing interest.

- Security: Personal guarantees may be required form owners/directors of the business. Some lenders do not require this; it will likely depend on the credit worthiness of the business

- Speed: Applications can be processed within 24 hours from receiving a full proposal and we can pay out within 48 hours.

You can think of revolving credit facilities as a type of loan that can be automatically renewed.

Once you’ve an agreement in place with a lender (who may charge a small commitment fee), you won’t pay anything until you actually start tapping into the line. You can make withdrawals whenever you need additional funding. Similarly you can make repayments whenever you want to. You might use the facility regularly or you might just dip into one once or twice.

You pay a fixed interest rate, usually daily, only on the amount you’ve drawn down, not the entire credit line. This means your payments will probably be irregular because you’re not borrowing a lump sum of money and being charged interest right away. Your payment terms will specify how quickly you need to make repayments after withdrawing funds.

This is in contrast to a fixed business loan, which gives you access to funds for a specific amount of time (i.e. the term) – and you repay the loan (principal and interest) according to a fixed repayment schedule.

You will only pay interest on the periods during which you are using the revolving credit facility. For example, if you use £5k of your £10k allowance in January and pay it off the following month, you’ll only pay interest on the £5kfrom the day the funds were taken out up until the day they were repaid. If you pay a small amount off over a number of months, you’ll only pay interest on the drawn balance.

As a rolling agreement, the only time your access to funds will stop is when you’ve already hit your limit, or you’ve cancelled your plan.

We can also offer secured business loans and unsecured business loans to help you grow your business.

You will only pay interest on the periods during which you are using the revolving credit facility. For example, if you use £5k of your £10k allowance in January and pay it off the following month, you’ll only pay interest from the day the funds were taken out up until the day they were repaid. If you pay a small amount off over a number of months, you’ll only pay interest fees on the remaining balance.

As a rolling agreement, the only time your access to funds will stop is when you’ve already hit your limit, or you’ve cancelled your plan.

We can also offer secured business loans and unsecured business loans to help you grow your business.

Many clients ask us whether having a revolving line of credit will hurt their credit rating. Unfortunately, like any form of credit, there is always the risk of your credit score being affected negatively if you don’t make repayments on time, and to the required amount. However, on the flip side, revolving loans can actually help improve your credit score when used properly.

At Aurora Capital, our experts are always available to provide support and financial guidance to businesses who are struggling to understand or improve their credit rating. Below, we share some tips for using a revolving credit facility to your advantage and avoiding bad credit:

Pay off balances every month

Businesses who pay off their revolving credit facility balances every month show future lenders that they are responsible and can afford to use credit. Consistent payments indicate a healthy credit profile. This doesn’t necessarily mean you need to pay in full every month, but you should try to pay off more than the minimum required if you hope to see an improvement in your credit score. Check your individual terms, too, as you may be charged with late payment fees if you don’t keep up.

Keep balances low

Having more available credit than you need indicates to lenders that you are sensible and will avoid maxing out your revolving credit facility allowance in one transaction. A lot of businesses who use the entirety of their available balance will likely struggle when it comes to paying it back consistently. For a healthy credit profile and peace of mind, try to keep your usage under 30% if you can. Of course, if you need to use more, you will still be able to, but make sure you have budgeted future funds to help bring your usage down.

Avoid repeat revolving credit applications

If you’re rejected for a revolving credit facility, speak to one of our advisors as they can help you recognise what you need in order to be accepted in future. Repeat revolving credit facility applications are typically best to avoid, no matter how likely it is that you’ll be accepted. Before applying for any credit, be sure to have considered your credit score first. If you need advice and help understanding your rating and what credit you’re likely to be accepted for, speak to one of our friendly advisors.

Lenders will look at various aspects of your financial history, both business and personal, to build up a picture of the risk you pose to them.

What lenders really care about is the amount of cash regularly flowing into your business bank account. This means that if you’re after just a small facility, a lender might look only at your bank account – an advantage if you’re a new company (though you’ll need to have been trading for more than 3 months).

Revolving credit facilities are generally short-term arrangements, so if you’ve previously struggled to find credit, you might have more success with this type of product.

If your business’s cash flow is a little irregular or sporadic, revolving credit can help get through the tougher periods. Unlike a generic business loan or cash advance, with a revolving credit facility you’re only charged for what you use. This makes it a great back-up option for unexpected expenses or periods where your business is less fruitful than you may have hoped.

Revolving credit for business usually features interest expenses, however, they are generally favoured compared with credit card rates. The exact interest rates you are offered for your revolving credit facility will depend on your lender.

A business credit line is a flexible lending product which allows a business to access finance immediately, drawing from a personalised line of credit. When you apply, you will be approved for a set credit limit, withdrawal fee percentage rate, and withdrawal repayment term. Once you have been approved, any amount of funds can be withdrawn, from £1k up to your agreed limit. Each withdrawal will incur a set annual percentage rate (a percentage of the amount withdrawn), which will be paid back alongside the loan itself. If you have any questions about how this business loan works or how to manage revolving credit facility payments, you can always contact our advisors directly.

Applying for revolving credit facilities doesn’t have to be arduous. Use our quick application form and one of our UK advisors will get back to you and take you through the simple steps for acquiring a revolving credit facility.

You can think of revolving credit facilities as a type of loan that can be automatically renewed.

Once you’ve an agreement in place with a lender (who may charge a small commitment fee), you won’t pay anything until you actually start tapping into the line. You can make withdrawals whenever you need additional funding. Similarly you can make repayments whenever you want to. You might use the facility regularly or you might just dip into one once or twice.

You pay a fixed interest rate, usually daily, only on the amount you’ve drawn down, not the entire credit line. This means your payments will probably be irregular because you’re not borrowing a lump sum of money and being charged interest right away. Your payment terms will specify how quickly you need to make repayments after withdrawing funds.

This is in contrast to a fixed business loan, which gives you access to funds for a specific amount of time (i.e. the term) – and you repay the loan (principal and interest) according to a fixed repayment schedule.

You will only pay interest on the periods during which you are using the revolving credit facility. For example, if you use £5k of your £10k allowance in January and pay it off the following month, you’ll only pay interest on the £5kfrom the day the funds were taken out up until the day they were repaid. If you pay a small amount off over a number of months, you’ll only pay interest on the drawn balance.

As a rolling agreement, the only time your access to funds will stop is when you’ve already hit your limit, or you’ve cancelled your plan.

We can also offer secured business loans and unsecured business loans to help you grow your business.

You will only pay interest on the periods during which you are using the revolving credit facility. For example, if you use £5k of your £10k allowance in January and pay it off the following month, you’ll only pay interest from the day the funds were taken out up until the day they were repaid. If you pay a small amount off over a number of months, you’ll only pay interest fees on the remaining balance.

As a rolling agreement, the only time your access to funds will stop is when you’ve already hit your limit, or you’ve cancelled your plan.

We can also offer secured business loans and unsecured business loans to help you grow your business.

Many clients ask us whether having a revolving line of credit will hurt their credit rating. Unfortunately, like any form of credit, there is always the risk of your credit score being affected negatively if you don’t make repayments on time, and to the required amount. However, on the flip side, revolving loans can actually help improve your credit score when used properly.

At Aurora Capital, our experts are always available to provide support and financial guidance to businesses who are struggling to understand or improve their credit rating. Below, we share some tips for using a revolving credit facility to your advantage and avoiding bad credit:

Pay off balances every month

Businesses who pay off their revolving credit facility balances every month show future lenders that they are responsible and can afford to use credit. Consistent payments indicate a healthy credit profile. This doesn’t necessarily mean you need to pay in full every month, but you should try to pay off more than the minimum required if you hope to see an improvement in your credit score. Check your individual terms, too, as you may be charged with late payment fees if you don’t keep up.

Keep balances low

Having more available credit than you need indicates to lenders that you are sensible and will avoid maxing out your revolving credit facility allowance in one transaction. A lot of businesses who use the entirety of their available balance will likely struggle when it comes to paying it back consistently. For a healthy credit profile and peace of mind, try to keep your usage under 30% if you can. Of course, if you need to use more, you will still be able to, but make sure you have budgeted future funds to help bring your usage down.

Avoid repeat revolving credit applications

If you’re rejected for a revolving credit facility, speak to one of our advisors as they can help you recognise what you need in order to be accepted in future. Repeat revolving credit facility applications are typically best to avoid, no matter how likely it is that you’ll be accepted. Before applying for any credit, be sure to have considered your credit score first. If you need advice and help understanding your rating and what credit you’re likely to be accepted for, speak to one of our friendly advisors.

Like all lines of credit, revolving credit facilities for business are calculated on a number of criteria.

Credit check

The most important of these criteria, of course, is your credit rating. The better it is, the more likely you are to be accepted for the business loan. Plus, you will also be able to access a higher credit limit.

Business size

The size of your business will also be taken into account when applying for a revolving credit facility – both in terms of assets, turnover and number of employees. In the majority of cases, UK businesses are accepted for a revolving credit facility, but be careful that you do not budget for more than you are offered.

At Aurora Capital we’ll be able to make sure that you’re paired with the lender that will provide you with the most value possible – all you need to do is fill out your application.

If your business’s cash flow is a little irregular or sporadic, revolving credit can help get through the tougher periods. Unlike a generic business loan or cash advance, with a revolving credit facility you’re only charged for what you use. This makes it a great back-up option for unexpected expenses or periods where your business is less fruitful than you may have hoped.

Revolving credit for business usually features interest expenses, however, they are generally favoured compared with credit card rates. The exact interest rates you are offered for your revolving credit facility will depend on your lender.

A business credit line is a flexible lending product which allows a business to access finance immediately, drawing from a personalised line of credit. When you apply, you will be approved for a set credit limit, withdrawal fee percentage rate, and withdrawal repayment term. Once you have been approved, any amount of funds can be withdrawn, from £1k up to your agreed limit. Each withdrawal will incur a set annual percentage rate (a percentage of the amount withdrawn), which will be paid back alongside the loan itself. If you have any questions about how this business loan works or how to manage revolving credit facility payments, you can always contact our advisors directly.

Applying for revolving credit facilities doesn’t have to be arduous. Use our quick application form and one of our UK advisors will get back to you and take you through the simple steps for acquiring a revolving credit facility.

Get your free, no

obligation quote Today!

- Apply in minutes

- FREE, no obligation, personalised quote

- FCA regulated

How much do you want to borrow?

Securing business funding:

How it works

We understand that timing is key when you’re looking to find funding options for your business,so our process is as quick and as streamlined as possible.

1

Apply Online in minutes

We cater to any sized business, so to apply for business funding, we only need you to share basic information about your company. Your application will take a few minutes, and our experts are always happy to assist with any questions you have about specific loan types or alternative finance options.

2

Get Matched in hours

Our LendTech technology will compare our trusted panel of lenders and match you with your most suitable finance option. Each business funding option is different, and we’ll help to make sure you’re fully clued up on the terms and conditions as well as indicative repayment details.

3

Get Funded in days

One of our funding specialists will discuss the available options with you and guide you through the process from application to approval. Once approved, the funds can be deposited in a matter of hours.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers

Navigate our range of business

funding options to find out more

We understand that timing is key when you’re looking to find funding options for your business, so our process is as quick and as streamlined as possible.

Prefer to talk? Call us on 020 3355 7462

4.9/5 based on 100+ by happy customers

100+ Happy Customers & Counting

Revolving Credit Facility: FAQs

You can borrow up to £250,000 with a revolving credit facility, and use these funds any time. The amount you can borrow will be calculated following your initial application.

You can borrow over a maximum term of 2 years. The length of time for which you can borrow will depend on your time trading and your credit information, which will be assessed following your application.

Yes, you can repay at any time without paying a penalty. Your lender will be able to provide all the information you need about repayment terms that are specific to them.

This will depend on which lender you are approved through. Some lenders will only require you to pay an interest only repayment for the duration of the contract, whereas others will require the interest and capital to be repaid from the drawn funds. You can always get in touch with our business loan experts if you need to clarify anything about your terms or fees.

Each lender has slightly different costs associated with their revolving credit facility offering. Some providers will take a single fixed fee from the drawdown amount, with no ongoing interest. Others will charge an ongoing interest on the used funds on either a daily or weekly basis.

A revolving credit facility can be used for any business expense as it is completely unrestricted. Whether you need to buy supplies in bulk, hire more staff or pay bills, a revolving credit business loan could be the perfect choice for your business.

The key advantage of a revolving credit facility is the flexibility it allows. Businesses can access funds up to the agreed limit at any time, and more often than not will be accepted for a renewal. On top of this, funds can be used for any business expense and interest rates are generally quite low.

In terms of disadvantages, revolving credit loans can seriously impact your credit score if your repayments are not well managed. Make sure you are keeping on top of your funds and repaying in a timely manner to avoid reducing your score.